In this article, I will elaborate on WunderTrading, one of the best crypto trading platforms with automated bots, copy trading, and portfolio distribution across multiple exchanges.

- What is WunderTrading?

- Key Overview

- How to Get Started with WunderTrading

- Step 1: Start with an Account

- Step 2: Continue to Your Profile

- Step 3: Linking Your Exchange Account

- Step 4: Check the Dashboard

- Step 5: Create a Trading Bot

- Step 6: Begin the Optional Copy Trading

- Step 7: Performance Tracking

- Step 8: Profit Withdrawal

- Pricing and Plans

- Benefits of Using WunderTrading

- Automated Trading Saves Time

- Access to Professional Strategies

- Improvement on Portfolio Management

- Less Risks of Emotional Trading

- Multiexchange Integration

- Security and Safety

- WunderTrading Compared and Alternatives

- Trading Tools on WunderTrading

- Is WunderTrading Worth It?

- Security Measures

- Two-Factor Authentication (2FA)

- Encrypted Transfer of Information

- Non-Custodial Structure

- API Key Function Clamping

- API Key Protection

- Automated Risk Management

- WunderTrading Supported Crypto Exchanges

- Key Features of WunderTrading

- Trading View Signal Bot

- Grid Bot

- AI Grid Bot

- DCA Bot

- Smart / Spread Trading Terminal

- Copy Trading Marketplace

- Multi-API Management

- Arbitrage Trading

- Crypto Portfolio Tracker

- Paper Trading

- In-Dashboard Analytics

- Risk Management Tools

- Pros and Cons

- Mobile App

- Conclusion

- FAQ

The purpose of WunderTrading is to help traders of all levels implement strategies, track metrics, and control risk with maximum efficiency. On WunderTrading, tools are available for all proficiency levels to optimize trading in digital currencies.

What is WunderTrading?

WunderTrading is a fully-fledged crypto trading platform designed to help rookie as a well as professional traders automate and improve trading strategies.

Founded to make trading cryptocurrency easier, users can link their exchange accounts through fully secured APIs and automatically trade without any constant range of oversight.

Automated trading bots, copy trading, portfolio management and real-time analytics streamline the intensive management of numerous digital assets. WunderTrading integrates with the biggest exchange, and trading platforms, like Binance and Bybit, maintaining a seamless operational experience across trading environments.

WunderTrading features robust security, with two-factor authentication, disparate two-factor authentication sites, and sophisticated protective measures to safeguard user data.

WunderTrading is fully integrated and streamlined, and works to minimize the extensive time and risk involved in trading to improve user efficacy with professionally managed data insights.

Key Overview

| Key Points | Details |

|---|---|

| Platform Name | WunderTrading |

| Founded | 2020 (approx.) |

| Founder(s) | Information about specific founders is limited, but the platform is developed by a team of crypto and trading experts. |

| Headquarters | Primarily online-based, global reach; no single physical HQ publicly listed |

| Category | Cryptocurrency Trading Platform / Crypto Automation & Copy Trading |

| Supported Assets | Major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and other altcoins |

| Supported Exchanges | Binance, Bybit, KuCoin, OKX, FTX (via API integration), and more |

| Platform Type | Web-based platform with mobile app support |

| Target Users | Beginners, intermediate, and advanced crypto traders |

| Key Features | Automated trading bots, copy trading, portfolio management, analytics, strategy backtesting |

| Security Features | Two-factor authentication (2FA), secure API integration, data encryption |

| Pricing Model | Free and subscription-based premium plans |

| Unique Selling Proposition (USP) | Enables automated and copy trading with professional-grade tools while integrating multiple exchanges |

How to Get Started with WunderTrading

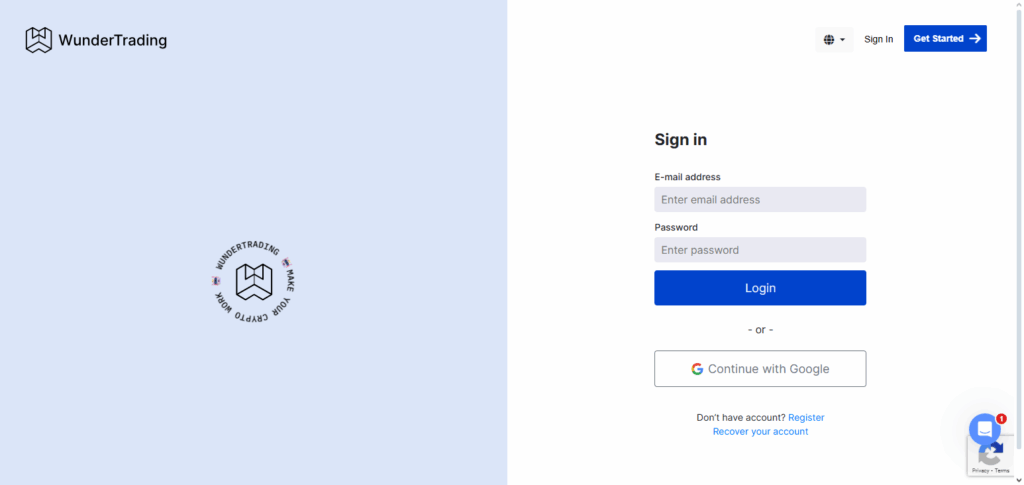

Step 1: Start with an Account

- Start with the official WunderTrading webpage.

