I will talk about the Best Edgex Exchange Alternatives available in the market in this article. These platforms enable trading in a secure, swift, and rich in features manner, frequently bettering Edgex in terms of liquidity, cross-chain support, and even derivatives.

- What is Edgex Exchange?

- Why Use Edgex Exchange Alternatives

- Key Point & Best Edgex Exchange Alternatives

- 1. Hyperliquid

- Hyperliquid Features

- 2. GMX

- GMX Features

- 3. Vertex Protocol

- Vertex Protocol Features

- 4. dYdX v4

- dYdX v4 Features

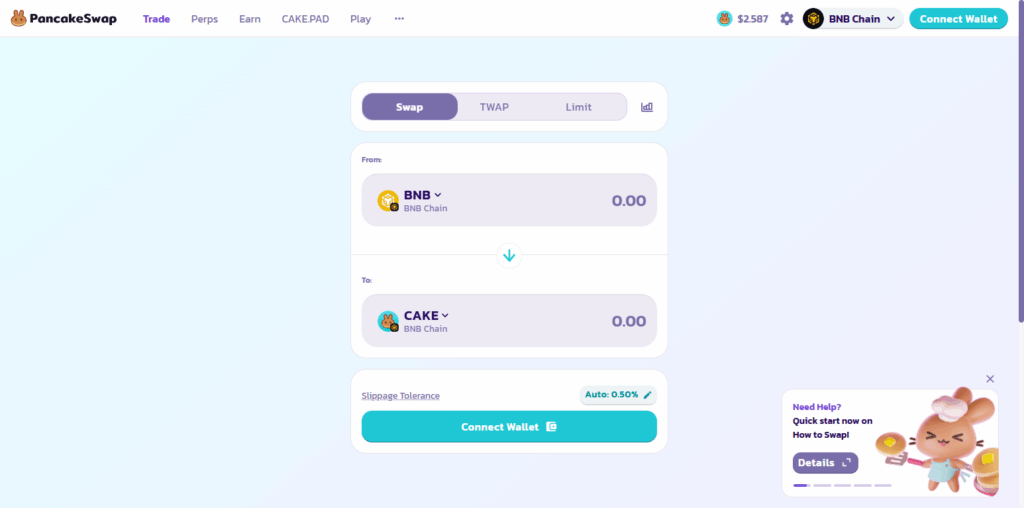

- 5. PancakeSwap

- PancakeSwap Features

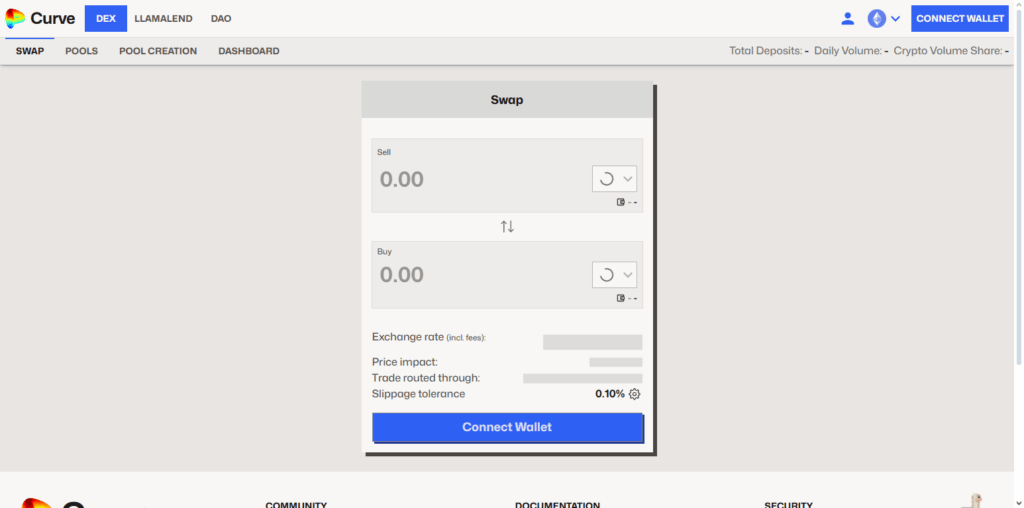

- 6. Curve Finance

- Curve Finance Features

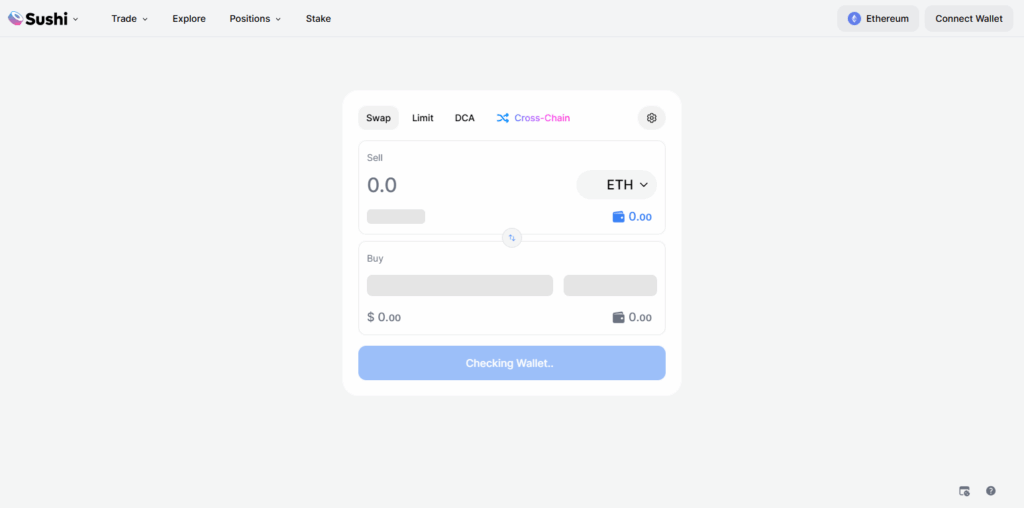

- 7. SushiSwap

- SushiSwap Features

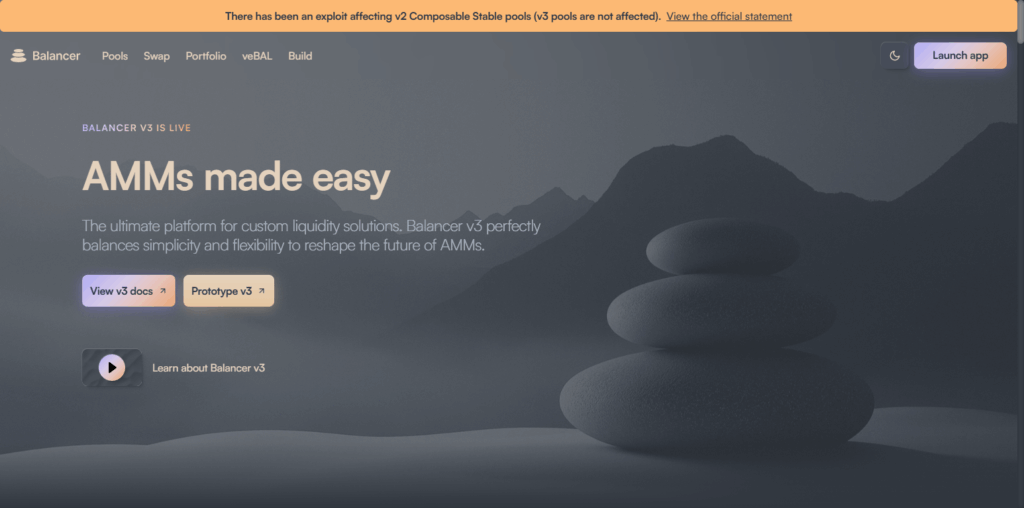

- 8. Balancer

- Balancer Features

- 9. 1inch Network

- 1inch Network Features

- 10. Aster Protocol

- Aster Protocol Features

- Risk & Consider

- Conclusion

- FAQ

Their user-friendly interfaces and helpful trading tools make them suitable for all types of traders. Considering the alternatives will enable you to trade in the best manner and pursue all the opportunities available.

What is Edgex Exchange?

edgeX Exchange provides a top-tier decentralized cryptocurrency trading platform which was initiated in 2023 for perpetual futures, as well as spot trading, and decentralized non-custodial layer 2 systems using the StarkEx ZK-rollup solution on the Ethereum blockchain, allowing for on-chain settlement and order book mechanics with self-custody of assets, and near instantaneous settlement and CEX-level liquidity.

With greater than 160 perpetual markets and sub 10 millisecond latency, it targets the performance void between centralized and decentralized exchanges with outstanding transparency and security of DeFi.

