The Top On-Chain Derivatives Platforms for Institutions will be covered in this post. These platforms offer safe, open, and effective trading environments for options, futures, and perpetual contracts.

- What is On-Chain Derivatives Platforms?

- Why Use On-Chain Derivatives Platforms for Institutions

- Key Point & Best On-Chain Derivatives Platforms for Institutions List

- 1. Synthetix

- 2. dYdX v4

- 3. GMX

- 4. Injective Protocol

- 5. Perpetual Protocol

- 6. Kwenta

- 7. Vertex Protocol

- 8. Ribbon Finance (Aevo)

- 9. Aevo Exchange

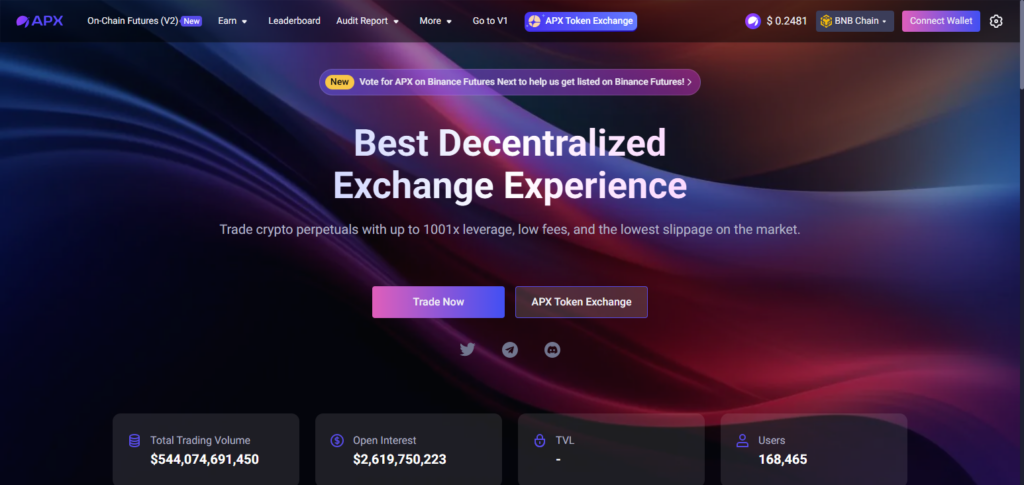

- 10. ApolloX

- Conclusion

- FAQ

They provide deep liquidity, low slippage, sophisticated risk management, and scalable infrastructure, all of which are tailored to the needs of institutions and allow them to confidently implement complicated strategies in the rapidly changing field of decentralized finance.

What is On-Chain Derivatives Platforms?

Users can trade derivative goods including futures, options, and perpetual contracts directly on-chain with on-chain derivatives platforms, which are decentralized financial systems based on blockchain networks.

These platforms function without middlemen and use smart contracts to automate trade execution, margin management, and settlement, in contrast to conventional derivatives markets.

Because every transaction is documented on the blockchain, they offer security, transparency, and immutability. In addition to providing features like leverage, minimal costs, and high liquidity, on-chain derivatives platforms frequently support a variety of assets, including commodities, cryptocurrencies, and synthetic assets.

They are therefore perfect for institutional and retail traders looking for decentralized, effective, and programmable trading solutions.

Why Use On-Chain Derivatives Platforms for Institutions

Decentralization and Transparency: Recently, institutions have been able to trade without intermediaries, and the transactions are fully transparent and auditable on the blockchain.

Lower Counterparty Risk: Trades and settlements are automated via smart contracts-without reliance on a centralized entity, the default risk is also lowered.

Access to Global Markets: On-chain platforms allow trading across various asset classes such as crypto, fiat, commodities, and synthetic assets.

Capital Efficiency and Liquidity: The AMMs and pivoted liquidity features allow the large trades to have typically lower slippage and better capital efficiency.

Programmable and Customizable Strategies: Automated complex derivatives strategies can be executed more efficiently with smart contracts.

Cost Effective and Scalable: Higher- and more cost-efficient transactions are made possible with Layer 2 solutions and blockchain infrastructures, which allow for more institutional trading, whether it’s large-scale or high-frequency.

