In this article, I will discuss How to Secure DeFi Assets Using Top Multi-Chain Wallets. The swift expansion of the DeFi ecosystem has made the protection of crypto assets across numerous blockchains more important than ever.

- What Are Multi-Chain Wallets?

- How to Secure DeFi Assets Using Top Multi-Chain Wallets

- Example: Securing DeFi Assets with Safe Multi-Sig Wallet (Ethereum + BNB Chain)

- 1. Select a Multi-Chain Wallet

- 2. Connect to Safe

- 3. New Safe Multi-Sig Wallet Setup

- 4. Safe Wallet Funding

- 5. Security Modules Setup

- 6. Use DeFi Protocols

- 7. Supervise & Maintain

- Key Security Features to Look for in a Multi-Chain Wallet

- Non-Custodial Private Key Control

- Strong Encryption & Secure Key Storage

- Multi-Factor Authentication (MFA)

- Hardware Wallet Support

- Recovery Seed Backup & Options

- Open-Source Code Transparency

- Anti-Phishing Protections

- Transaction Simulation & Alerts

- Auto-Lock & Biometric Authentication

- Secure Cross-Chain Bridging Integration

- Top Multi-Chain Wallets for Securing DeFi Assets

- Common Threats to DeFi Wallet Security

- Phishing Attacks

- Malicious Smart Contracts

- Fake Token Airdrops and Scams

- Keyloggers and Malware

- Bridge Exploits

- Rogue Browser Extensions/App

- Social Engineering Scams

- SIM-Swapping Attacks

- Future of Multi-Chain Security in DeFi

- Pros & Cons

- Conclusion

- FAQ

Multi-chain wallets offer enhanced security as well as added flexibility and control. In this guide, I will explain how these wallets operate, highlight their key security functionalities, and help you identify the best assets to protect your decentralized investments.

What Are Multi-Chain Wallets?

Multi-chain wallets are all-in-one crypto wallets that function on several blockchains simultaneously. In contrast to single-chain wallets, which operate on one blockchain network (e.g., BTC or ETH) at a time, multi-chain wallets let you keep, handle, and engage with several digital currencies and blockchains all at once, which include Ethereum, BNB Chain, Polygon, Solana, and others.

These wallets facilitate participation in DeFi with less hassle due to instantaneous, uncomplicated transfers between networks.

Users can stake, swap, and connect to DApps without the inconvenience of managing multiple wallets. Increased interoperability with security enhancements make multi-chain wallets indispensable in the rapidly increasing decentralized finance space.

How to Secure DeFi Assets Using Top Multi-Chain Wallets

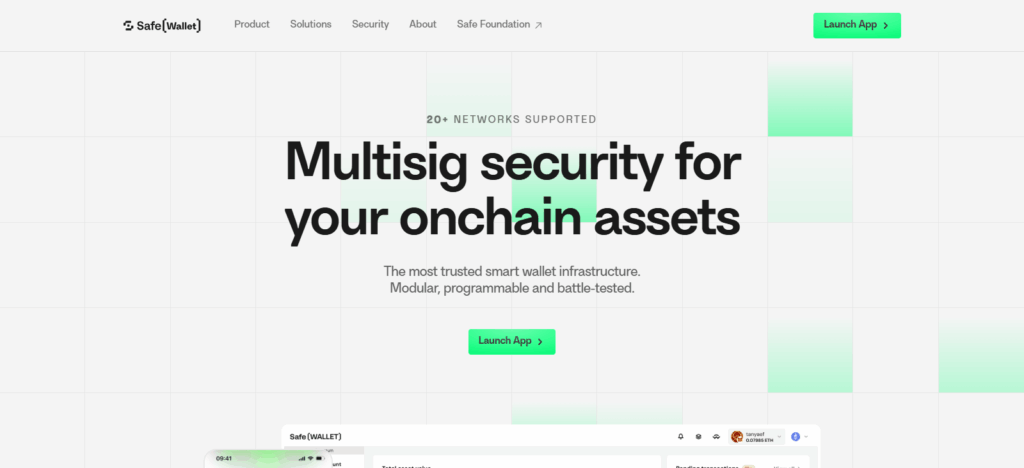

Example: Securing DeFi Assets with Safe Multi-Sig Wallet (Ethereum + BNB Chain)

1. Select a Multi-Chain Wallet

- Suggestions: Safe (multi-sig), Ledger Nano X, or Rabby Wallet

- Compatible with Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, etc.

2. Connect to Safe

- Go to Safe Global

- Connect through MetaMask, WalletConnect, or Ledger.