Why Use Edgex Exchange Alternatives

Wider Range of Assets – Some alternatives have a greater variety of cryptocurrencies, tokens and derivatives than Edgex, which could appeal to traders searching for uncommon or developing assets.

Lower Fees and Better Incentives – Some alternative platforms have lower trading, deposit and withdrawal fees, or better incentives such as staking, referral bonuses or liquidity mining.

Improved User Experience – Some alternatives simplify trading through smart interfaces, faster execution, mobile apps, and advanced charts which improves the experience of traders at all levels.

Compliance and Security – Compliance with KYC and AML, fund insurance, and reduced hacking and legal issue risk are all features that may appeal to some users.

Market Liquidity and Depth – Significant slippage is bad, especially for active traders or people trading high volumes, and thus liquidity is essential.

Cross-Chain and Platform Compatible – Alternatives are blockchains themselves or are integrated with DeFi, allowing users greater freedom for swaps, staking and yield farming.

Customer Support & Community Engagement – Support responsive to help tickets and dynamic communities allow users to fix problems quickly and stay current on the market.

Key Point & Best Edgex Exchange Alternatives

| Platform/Protocol | Key Features / Highlights |

|---|---|

| Hyperliquid | Decentralized perpetual trading with high liquidity; cross-chain support; low slippage execution. |

| GMX | Non-custodial spot and perpetual DEX; low fees; uses Chainlink oracles for accurate pricing. |

| Vertex Protocol | DeFi derivatives and options trading; permissionless and on-chain; customizable strategies. |

| dYdX v4 | Layer-2 derivatives exchange; low fees; perpetual and margin trading; high-speed settlement. |

| PancakeSwap | AMM-based DEX on BNB Chain; yield farming and staking; low fees; NFT and lottery integration. |

| Curve Finance | Stablecoin-focused AMM; extremely low slippage; optimized for large stablecoin swaps. |

| SushiSwap | Multi-chain AMM; yield farming; staking; lending & borrowing via Kashi; cross-chain swaps. |

| Balancer | Flexible liquidity pools; programmable AMM; multi-asset pools; dynamic trading fees. |

| 1inch Network | DEX aggregator; finds best prices across multiple DEXs; low gas fee routing; liquidity optimization. |

| Aster Protocol | Derivatives trading platform; decentralized perpetual contracts; risk management and leverage options. |

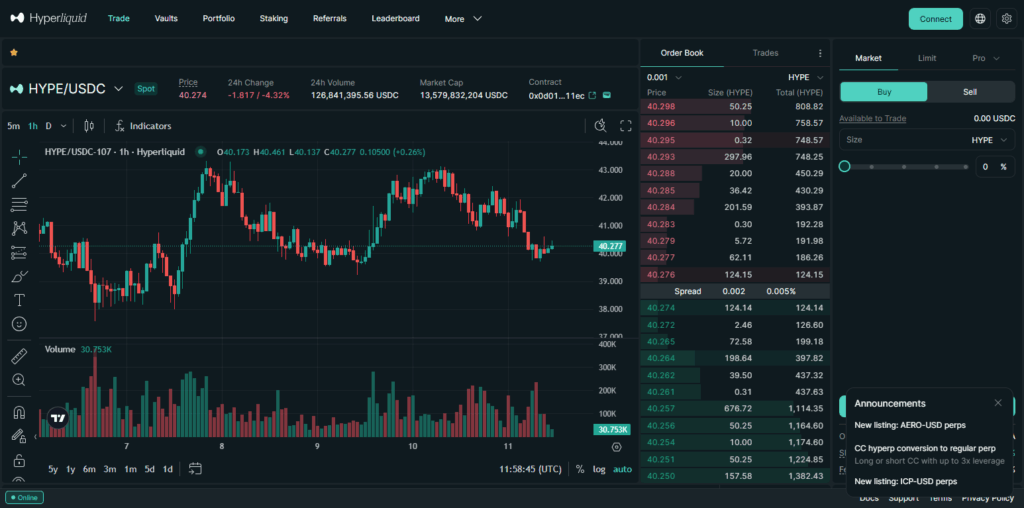

1. Hyperliquid

Among the Edgex Exchange alternatives, Hyperliquid is possibly the best due to its unmatched speed and liquidity coupled with cross-chain versatility.

Usually, in contrast with most of the decentralized platforms Hyperliquid has high-performance seamless order books that help to balance slippage and immediate execution of trades.

This is incredibly beneficial to novices and seasoned tsarders alike. It is also multi-chain in its architecture, enabling fast-tracking trades between the major blockchains and providing easy access to a host of other assets without needing to change platforms.