Key Point & Best On-Chain Derivatives Platforms for Institutions List

| Platform | Key Points / Features |

|---|---|

| Synthetix | Decentralized synthetic asset platform; supports trading of crypto, commodities, and fiat; uses SNX token for staking and governance. |

| dYdX v4 | Layer 2 decentralized derivatives exchange; supports perpetual contracts; low fees with fast settlement using StarkWare scaling. |

| GMX | Decentralized perpetual exchange on Arbitrum & Avalanche; supports spot & leverage trading; fee sharing with GMX token holders. |

| Injective Protocol | Fully decentralized derivatives and DeFi platform; cross-chain derivatives; fast transaction finality with Tendermint consensus. |

| Perpetual Protocol | Perpetual swaps trading on Ethereum & Optimism; uses virtual AMM model; allows leverage up to 25x. |

| Kwenta | Frontend DEX for Synthetix; enables trading of synthetic assets; simple interface for options and spot trading. |

| Vertex Protocol | Decentralized derivatives protocol; offers flexible trading with low slippage; Layer 2 optimized for speed and cost efficiency. |

| Ribbon Finance (Aevo) | Structured products & options platform; focuses on automated yield strategies; integrates with Aevo Exchange for derivatives. |

| Aevo Exchange | Options and derivatives trading platform; supports multiple strategies; designed for retail and institutional traders. |

| ApolloX | Crypto derivatives & futures trading platform; offers high leverage; user-friendly interface with spot and futures markets. |

1. Synthetix

Because of its powerful configurable and secure system for designing and trading synthetic assets, Synthetix is highly regarded among on-chain derivatives platforms for institutions.

The ability to access a variety of assets such as cryptocurrencies, commodities, and fiat, without having to own the underlying asset, is a significant advantage for institutions. The SNX staking mechanism optimizes the balance of risks among stakeholders, while the system’s decentralization provides transparency and reduces systemic risks.

Synthetix’s virtual AMM model provides the institution’s liquidity, allowing for the quick execution of large and intricate trading strategies on leading Defi protocols with minimal slippage and even less counterparty risk which is ideal for highly traded derivatives.

| Feature | Details |

|---|---|

| Platform Name | Synthetix |

| Type | On-Chain Derivatives (Synthetic Assets) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not Required for basic trading |

| Supported Assets | Cryptocurrencies, Commodities, Fiat, Synthetic Assets |

| Trading Products | Perpetuals, Spot, Options |

| Liquidity Model | Virtual Automated Market Maker (vAMM) |

| Leverage | Available via synthetic derivatives |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Deep liquidity, programmable trading strategies, fully decentralized |

2. dYdX v4

Because dYdX v4 combines speed, security, and cost-effectiveness, it is a top option for institutions looking for on-chain derivatives. High-throughput trading with low gas costs is made possible by StarkWare’s zero-knowledge rollup technology, which is built on Layer 2 and is essential for institutional-scale operations.

Large trades with little slippage are made possible by the platform’s extensive liquidity across several cryptocurrency assets and sophisticated perpetual contracts.

Through transparent smart contracts, its non-custodial architecture guarantees complete control over funds while upholding regulatory compliance. dYdX v4 provides a smooth, dependable environment for institutional derivatives trading with professional-grade risk management tools and a strong order book.

| Feature | Details |

|---|---|

| Platform Name | dYdX v4 |

| Type | On-Chain Derivatives (Perpetual Contracts) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Limited KYC for large withdrawals |

| Supported Assets | Major Cryptocurrencies (BTC, ETH, etc.) |

| Trading Products | Perpetual Contracts, Spot Trading |

| Liquidity Model | Layer 2 Order Book & Matching Engine |

| Leverage | Up to 25x |

| Security | Non-custodial, Layer 2 smart contract-based |

| Unique Selling Point | High-speed, low-cost trading with deep liquidity on Layer 2 |

3. GMX

Because of its creative approach to decentralized perpetual trading, GMX is a top on-chain derivatives platform for institutions. It provides institutions with access to high liquidity, low slippage, and leverage trading in a completely decentralized setting.

It is based on Arbitrum and Avalanche. Capital efficiency is made possible by its special multi-asset liquidity pool architecture, which permits big trades without having a major effect on pricing. Institutions gain from an open fee-sharing system, which aligns incentives with platform expansion by rewarding GMX token holders.

Furthermore, GMX offers experienced traders looking for safe, scalable, and institution-ready on-chain derivatives solutions flexibility and efficiency by supporting both spot and derivatives trading through a single interface.

| Feature | Details |

|---|---|

| Platform Name | GMX |

| Type | On-Chain Derivatives (Perpetuals & Spot Trading) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for basic trading |

| Supported Assets | Cryptocurrencies (BTC, ETH, AVAX, etc.) |

| Trading Products | Spot, Perpetual Contracts |

| Liquidity Model | Multi-Asset Liquidity Pools |

| Leverage | Up to 30x |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Capital-efficient liquidity and decentralized fee-sharing mechanism |

4. Injective Protocol

Because of its completely decentralized, cross-chain architecture, Injective Protocol is a premier on-chain derivatives platform for institutions. Without depending on centralized middlemen, it allows institutions to produce and trade a variety of derivative products, such as futures, perpetuals, and custom markets.

