In my article I will examine some of the Best Crypto Derivatives Platforms, specifically, the foremost exchanges offering options, futures, and perpetual contracts on cryptocurrencies.

- What is Crypto Derivatives Platforms?

- Why Use Crypto Derivatives Platforms

- Hedges Are Used to Protect from Volatility

- It is Possible to Trade with Leverage

- It is Possible to Profit from a Market Going Up or Down

- Accessibility of More Advanced Trading Features

- Liquidity is High and Trading Occurs More Rapidly

- Good for Professional and Institutional Trading

- Best Crypto Derivatives Platforms Points

- 10 Best Crypto Derivatives Platforms

- 1. Bybit

- 2. OKX

- 3. Bitget

- 4. Kraken Futures

- 5. Huobi Futures (HTX)

- 6. Gate.io Futures

- 7. MEXC Futures

- 8. BitMEX

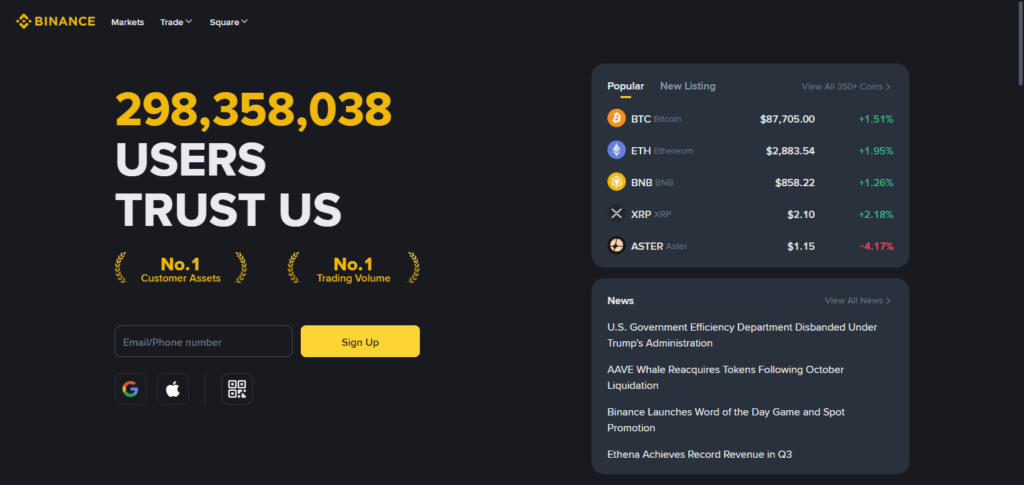

- 9. Binance

- 10. Phemex

- Pros & Cons

- Conclusion

- FAQ

These tools help in the development of complex strategies since they help in trading in both bull and bear markets.

These platforms offer high liquidity, and options of high leverage. For newbies and experienced alike, this guide will help you in getting the most appropriate platform.

What is Crypto Derivatives Platforms?

Exchanges that trade cryptocurrencies without owning the underlying asset are called derivatives crypto platforms. They allow the buying and selling of contracts such as options, futures, and perpetual contracts.

Those contracts allow speculators to make bets on, to hedge, or to increase their investment through leverage on the movements of the underlying asset. They mitigate their investment risk through futures contracts and perpetual contracts.

Trading platforms help traders of all levels of experience, liquidity, and margin trading to maintain both long and short market positions.

Experienced and professional traders are attracted to crypto derivatives platforms that allow flexible trading and that have better risk management. They provide an opportunity to profit whether the market is rising or falling.

Why Use Crypto Derivatives Platforms

Hedges Are Used to Protect from Volatility

Derivatives enable traders to protect their portfolio from sudden price changes by guaranteeing a price, or neutralizing the effects of the market.

It is Possible to Trade with Leverage

Users of the platform are enabled to open bigger positions, which can lead to greater profits, although it also can lead to greater risks.

It is Possible to Profit from a Market Going Up or Down

Derivatives enable a trader to go long and profit from an increase in price, or go short and profit from a decrease in price.

Accessibility of More Advanced Trading Features

Some advanced trading tools include: stop-loss, margin trading, various charting tools, and perpetual contracts.

Liquidity is High and Trading Occurs More Rapidly

For traded liquidity to be deep, a system must be set up, trading volumes must be high, and slippage must be minimal.

Good for Professional and Institutional Trading

More advanced trading includes a system in which strategy is applied to the trades, including: arbitrage, hedging, and market making.

Best Crypto Derivatives Platforms Points

- Bybit – Offers perpetual and futures contracts with high leverage and advanced trading tools.