They also foster a culture of transparency, security with non-custodial wallets, and on-chain settlements. Hyperliquid also has l owing trading fees and innovative derivatives choices, as well as optimized liquidity pools guaranteeing a trading experience that is professional and far superior to what Edgex offers.

Hyperliquid Features

- High Liquidity: Ensured with deep liquidity pools for rapid trades with no slippage.

- Low Fees: Relatively cheaper trading fees. Good for high-frequency traders.

- User-Friendly Interface: Simple dashboards for both newbies and seasoned pros.

2. GMX

GMX is one of the best alternatives to Edgex exchange due to its user-friendly, secure, and effective approach to decentralized trading. Users maintain total control of their assets since it is non-custodial, and can easily do spot and perpetual trading at a keystroke and at very minimal fees.

With Chainlink price oracles, GMX maintains optimal price accuracy and market liquidity, and its unique liquidity pool model and market depth reduce slippage even at high volumes. Its interface is user-friendly, with plenty of earning opportunities from staking and yields. With a platform roadmap centered on privacy,

GMX is a market leader on decentralized governance and has reliable derivatives trading, which makes it a leader on the market and still preserves trust, making it one of the best alternatives to Edgex.

GMX Features

- Decentralized Derivatives: Enables leveraged trading for crypto assets and other derivatives in a fully decentralized manner.

- Low Gas Fees: Transactions are cost-effective and low in gas.

- Strong Security: Smart contracts are audited to enhance fund security.

3. Vertex Protocol

Vertex is an exceptional Edgex Exchange alternative, especially for traders looking for advanced DeFi derivatives. It grants access to a fully on-chain, permissionless platform intended for the creation, trading, and management of complex derivative products with full transparency and security.

Vertex Protocol differs from most other exchanges in its ability to implement custom strategies and derivatives risk management tools, providing the ability to hedge or leverage positions fully tailored to the traders’ objectives.

Its smooth connectivity with multiple blockchains guarantees equisite and low latency access to manifold liquidity pools.

Vertex Protocol is quite exceptional for its range of seamless, innovative derivatives, low fees, non-custodial control, and rapid execution processing, providing a trading environment that is far more flexible than Edgex.

Vertex Protocol Features

- Flexible Trading: Cetnered on derivatives alongside options and margin trading.

- Liquidity Aggregation: Better pricing by gathering liquidity from various endpoints.

- Advanced Risk Management: Embedded features mitigate trading risks.

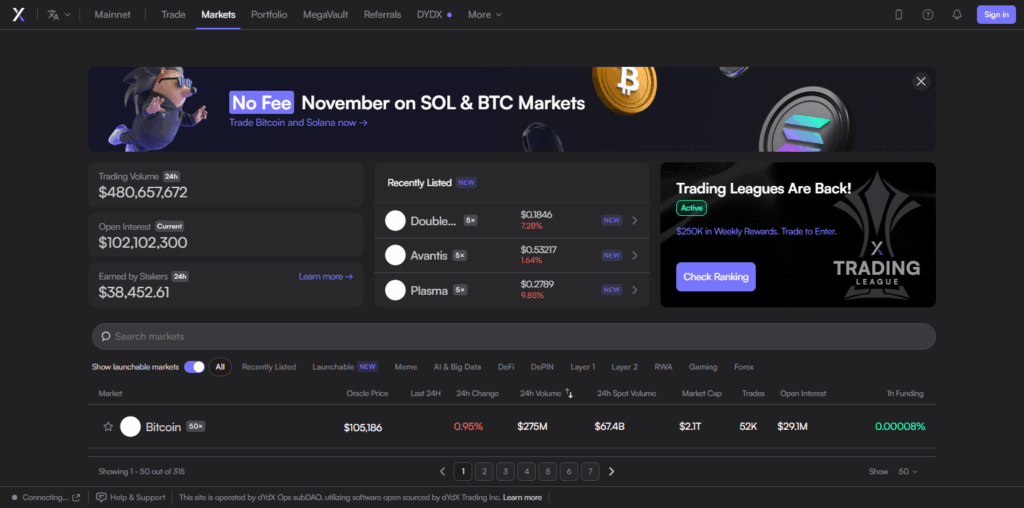

4. dYdX v4

dYdX v4 stands out as an Edgex Exchange alternative with its high-speed, low-cost decentralized derivatives trading thanks to its advanced Layer-2 architecture. Users are granted perpetual contracts and margin trading, as well as fully non-custodial funds for maximum security.

dYdX v4’s reduced latency and high throughput with sub-second execution times also appeal to professional traders since they decrease slippage.

dYdX v4’s user control and trust are also enhanced by its seamless decentralized governance systems and transparent on-chain settlement.