Rapid transaction finality is ensured by its fast Tendermint-based consensus, which is essential for institutional trading tactics. By enabling smooth access to assets across several blockchains, Injective’s special cross-chain functionality increases trading opportunities and liquidity.

Injective Protocol is a perfect option for professional-grade, scalable on-chain derivatives trading because of its non-custodial security, cheap costs, and advanced order types, which allow institutions to execute complicated strategies effectively and openly.

| Feature | Details |

|---|---|

| Platform Name | Injective Protocol |

| Type | On-Chain Derivatives (Futures, Perpetuals, Custom Markets) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for standard trading |

| Supported Assets | Cryptocurrencies and Cross-Chain Assets |

| Trading Products | Perpetuals, Futures, Custom Derivatives |

| Liquidity Model | Decentralized Order Book & AMM Hybrid |

| Leverage | Up to 20x |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Cross-chain derivatives with high-speed, decentralized settlement |

5. Perpetual Protocol

The vAMM model provides deep liquidity and predictable pricing for large trades which makes Perpetual Protocol a top on-chain derivatives platform for institutions.

Built on Ethereum and Optimism, Perpetual Protocol has scalable, low-cost, high-leverage trading (up to 25x) which benefits institutions.

The platform is also non-custodial, which means institutions retain full control over their funds, and the smart contracts have transparency to lower the risks of dealing with a counterparty.

Institutions have access to real-time funding rates and liquidation tools as a risk management solution. PERP is a top on-chain derivatives platform due to their state-of-the-art trading tools.

| Feature | Details |

|---|---|

| Platform Name | Perpetual Protocol |

| Type | On-Chain Derivatives (Perpetuals & Synthetic Assets) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for basic trading |

| Supported Assets | Cryptocurrencies, Synthetic Assets |

| Trading Products | Perpetual Contracts, Spot Trading |

| Liquidity Model | Virtual Automated Market Maker (vAMM) |

| Leverage | Up to 25x |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Predictable pricing and deep liquidity via vAMM for institutional trades |

6. Kwenta

Kwenta is top tier on-chain derivatives service provider and is the first of its kind to offer a user friendly experience as a synthetic asset trader on the Synthetix network.

Kwenta’s ability to offer various asset classes–cryptocurrencies, commodities, and fiats–without the underlying asset makes him a very attractive player to institutions as they are able to decrease operational complexities.

Thanks to Synthetix’s liquidity and unique AMM system, trades can be executed without any price manipulation. Kwenta’s Synthetix non custodial framework is possibly the most secure and flexible fund preservation system.

Kwenta’s diverse services and advanced derivatives trading capabilities as well as product offerings make it one of the top Synthetix trading platforms for professionals.

| Feature | Details |

|---|---|

| Platform Name | Kwenta |

| Type | On-Chain Derivatives (Synthetic Assets) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for standard trading |

| Supported Assets | Cryptocurrencies, Commodities, Fiat via Synthetix |

| Trading Products | Perpetuals, Spot, Options |

| Liquidity Model | Virtual Automated Market Maker (vAMM) through Synthetix |

| Leverage | Available on selected synthetic derivatives |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Easy access to synthetic assets with deep liquidity for institutional trades |

7. Vertex Protocol

Vertex Protocol is a cutting-edge trading tool for big holders that is built on-chain and enables fast and inexpensive trades on Layer 2. Vertex Protocol’s unique architecture integrates a decentrally ordered book and a range of liquid pools.

This allows institutions to make large trades with low price impact. Vertex Protocol’s range of derivatives is broad. This includes tailored perpetuals, for sophisticated trading, and options with a variety of leverages.

Vertex Protocol’s non-custodial and transparent smart contracts models enhances security control while reducing counterparty risks. Vertex Protocol strengthens institutions with on-chain derivatives trading that is professional, sophisticated, and efficient within a provided streamlined, multi-asset, and professional grade risk management.

| Feature | Details |

|---|---|

| Platform Name | Vertex Protocol |

| Type | On-Chain Derivatives (Perpetuals & Options) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for standard trading |

| Supported Assets | Cryptocurrencies and Synthetic Assets |

| Trading Products | Perpetual Contracts, Options |

| Liquidity Model | Decentralized Order Book with Capital-Efficient Liquidity Pools |

| Leverage | Flexible leverage options |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | High-speed, capital-efficient trading with minimal slippage for institutions |

8. Ribbon Finance (Aevo)

Because of its emphasis on structured products and automated options strategies, Ribbon Finance (Aevo) is a unique on-chain derivatives platform for institutions. It combines efficiency and predictability by giving institutional traders access to complex yield-generating contracts with little manual intervention.