- Start with the Sign Up option on the portal.

- Provide an email address to use and prepare a strong password.

- Check your inbox and verify your account by clicking the confirmation link.

Step 2: Continue to Your Profile

- Start with logging into the account.

- Provide personal information like your name and currency.

- Activate two-factor authentication (2FA) to secure your account.

Step 3: Linking Your Exchange Account

- Head over to the API Integration tab.

- Choose the exchange you wish to connect (Binance, Bybit, KuCoin, etc.)

- Create an API key in your exchange account and copy it to the clipboard.

- In WunderTrading, paste your new API key and secret.

- Grant permissions to trade and access your account (withdrawals should never be allowed for protection).

Step 4: Check the Dashboard

- Spend time getting accustomed to your dashboard: Portfolio, Bots, Copy Trading, and Analytics.

- Determine your account balance as well as your connected assets.

Step 5: Create a Trading Bot

- Go to the option of Trading Bots.

- Select one of the automated trading robots that are available on the platform or develop one from scratch using the strategy creator.

- Select the market or trading pair, the amount you wish to invest, and define the risk settings.

- Optionally, you can test the strategy and see how it would have performed in the past.

Step 6: Begin the Optional Copy Trading

- Go to the Copy Trading section and see who the best traders are.

- Select a trader based on your risk tolerance and trading strategy.

- Specify your investment, and the system will auto-trade for you.

Step 7: Performance Tracking

- Monitors the activities of your auto trading bots and copy traders.

- Modify your auto trading bot’s settings: strategy, stop loss, and take profit.

- Make use of the available platform tools to run analyses and determine a course of action.

Step 8: Profit Withdrawal

- Once you have made profit, you can send withdraw it from the trading platform to your exchange account.

- Make sure you comply with the exchange platform’s withdrawal guidelines.

Pricing and Plans

Free Plan

If you are an absolute beginner, the Free Plan is the go-to option. Starting out, this plan provides you with access to the trading terminal, copy trading, portfolio tracking, and paper trading.

With the ability to connect one API per exchange, you are able to get a feel of the trading features that WunderTrading offers, along with testing different trading strategies and becoming more familiar with the platform, no money on the line. This is a great plan to learn the basics and gain familiarity with automated trading.

Starter Plan

At the price of $4.95 a month, the Starter Plan is an additional benefit to the Free Plan by giving access to one of the active signal bots, a DCA trading terminal, an AI bot, and a Pump Screener. This Pump Screener is beneficial as it assists with the identification of rapid shifts in the market.

Other features such as futures spreads and arbitrage trading are available as well to broaden the scope of strategies. This is an ideal plan for traders that are ready to advance in their trading and want access to more sophisticated trading tools.

Basic Plan

The Basic Plan, which is offered at a monthly cost of $19.95, offers automation features tailored to the needs of users who want to improve their trading results as passive income traders.

It has a total of five active signal bots, 2 APIs, the option to add multiple bots for take profit, and has the ability to add five grid bots. Overall, the plan has a variety of options which allows users to customize their trading techniques.

Pro Plan

The Pro Plan brings a higher monthly cost of $39.95 and is dedicated to a more experienced target audience. It features a total of 15 active signal bots, 5 APIs per exchange, and the option to add swing and spread trading.

For the Pro Plan automated bots, there are 3 AI options available and a total of 10 grid bots which together allows the user to execute much more sophisticated techniques and capture value that otherwise would have been tightly managed risk.

Premium Plan

Most professional users and traders wishing to grow their business would opt for the Premium Plan. It is priced at $89.95 per month and allows for limitless active bots to be added, as well as unlimited APIs per exchange.

The same flexibility for AI bots and grid bots is provided, but there are 10 of each and 200 grid bots for added bonus. Advanced trading techniques and the management of a vast quantity of positions, which allows for the holding of thousands of open positions at once, are the key to successful economic management of a large portfolio.

Benefits of Using WunderTrading

Automated Trading Saves Time

- Bots automate trading strategies with wonders of trading so there’s no need to keep an eye on the market constantly. Bots can execute trades while traders get to focus on the strategy.