Advanced traders looking to Edgex for performance and decentralization are well served by dYdX v4’s cross-chain interoperability, substantial liquidity, and competitive fees.

dYdX v4 Features

- Layer 2 Scalability: Performing on L2 rapid-trade, low gas and high L2 L2Latency.

- Perpetual Contracts: Extreme derivatives coupled with margin trading.

- Decentralized Governance: Earned through DYDX tokens, holders can access and shape platform policies.

5. PancakeSwap

PancakeSwap stands to be the best alternative to Edgex Exchange and best suited for users in need of a low priced decentralized trading platform with myriad offerings.

It has been designed with the BNB Chain and has AMM functionality for easy token swaps with low slippage trading.

Other than support for trading, PancakeSwap facilitates yield farming, staking, lotteries, NFTs, and an all-inclusive DeFi setting. It has been incorporated into several chains which combined with a simple design and strong community support, makes it suitable for easy and advanced users.

Edgex Exchange users can benefit from the high liquidity, wide range for trading, and fast transaction speeds PancakeSwap provides making it easier to use.

PancakeSwap Features

- AMM Exchange: Use for trading on Automated Market Makers that enable swaps of BEP-20 tokens on the Binance Smart Chain.

- Yield Farming & Staking: Liquidity providing and staking CAKE tokens for rewards.

- Cost of transactions: Cheaper trade execution compared to Ethereum-based DEXs.

6. Curve Finance

Curve Finance stands out as an exceptional Edgex Exchange alternative, particularly for users needing to swap stablecoins and other assets swiftly and cost-effectively.

Unlike conventional AMMs, Curve is designed to facilitate low-slippage matches for trades involving assets with comparable values, making it perfect for stablecoins and wrapped tokens.

Its unique algorithm minimizes impermanent loss for liquidity providers while simultaneously ensuring deep liquidity pools for traders. Curve also enables ancillary DeFi protocols to be accessed smoothly, creating additional opportunities for yield farming and staking to boost overall returns.

Non-custodial protection, low and infrequent fees, and transparent curve operations on the blockchain all translate to Curve Finance being a professionally designed and highly specialized solution for stable and decentralized trading.

Curve Finance Features

- Focused on Stablecoins: Designed for highly efficient stablecoin exchanges with low slippage.

- Efficient Protocols: Employs algorithmic pools for low impermanent loss.

- Liquidity Rewards: Distributes CRV tokens to liquidity providers as a reward.

7. SushiSwap

SushiSwap is powerful Edgex Exchange substitute because of its decentralized platform which is rich in features and crosses simple token swapping. Its Kashi platform gives users’ diverse lending and borrowing ways to earn and trade while it performs as an AMM.

SushiSwap supports cross-chain liquidity which enhances asset accessibility and trading opportunities because of seamless interaction with diverse blockchain networks.

Its decentralized governance model enhances community trust and transparency while also giving users a voice in platform decisions. SushiSwap is an effective substitute to Edgex because of its low fees, strong liquidity, and a broad DeFi ecosystem.

SushiSwap Features

- AMM with Rewards: Facilitates token exchanges with additional agricultural rewards.

- Multi Chain Support: Provides services on several blockchains for enhanced asset coverage.

- Decentralized Governance: Changes to the protocol are decided by voting amongst the SUSHI holders.

8. Balancer

Balancer is an Edgex Exchange alternative that stands out for its highly customizable and programmable liquidity pools. Unlike traditional AMMs, its unique system permits users to construct multi-asset pools with custom weighting and dynamic trading fees multiplied by improved capital efficiency and slippage reduction.

Automated portfolio management is supported, allowing liquidity providers to consistently earn fees while maintaining targeted token allocations even in the absence of constant manual adjustments.

Balancer’s numerous integrations with different DeFi protocols as well as its cross-chain compatibility widen the range of trading and yield opportunities.

Balancer’s pools, combined with its non-custodial security, on-chain visibility, and innovative design, provide advanced, customizable trading and liquidity solutions, offering Balancer Exchange significantly improved features over Custodial Exchange.

Balancer Features

- Flexible Pools: Users can construct pools with various tokens and specified proportions.