High liquidity and flexible trading of options and other derivative instruments are provided by Ribbon Finance’s integration with Aevo Exchange, enabling sophisticated strategies like covered calls and puts at scale.

Its non-custodial, smart contract-based architecture lowers counterparty risk by guaranteeing security and transparency. Ribbon Finance (Aevo) offers institutions a dependable, effective, and cutting-edge platform for on-chain derivatives trading by combining automated techniques, professional-grade derivatives, and scalable infrastructure.

| Feature | Details |

|---|---|

| Platform Name | Ribbon Finance (Aevo) |

| Type | On-Chain Derivatives (Options & Structured Products) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for standard trading |

| Supported Assets | Cryptocurrencies, Synthetic Assets |

| Trading Products | Options, Structured Derivatives |

| Liquidity Model | Integrated with Aevo Exchange, high liquidity pools |

| Leverage | Available depending on strategy |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Automated yield-generating strategies with deep liquidity for institutions |

9. Aevo Exchange

Aevo Exchange provides superior on chain options and sophisticated derivatives trading to institutions. Aevo’s unique combination of high liquidity and sophisticated order types allow institutions and professional traders to place large trades with very little slippage and better manage their risk when trading options and derivatives.

Institutions are able to strategically trade complex derivatives. Built with non-custodial smart contracts, Aevo features transparency and achieves operational and counterparty risk neutrality.

Aevo Exchange has multi-asset derivatives and specifically crafted trading methods for advanced institutions. With fast, scalable and safe on chain derivatives solutions, Aevo Exchange provides institutions the ability to trade on their own terms with operational dexterity.

| Feature | Details |

|---|---|

| Platform Name | Aevo Exchange |

| Type | On-Chain Derivatives (Options & Perpetuals) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for standard trading |

| Supported Assets | Cryptocurrencies, Synthetic Assets |

| Trading Products | Options, Perpetual Contracts |

| Liquidity Model | High liquidity pools integrated with advanced order types |

| Leverage | Flexible leverage options |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Professional-grade derivatives trading with secure, transparent execution |

10. ApolloX

ApolloX is an on-chain derivatives platform for institutions that aims for excellence in performance and trading capabilities. ApolloX’s core competancy is having both spot and derivatives markets, high leverage, and low cost.

It is a perfect match for instutitional trading. ApolloX also is safe and non-custodial, allowing instutitions to keep full control of their funds while performing multi trades at an execution.

Premuim tools for risk management and interfaces designed for experts in the field are also available. It is a perfect match for trading on chain derivatives. ApolloX is a safe and multi asset trading platform for institional trading.

| Feature | Details |

|---|---|

| Platform Name | ApolloX |

| Type | On-Chain Derivatives (Futures, Perpetuals & Spot Trading) |

| Target Users | Institutional Traders |

| KYC Requirement | Minimal / Not required for basic trading |

| Supported Assets | Cryptocurrencies (BTC, ETH, and others) |

| Trading Products | Futures, Perpetual Contracts, Spot Trading |

| Liquidity Model | Deep liquidity pools for capital-efficient trading |

| Leverage | High leverage options available |

| Security | Non-custodial, smart contract-based |

| Unique Selling Point | Combines spot and derivatives trading with scalable, institution-ready infrastructure |

Conclusion

To sum up, the top on-chain derivatives platforms for institutions offer a highly effective, transparent, and safe trading environment.

Advanced derivatives functionalities are combined with decentralized, non-custodial infrastructure in platforms like as Synthetix, dYdX v4, GMX, Injective Protocol, Perpetual Protocol, Kwenta, Vertex Protocol, Ribbon Finance (Aevo), Aevo Exchange, and ApolloX. They make it possible for institutions to safely execute sophisticated strategies, execute big deals with little slippage, and access deep liquidity.

These systems enable institutional traders to function with assurance, effectiveness, and accuracy in the dynamic realm of on-chain derivatives markets by providing scalability, cross-chain capabilities, and programmable trading tools.

FAQ

What are on-chain derivatives platforms?

On-chain derivatives platforms are decentralized trading systems built on blockchain networks that allow users to trade derivatives such as futures, options, and perpetual contracts. Trades and settlements are executed via smart contracts, ensuring transparency, security, and automation without intermediaries.

Why should institutions use on-chain derivatives platforms?

Institutions benefit from reduced counterparty risk, transparent transactions, deep liquidity, global market access, capital efficiency, and the ability to implement programmable, complex trading strategies.

Are on-chain derivatives platforms secure for institutional trading?

Yes, they use non-custodial, smart contract-based systems that provide transparency and reduce operational and counterparty risk. Reputable platforms undergo audits and leverage Layer 2 solutions for added security.