3. New Safe Multi-Sig Wallet Setup

- Start a new Safe wallet

- Pick a network (ex. Ethereum Mainnet)

- Include additional owners (wallet addresses) for multi-sig control

- Set a threshold (ex. 2 of 3 required for a transaction)

4. Safe Wallet Funding

- Put ETH, USDC, or other DeFi assets to your Safe address

- For cross-chain asset transfer, use Orbiter Finance or LayerZero bridges.

5. Security Modules Setup

- Set Spending Limits to enforce withdrawal caps.

- Activate Guard Contracts for transaction approval.

- Implement Recovery Mechanisms (e.g., trusted backup wallets)

6. Use DeFi Protocols

- Access Safe Apps to use DeFi Aave, Uniswap, or Lido.

- All transactions require multi-sig approval, which mitigates risk of unauthorized access.

7. Supervise & Maintain

- For tracking use DeBank or Zapper.

- If you are using a Ledger wallet, make sure you update your wallet’s firmware regularly.

- Make sure to revoke any unused token approvals using Revoke.cash.

Key Security Features to Look for in a Multi-Chain Wallet

Non-Custodial Private Key Control

You should have the complete authority over your assets by managing the keys by yourself and not having them with an exchange or third party.

Strong Encryption & Secure Key Storage

Wallets should use strong encryption and other techniques to employ advanced malware or other unpermitted access to private keys.

Multi-Factor Authentication (MFA)

Additional security measures which can include biometric data and other factors such as passcodes or an OTP to help get in and complete transactions.

Hardware Wallet Support

Connectivity with cold storage devices like Ledger, Trezor, etc can provide additional offline signing for sensitive transactions.

Recovery Seed Backup & Options

Ensure there are clear and secure backup ways so assets can be recovered even if the wallet is lost (like a seed phrase or recovery technologies such as Shamir Backup).

Open-Source Code Transparency

Code that can be accessed and used by the community to enhance their own system for added risks and for security.

Anti-Phishing Protections

Alerts for wicked/untrusted websites and phishing attacks for those connecting to DApps.

Transaction Simulation & Alerts

Demonstrating anticipated outcomes before signing a transaction: approvals, spending limits, gas fees, and contract engagements to prevent scams.

Auto-Lock & Biometric Authentication

Wallet locks automatically after a period of inactivity and supports biometric safety features, either fingerprint or facial recognition.

Secure Cross-Chain Bridging Integration

For cross-chain asset transfers, uses trusted protocols to minimize risks of bridge exploits.

Top Multi-Chain Wallets for Securing DeFi Assets

MetaMask

MetaMask is considred one of the best Multi chain wallets as it strikes the best balance between usability, security, and access to DeFi. It is also a non custodial wallet which means that it is less dependent on centralized systems as the users have more control and custodian access of their private keys.

Multi networks, Ethereum, BNB chain, Polygon and a multitude of custom EVM chains are bridged to assist users in accessung DeFi apps in a safe browser or mobile interface.

Built in phishing avoidance, transaction previews, and permission exclusion are effective in avoiding a range of malicious smart contracts. MetalMask is able to offer more flexible security layers and advanced protection on DeFi portfolios due to cold storage and signing by lidger hardware wallets.

Trust Wallet

Trust Wallet is seen as one of the finest multi-chain crypto wallets because it allows access to DeFi assets on various blockchains including Ethereum, BNB Chain, Solana, and Polygon, all on one platform.

As a non-custodial wallet, Trust Wallet allows full ownership and control of all crypto holdings as the user has full control and access to the private keys. Trust Wallet enhances safety with locally stored keys, biometric locks, and various encryption methods.

Trust Wallet also has a Web3 browser which allows users to safely interact with DeFi services offered on the platform. Trust Wallet enhances the safety of assets with built-in staking, asset control, and DApp integration.

Coinbase Wallet

Coinbase Wallet stands out as a robust multi-chain wallet. Its reputation in the industry enables it to confidently enforce strong security protocols. The wallet is entirely non-custodial which means you can manage your private keys and seed phrase.

Furthermore, it is compatible with Eric, Base, Polygon, and BNB Chain networks, which makes it easier to participate in DeFi across different layers. Coinbase Wallet offers additional security with biometric and custom- scam- detection features.

This scam detection integrated with risk identification of DAPs and tokens is highly unique. Users can manage their diverse digital assets in a safe boarding environment thanks to its direct integration with major DeFi protocols, NFT marketplaces, and hardware wallets.

Ledger Live

Ledger Live is respected for safeguarding DeFi assets as it integrates with Ledger hardware wallets, which gives users the most secure form of private key protection—offline cold storage.