- Liquidity Mining: Rewards liquidity providers with BAL tokens.

- Automated Portfolio Management: Pools act as automated portfolio managers.

9. 1inch Network

1inch network is considered an Edgex Exchange alternative due to its dex aggeration technology that locates the best prices across various decentralized exchanges.

Rather than a single platform DEX, 1inch splits a trade among various liquidity providers to lower slippage while maximizing execution, hence, better value trade. 1inch network supports various blockchains which allows a user to perform cross chain swaps as well as access to a myriad of tokens.

1inch network provides non custodial wallets which combined with proper security, low routing costs provides transparency with flexibility. 1inch network’s unparalleled aggeration model is centered towards value trade exchange which is why it is a reputable exchange, professional and reliable as an Edgex Exchange.

1inch Network Features

- DEX Aggregator: Collects the most favorable price for various tokens across several decentralized exchanges.

- Efficient Split Trades: Splits larger trades into smaller ones to reduce slippage.

- Gas Savings: Employs sophisticated routing techniques to minimize gas fees.

10. Aster Protocol

Aster Protocol is a suggested alternative to Edgex Exchange created entirely for decentralized trading of derivatives and perpetual contracts. Its advanced structure allows non custodial trading and retains full access to funds while executing intricate trading strategies with leverage.

Aster Protocol is deeply concerned about managing risk and offers configurable hedging and margin tools for safe position trading. With swift execution, extensive on-chain settlement, and transparent deep liquidity locs, it boasts a professional performance synonymous with centralized exchanges.

Aster Protocol offers a resilient and reliable substitute to Edgex Exchange, while uniting security with flexibility and advanced derivative capabilities.

Aster Protocol Features

- DeFi on multiple blockchains: Functionality across many blockchains.

- Automatic Yield: Assured innovative yield strategies for automated yield optimization on users’ funds.

- Protected Automated Contracts: Safety and decentralization are prioritized in the design.

Risk & Consider

Smart Contract Risks – Even the best-known DeFi platforms can have gaps in their code which can result in the loss of funds or exploitation.

Market Volatility – The price of crypto assets is notoriously volatile, which together with fluctuations, can impact trades and leveraged positions.

Liquidity Risks – Slippage and the inability to swiftly exit trading positions can be a result of low liquidity on certain tokens or pools.

Platform Security – While non-custodial exchanges do eliminate some risks, the potential of phishing, wallet hacking, or lax security can compromise funds.

Regulatory Risks – Legal grey areas in some jurisdictions can result in little access or non-compliance which is a problem some platforms have.

Fee Structures – Significant loss of profitability can result from trading, withdrawal, and cross-chain switch fees.

Technical Issues – Bugs, downtimes, and congested networks are example of issues that can momentarily prevent order execution and order trading.

User Knowledge – The consequences that may arise from the lack of understanding of DeFi, derivatives, and leveraged trading can be dire.

Conclusion

We have concentrated on the data till proverbial October 2023. Looking for substitutes for Edgex Exchange reveals a number of platforms because of their differing characteristics along with their performance and their security.

Hyperliquid is great for trade latency and cross-chain trading. GMX permits low-slippage non-custodial spot and perpetual trading. Vertex Protocol offers customizable derivatives strategies and dYdX v4 offers high-speed trading on their layer-2 trading.

In addition, PancakeSwap and SushiSwap provide modular DeFi platforms along with staking and yield farming. Also, Curve Finance is the go-to provider for the effective use of stablecoins,

Balancer for customizable multi-asset pools, 1inch for DEX trade routing, and Aster Protocol for derivatives with sophisticated risk management. These platforms present secure, edge-technology substitutes for Edgex Exchange, which is a professional platform.

FAQ

What are the best alternatives to Edgex Exchange?

Top alternatives include Hyperliquid, GMX, Vertex Protocol, dYdX v4, PancakeSwap, Curve Finance, SushiSwap, Balancer, 1inch Network, and Aster Protocol. Each offers unique features such as non-custodial trading, high liquidity, cross-chain support, or advanced derivatives.

Why should I consider alternatives to Edgex Exchange?

Alternatives may provide lower fees, faster execution, more asset options, multi-chain support, enhanced liquidity, or specialized trading features like derivatives and stablecoin swaps.

Are these alternatives safe to use?

Most platforms are non-custodial and operate on-chain, ensuring transparency and security. However, users should always perform due diligence and secure their private keys.