Access to Professional Strategies

- Copy trading helps beginners as they can follow professional traders, gaining the opportunity to witness a strategy in action and implement it without an in-depth market understanding.

Improvement on Portfolio Management

- Track multiple assets on multiple exchanges on one dashboard with the ability to get real-time analytics on your investment and keep alerts to stay on top of your investment.

Less Risks of Emotional Trading

- Impulsive trading decisions are reduced as the automated bots take on the trading themselves while your plans are being structured, helping more effective risk management.

Multiexchange Integration

- WunderTrading connects with multiple popular exchanges through API, permitting you to trade on multiple platforms at once without having to switch accounts.

Security and Safety

- Users face a minimal risk of being exposed to cyber threats as they can trade with their 2FA, secure API integrations and data encryption in place.

WunderTrading Compared and Alternatives

| Platform | Key Features | Strengths (vs WunderTrading) | Weaknesses |

|---|---|---|---|

| WunderTrading | TradingView‑signal bots, DCA bots, Grid bots, Copy‑trading marketplace, Multi‑exchange API | Very good TradingView integration, copy trading, clean UI, powerful built-in bots | Counterparty risk (keys stored on servers) |

| 3Commas | SmartTrade terminal, DCA bots, Grid bots, Arbitrage, Paper trading | More advanced customization, strong bot variety, more mature strategy capabilities | More expensive; steeper learning curve |

| Cryptohopper | Cloud-based bots, Strategy designer, Signal Marketplace, Backtesting, Social trading | Very flexible strategies, marketplace to buy/sell signals, good for beginners who want strategy variety | Free features are limited; advanced use needs paid plan; more complex UI |

| Pionex | 16+ built-in bots (Grid, DCA, Arbitrage), no bot-subscription fees | Extremely low cost (pay via trading fees), very beginner-friendly, no API setup needed | Only works within Pionex (can’t connect external exchanges) |

| Bitsgap | Grid & DCA bots, portfolio management, cross-exchange arbitrage, unified trading terminal | Excellent for cross-exchange trading and arbitrage, great for portfolio overview | Higher price for advanced plans; may be overkill for small traders |

Trading Tools on WunderTrading

| Tool / Feature | Description |

|---|---|

| Signal Bot (TradingView) | Automates trades based on TradingView alerts. You can send custom strategies or indicator signals, and the bot executes trades accordingly. |

| DCA Bot | Employs a dollar-cost averaging strategy, placing regular buys to manage risk and smooth out entry price over time. |

| Grid Bot | Places buy and sell orders in a predefined price “grid” to profit from market volatility. Works for both spot and futures. |

| AI Bot (AI Grid) | Uses machine learning to optimize grid trading: it chooses grid step sizes based on market conditions, opens multiple bots, and has risk controls like trailing stop. |

| Smart / Spread Trading Terminal | A trading terminal that supports conditional orders (take profit, stop‑loss, trailing stops) and allows “spread trading” (pairs trading) where you trade two assets simultaneously. |

| Multi‑API Management | Lets you connect multiple API keys (across the same or different exchanges) and trade across them from a single interface. |

| Arbitrage Trading | A terminal to automate arbitrage strategies between exchanges — buy on one exchange and sell on another to exploit price differences. |

| Crypto Portfolio Tracker | Tracks your crypto holdings across connected exchanges, giving you a unified view of your portfolio distribution and performance. |

| Paper Trading | Simulated trading environment that lets you test bots and strategies in a risk‑free way before deploying real funds. |

Is WunderTrading Worth It?

Sure — WunderTrading is worth the time for various crypto investors. This platform provides a distinguished collection of crypto automated bots (DCA, grid, TradingView-based), copy-trading, and a consolidated trading hub from various exchanges.

Its tiered pricing system, including a complimentary tier, is a plus, while advanced features accommodate professional traders. Still, it’s not a magic profit vending machine — a good trading strategy, risk management, and active monitoring are required.

Security Measures

Two-Factor Authentication (2FA)

To fortify the security of account logins, WunderTrading enables 2FA using Google Authenticator.

Encrypted Transfer of Information

SSL encryption protects all information transferred between users and the system and all other entities.

Non-Custodial Structure

WunderTrading does not custodialize customer money; it connects to your exchange accounts on a read-only basis via API keys, so your money stays in the exchange.

API Key Function Clamping

Users can whitelist API keys to only allow trading (no withdraw permissions), thus reducing the loss exposure should an attacker gain access to your API keys. ([Hedge With Crypto])

API Key Protection

API keys are sealed in a vault and access is logged, thus reducing the risk of losing your keys.

Automated Risk Management

The platform includes pre-set stop loss orders, adjustable position size, and maximum portfolio exposure on each bot to help users mitigate the risks of automated trading.