- OKX – Provides futures, perpetual swaps, and options with multi-asset margin support.

- Bitget – Known for copy trading, futures contracts, and competitive fees.

- Kraken Futures – Professional-grade derivatives with robust security and multiple crypto options.

- Huobi Futures (HTX) – Offers leveraged trading, perpetual swaps, and risk management features.

- Gate.io Futures – Supports crypto futures trading with high liquidity and multiple pairs.

- MEXC Futures – Provides leveraged futures contracts and user-friendly trading interfaces.

- BitMEX – Pioneer in crypto derivatives offering futures and perpetual contracts with high leverage.

- Binance – Leading exchange with futures, options, and margin trading for many cryptocurrencies.

- Phemex – Offers zero-fee futures trading, high leverage, and institutional-grade tools.

10 Best Crypto Derivatives Platforms

1. Bybit

Bybit is one of the best platforms for trading crypto derivatives. It is one of the few brokers operating in the derviative secotr in most countries, and is able to provide multi-lingal support.

They are also one of the most secure brokers, with cold wallets, multi-signature withdrawal systems, and sophisticated risk management protocols in place to protecd the integrity of all user crypto assets.

To top all of this Bybit also offers 24-7 customer support for all products with prompt and friendly assistance.

Bybit also has some of the most sophisticated and user-friendly trading platforms and apps, espeically for für novices, with extreemy liquProfitable Market Making Options and competivitive fee structures. All of this make Bybit one of the best brokers in the world.

| Feature | Details |

|---|---|

| Established Year | 2018 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and more |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 100x |

| KYC Requirement | Minimal for trading; full KYC for higher limits |

| Security | Cold wallets, 2FA, multi-signature technology |

| Customer Support | 24/7 via live chat and email |

| Fees | Competitive trading fees; no deposit fees |

| Local Language Support | Multiple languages for global users |

2. OKX

Founded in 2017, OKX is among the top players in terms of providing a fully-fledged crypto derivative trading platform, including futures, perpetual swaps as well as options trading. It has a different range of supported coins including Bitcoin, Ethereum and other altcoins. The platform is available in different languages.

OKX as well takes user’s security seriously as they have user cold storage, two-factor authentications (2FA), as well as multi-sig wallets. Customer service is available 24/7 and is responsive through live chat and email. OKX has great services and products for every user in the industry.

| Feature | Details |

|---|---|

| Established Year | 2017 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and multiple altcoins |

| Trading Options | Futures, Perpetual Contracts, Options |

| Leverage | Up to 125x |

| KYC Requirement | Minimal for basic trading; full KYC required for higher limits |

| Security | Cold storage, 2FA, multi-signature wallets |

| Customer Support | 24/7 via live chat, email, and ticket system |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global accessibility |

3. Bitget

Bitget is a cryptocurrency trading platform that specializes in derivatives and has trading options for Bitcoin and Ethereum, amongst others.

Founded in 2018, the company quickly grew and became a major player in the derivatives trading market due to the ease of use of its platform, the introduction of various features such as copy-trading, and the various partnerships it has made. In order to perfect their service on a worldwide scale, the platform is offered in many different languages.

For security, Bitget uses cold storage for its wallet and 2FA, as well as multisig technology to secure and safeguard company and client funds.

The company has also incorporated a system that provides care and customer service to over 100,000 clients for free which takes clients about ten seconds to reach. The platform also has low market fees, and so is a well-functioning platform for all types of clients, including new clients.

| Feature | Details |

|---|---|

| Established Year | 2018 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and other major altcoins |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 100x |

| KYC Requirement | Minimal for basic trading; full KYC for higher limits |

| Security | Cold wallets, 2FA, multi-signature wallets |

| Customer Support | 24/7 via live chat, email, and social channels |

| Fees | Low trading fees; competitive withdrawal fees |

| Local Language Support | Multiple languages for global users |

4. Kraken Futures

Kraken Futures is one of the top futures trading platform accessible on multiple websites trading Bitcoin, Ethereum, and other primary altcoins. The company, founded in 2011 and moving into the derivatives part of trading later, expanded into one of the top crypto derivative platforms trading various altcoins.

Futures trading is available in many languages and supported across the globe, thus, this platform is accessible to every country. Kraken Futures is regarded as one of the top tier platforms in the crypto world and on their own.