Ledger Live provides users with secure, multi-chain asset management right from their control center for a number of networks, including Ethereum, Bitcoin, Polygon, and Solana, among others. Every transaction on Ledger Live requires physical confirmation on the wallet, so malware and phishing attacks cannot authorize transactions.

DeFi users can securely stake, swap, and track their portfolios with DeFi integrations in Ledger Live. With consistent revisions on the software and high-level encryption, Ledger Live is a secure platform for Defi users.

SafePal

SafePal is invaluable as a go-to multi-chain wallet for DeFi security due to its software convenience, reasonable pricing, and hardware protection. SafePal wallet is able to integrate and work with DeFi tools across different ecosystems because it has access to a range of blockchain networks including Ethereum, BNB Chain, Tron, and Polygon.

SafePal has innovative security features to stop network-based hacks including a self-destruction feature, true offline signing, and secure QR code transactions.

Users are able to control their own encrypted access and keys which are also protected with biometric safeguards. SafePal has a built-in DApp browser, multiple access tools for staking and swapping, and a safe flexible design for diverse DeFi assets which secures and streamlines asset management for users.

Common Threats to DeFi Wallet Security

Phishing Attacks

Users may unknowingly expose their private keys to fake websites, malicious wallet pop-ups, and deceptive DApp links, or are led to sign dangerous transactions.

Malicious Smart Contracts

Users who interact with unverified contracts may find scammers and hackers draining their funds or acquiring spending authority, and these scammers are often smart in their contract creation.

Fake Token Airdrops and Scams

Scammers use worthless and dangerous tokens as bait, and scammers use dangerous, malicious, and worthless tokens to bait users into engaging harmful contracts.

Keyloggers and Malware

Devices with such infections expose a wallet to danger by capturing passwords, seed phrases, and transaction details.

Bridge Exploits

Cross-chain bridges are desirable targets for attackers and make transferred assets particularly vulnerable.

Rogue Browser Extensions/App

Stolen data is obtained through malicious or hijacked extensions posing as authentic wallets.

Social Engineering Scams

Users may be manipulated into relinquishing access by hackers posing as community members or support staff.

SIM-Swapping Attacks

Mobile number takeovers allow hackers to circumvent SMS-based authentication and account recovery.

Future of Multi-Chain Security in DeFi

Future developments in DeFi’s multi-chain security seek to construct robust and secure networks for cross-chain interactions while eradicating single failure points.

Innovations such as MPC (Multi-Party Computation) and ZK-based wallets reduce dependence on classic seed phrases by compartmentalizing and securing private key control. Enhancements to cross-chain communication provide lower risk levels for inter-network asset bridge exploits.

AI-driven security oversight coupled with real-time threat intelligence streamlining adaptive scam and malicious smart contract wallet attack defenses will provide more robust contract security.

The level of institutional adoption in DeFi will determine the extent of advanced identity verification and compliance multilayer wallets provide seamlessly with core decentralization elements. This will bolster accessibility and security of DeFi on a global scale.

Pros & Cons

| Pros | Cons |

|---|---|

| Support multiple blockchains in one wallet, simplifying asset management | Added complexity increases the chance of user mistakes |

| Non-custodial design gives full control of private keys | Losing seed phrase can lead to permanent loss of assets |

| Seamless access to DeFi, NFTs, and DApps across ecosystems | Fake DApps and phishing scams remain a major risk |

| Hardware wallet compatibility for stronger security | Some networks may not be fully supported or require manual setup |

| Faster cross-chain transactions with integrated bridges | Cross-chain bridges are common hacker targets |

| Regular updates for new chains and security improvements | Security depends partly on the user’s device and digital hygiene |

Conclusion

Defi asset security starts with selecting a reliable multi-chain wallet with comprehensive security features, support for multiple networks, and non-custodial key ownership.

MetaMask, Trust Wallet, Ledger Live, and SafePal provide users access to and interaction with DeFi ecosystems and protective measures like hardware wallet integration, encryption, and anti-phishing.

Still, even the best wallet security features depend on the user: protective settings should be enabled, DApps should be verified before seed phrase and seed key access, and blind wallet connection should be pursued.

Defi asset protection should combine wallet security with safe and smart user security to confidently enable the user to protect their assets with a ProDeFi user approach.

FAQ

How can I secure my private keys in a multi-chain wallet?

Store your seed phrase offline, avoid screenshots, and consider pairing the wallet with a hardware device like Ledger for enhanced protection.

Can hardware wallets be used for DeFi transactions?

Yes, hardware wallets such as Ledger and SafePal allow offline signing, significantly reducing the risk of hacks during DeFi interactions.

What are the biggest threats to DeFi wallet security?

Phishing attacks, malicious smart contracts, fake apps, bridge exploits, and malware are the most common threats users must stay aware of.