WunderTrading Supported Crypto Exchanges

| Exchange | Notes / Highlights |

|---|---|

| Binance | Spot & Futures trading supported. |

| Bybit | Fully integrated for automated trading. |

| OKX | Supports spot, futures, and margin. |

| Bitget | Available for bots and strategies. |

| Gate.io | Included in supported exchanges list. |

| BingX | Supported for automation and trading. |

| WOO X | Integrated for trading on WunderTrading. |

| MEXC | Bots like Grid, AI, DCA work with MEXC. |

| Coinbase (Advanced) | Support for Coinbase Advanced account. |

| Deribit | Supported for futures / options trading. |

| BitMEX | Integrated for automated trading. |

| Kraken (Futures) | Supported for futures trading. |

| Phemex | Included in the 2023+ roadmap. |

| HyperLiquid | Web3‑wallet integration supported. |

| Bittrex | Supported since earlier versions. |

Key Features of WunderTrading

Trading View Signal Bot

Automates trade execution instantly after receiving alerts according to your TradingView strategies (custom or PineScript).

Grid Bot

Places a number of buy and sell orders at various prices in a given price range to take advantage of the profit when the market is in a volatile state.

AI Grid Bot

Optimises the grid trading while using smart money management principles and machine learning to run several grids at a time.

DCA Bot

Applies a dollar-cost averaging strategy to spread out the buys over a time period to mitigate timing risk.

Smart / Spread Trading Terminal

Lets you do what’s known as pair trading. You buy one asset while simultaneously selling another one and you can easily specify take profit, stop loss, trailing stop orders to make your trade more sophisticated.

Copy Trading Marketplace

Follow and buy trade copies of professional traders automatically, you can also specify your position size and risk params.

Multi-API Management

Allows linking multiple exchange accounts via API and trade across all of them from one dashboard.

Arbitrage Trading

Automates trade strategies popping price inefficiencies across different exchanges.

Crypto Portfolio Tracker

View your diverse exchange portfolio in one location, and you can see stats about your portfolio performance.

Paper Trading

Test your bots and simulate trades without using real money.

In-Dashboard Analytics

Check metrics within the dashboard for each strategy like bot win rate and profit factor, trade volume, and ROI.

Risk Management Tools

Adjust how much of your portfolio bots can utilize, customize position sizes, and set stop-loss/take-profit for bots.

Pros and Cons

| Pros | Cons |

|---|---|

| Comprehensive toolkit: bots (TradingView, Grid, DCA), copy‑trading, multi‑API terminal | Learning curve can be steep, especially for beginners |

| Free plan available with basic features and paper trading | Advanced features (many bots, multi‑API) require paid subscriptions |

| Non-custodial: funds stay on your exchange, reducing risk | Relies on exchange APIs, so outages/slippage can affect bot execution |

| Multi‑exchange account management from one dashboard | Copy trading risk: success depends on the strategy providers |

| Strong security: 2‑factor authentication and encrypted data | Mobile app is limited — mostly for monitoring, not bot setup |

| Robust analytics and performance insights | Pricing can become expensive, especially for professional-level tiers |

Mobile App

WunderTrading has created an app so traders can manage their portfolios while on the go. Users can view performance analytics in real-time and track their bots. Users can control trades on multiple exchanges.

Active traders can easily monitor their bots as they set up their strategies on the web platform. The app alerts users of trades and important market shifts so traders can make on the spot changes to their strategies. Ultimately, the app gives users enhanced flexibility to manage their trades from any location.

Conclusion

For traders in the cryptocurrency market, WunderTrading is a great option, regardless of your level of experience. For newbies, cryptocurrency trading is made affordable with the platform’s tiered pricing, and features are efficient and automated.

For veterans, trading becomes a breeze for advanced features, including trading bots, copy trading, multi-exchange trading, and expert-level portfolio management.

Although the platform has some learning curves, WunderTrading’s security, analytics, and portfolio management features, combined with growing flexible pricing, make for a great trading experience.

FAQ

What is WunderTrading?

WunderTrading is a cloud‑based crypto trading platform that allows users to automate trades, manage multiple exchange accounts, and follow expert traders via copy trading.

How does copy trading work on WunderTrading?

In WunderTrading’s copy‑trading marketplace, you can follow signal providers (traders) and automatically replicate their trades on your own connected exchange account.

One common issue: if trades don’t replicate, it might be because your allocated funds are too small for the provider’s strategy or below the exchange’s minimum trade limit.

Is my personal data safe on WunderTrading?

Yes. WunderTrading uses SSL encryption to secure data in transit.

They collect minimal personal information (e.g., email, IP, trade data) and only store what is necessary.