Due to the popularity of their platforms, they optimized their trading platforms and allowed traders to execute ceaslessly and effectively. Their optimized customer assistance is available 24 hours a day, every day of the week. Without a doubt, Kraken serves as one of the best in the industry.

| Feature | Details |

|---|---|

| Established Year | 2011 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and other major altcoins |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 50x |

| KYC Requirement | Minimal for small trades; full KYC required for higher limits |

| Security | Cold storage, 2FA, advanced risk management |

| Customer Support | 24/7 via live chat and email |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global users |

5. Huobi Futures (HTX)

Since 2013, Huobi Futures has been a major player in the cryptocurrency industry, being one of the original cryptocurrency derivatives platforms.

They offer futures and perpetual contracts for a number of different cryptocurrencies, including Bitcoin, Ethereum, and many others. The platform also supports a wide number of local languages.

Huobi equips its’ users with a number of security features such as cold wallets, 2FA, and Multi-Sig, and also has a 24/7 customer support system using LiveChat, work email, and social media. They maintain a high customer satisfaction rating with low costs, and a large number of customizable trading tools.

| Feature | Details |

|---|---|

| Established Year | 2013 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and major altcoins |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 125x |

| KYC Requirement | Minimal for basic trading; full KYC for higher limits |

| Security | Cold wallets, 2FA, multi-signature technology |

| Customer Support | 24/7 via live chat, email, and ticket system |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global users |

6. Gate.io Futures

In 2013, Gate.io launched Gate.io Futures, a crypto derivatives marketplace with perpetual and futures contracts on Bitcoin, Ethereum, and other altcoins.

Gate.io Futures is accessible to traders around the world and in different regions because it has a multilingual platform. Gate.io Futures protects users’ funds with security measures like cold wallets, two-factor authentication (2FA), and sophisticated risk control.

They have on the clock customer support through email and chat. With great liquidity, advanced trading features, and low trading costs, Gate.io Futures has great offers for beginners and advanced traders.

| Feature | Details |

|---|---|

| Established Year | 2013 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and other major altcoins |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 100x |

| KYC Requirement | Minimal for basic trading; full KYC required for higher limits |

| Security | Cold storage, 2FA, multi-signature wallets |

| Customer Support | 24/7 via live chat, email, and ticket system |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global users |

7. MEXC Futures

Founded in 2018, MEXC Futures is one of the top players in the industry. MEXC is one of the best in the derivatives, leveraged futures, and futures contract offerings, providing its over 7 million customers with futures contracts for Bitcoin, Ethereum, and many well-known altcoins.

MEXC is available in all major languages, making it easy for clients from all countries to navigate the MEXC website. MEXC’s top priorities are the safety and protection of clients’ assets.

MEXC employs cold wallets, 2FA, and proprietary advanced risk control mechanisms to protect the assets of users of MEXC. Other than the above, MEXC’s support is available 24/7.

MEXC offers support via live chat, as well as email support. For crypto trading, MEXC Futures has a combination of features that makes it a great platform for both beginners and advanced users.

MEXC has great liquidity, very low trading costs, and excellent trading features. MEXC is a great platform for both novice and advanced users of trading crypto to utilize complex tools and features.

| Feature | Details |

|---|---|

| Established Year | 2018 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and other major altcoins |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 125x |

| KYC Requirement | Minimal for basic trading; full KYC required for higher limits |

| Security | Cold storage, 2FA, multi-signature wallets |

| Customer Support | 24/7 via live chat, email, and ticket system |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global users |

8. BitMEX

The first crypto derivatives trading platform is BitMEX which launched in 2014. It specializes in futures and perpetual contracts for top crypto assets such as Bitcoin and Ethereum.

Being a global exchange, BitMEX is available in many languages. BitMEX takes security seriously and uses cold storage, and multi-signature crypto wallets, and 2FA for added protection for users when trading.

Customer service remains available 24/7, and users can contact support through live chat or email. The platform is designed for professional traders offering high liquidity, and advanced trading options, as well as low fees. It is considered one of the top crypto trading platforms.

| Feature | Details |

|---|---|

| Established Year | 2014 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 100x |

| KYC Requirement | Minimal for small trades; full KYC required for higher limits |

| Security | Cold storage, 2FA, multi-signature wallets |

| Customer Support | 24/7 via live chat and email |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global users |

9. Binance

One of the world leaders in cryptocurrency trading and crypto derivatives trading, and offering futures, options, and margin trading in numerous cryptos (Bitcoin, Ethereum, and many altcoins) is Binance, operational since 2017.

The site has numerous language options so it is accessible globally. Binance has cold wallets, two factor authentication (2FA), the SAFU (security asset funds for users) insurance Fund, and other techniques to monitor and keep the assets of its users secure, and outstanding safety protocols.

Binance also has 24/7 support for users, via Live Chat, email, and social to improve the response times for users that are trading. Binance is accessible to users with all levels of trading experience. It also has high liquidity and is a good site to trade with to obtain low fees.

| Feature | Details |

|---|---|

| Established Year | 2017 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and hundreds of altcoins |

| Trading Options | Futures, Options, Perpetual Contracts |

| Leverage | Up to 125x |

| KYC Requirement | Minimal for small trades; full KYC required for higher limits |

| Security | Cold storage, 2FA, SAFU fund, advanced monitoring systems |

| Customer Support | 24/7 via live chat, email, and ticket system |

| Fees | Competitive trading fees; low withdrawal fees |

| Local Language Support | Multiple languages for global users |

10. Phemex

Founded in 2019, Phemex is one of the fastest growing derivatives exchanges, offering future and perpetual contracts for Bitcoin, Ethereum and dozens of other altcoins. With the exchange customising its website in several different native languages, it is able to service and attract international traders.

Security is also a priority and the exchange uses cold storage, 2FA, and other proprietary risk management tools. Phemex uses a variety of tools for customer service available at all hours to respond to the needs of traders.

With the exchange having high liquidity for all of its trading pairs, offering almost all trading pairs at zero trading fees, and competitve fee structures for paying trades, the level of the trading tools available on the exchange, Phemex is one of the most considered exchanges to trade on for crypto derivatives for both new and more experienced traders.

| Feature | Details |

|---|---|

| Established Year | 2019 |

| Supported Cryptocurrencies | BTC, ETH, USDT, XRP, LTC, and major altcoins |

| Trading Options | Futures, Perpetual Contracts |

| Leverage | Up to 100x |

| KYC Requirement | Minimal for basic trading; full KYC required for higher limits |

| Security | Cold storage, 2FA, multi-signature wallets |

| Customer Support | 24/7 via live chat, email, and ticket system |

| Fees | Zero-fee options; competitive trading and withdrawal fees |

| Local Language Support | Multiple languages for global users |

Pros & Cons

Pros:

- Profit in Rising and Falling Markets: Being able to go long and short means one can profit (in theory) regardless of whether the market is going up or down.

- Leverage Trading: Can control larger positions with a smaller amount of capital, thus increasing potential upside.

- Hedging Opportunities: Provides market protections to one’s crypto in a recession.

- Advanced Trading Tools: Provides various features such as stop-loss, margin, and charting.

- High Liquidity: Provides smooth execution of one’s orders with little or no slippage.

- Global Accessibility: Many platforms managed to intergrate various languages as well as a multitude of different crypto.

Cons:

- High Risk: Trading can be quite risk even to the point of losing a lot of money, especially with leverage and for beginners.

- Complexity: Knowing a fair amount of market strategies and derivatives is required.

- Fees and Funding Costs: Users can be hit with large costs due to high leverage and overnight fees (when position is left open overnight) on some platforms.

- Regulatory Restrictions: Due to the potential threats and risk, some countries have deemed it illegal to operate.

- Potential for Liquidation: People risk losing ill-conditioned open positions due to margin calls and very specific risk criteria not being met.

Conclusion

In summary, the top crypto derivatives platforms empower users with tools to speculate, hedge, and gain on profits the fluctuating crypto market.

Diverse and high-level market makers and derivatives providers like Bybit, OKX, Bitget, Kraken Futures, Huobi Futures, Gate.io Futures, MEXC Futures, BitMEX, Binance, and Phemex that feature high liquidity and advanced security, offer suitable venues for both rookie and expert traders to execute and diversify on their trading strategies.

Leveraged and derivative trading systems, with their scaling potential, also come with heightened risks; with this context, we’d recommend trading venues with solid security and a fair customer support and fee structure. These trading venues continue to influence the paradigm surrounding global crypto trading.

FAQ

What are crypto derivatives platforms?

Crypto derivatives platforms are trading exchanges where users can buy and sell derivative contracts, such as futures and options, based on the price of cryptocurrencies without owning the underlying assets.

How do crypto derivatives work?

They allow traders to speculate on price movements, hedge risks, or use leverage to increase exposure, enabling profits in both rising and falling markets.

Are crypto derivatives platforms safe?

Top platforms implement cold storage, two-factor authentication (2FA), multi-signature wallets, and advanced monitoring to secure user funds, but trading always carries inherent risk.

Can beginners use crypto derivatives platforms?

Yes, but beginners should start with low leverage and practice risk management, as derivatives trading is more complex than spot trading.