This article will cover Cross-Chain DeFi Arbitrage and will teach you to profit from price differences across blockchains using Cross-Chain DeFi Arbitrage.

- Understanding Cross-Chain DeFi Arbitrage

- How to Do Cross-Chain DeFi Arbitrage with the Top Platforms

- Example: Cross Arbitrage on Synapse Protocol and PancakeSwap on Ethereum and BNB Chain

- Step 1: Spot a Price Difference

- Step 2: Prepare Your Funds and Wallet

- Step 3: Move Your USDT Via The Bridge

- Step 4: Complete The Exchange

- Step 5: Rebalance Your Funds

- Step 6: Track and Optimize

- How Cross-Chain Arbitrage Works

- Identify Price Gaps Across Chains

- Select the Right Tools

- Bridge Tokens Between Networks

- Execute the Trade

- Manage Fees and Slippage

- Automate the Process (Optional)

- Top Platforms for Cross-Chain DeFi Arbitrage

- Strategies for Successful Cross-Chain Arbitrage

- Real-Time Price Differences

- Trusted Cross-Chain Bridges

- Trade Automation

- Gas and Transaction Fee Optimization

- Diversification

- Slippage and Liquidity

- Tips to Maximize Profits

- Choose High-Liquidity Chains

- Compare Multiple DEXs Before Trading

- Track Gas and Bridge Fees

- Automate for Speed and Efficiency

- Stay Updated on Market Trends

- Risks and Challenges

- Bridge Vulnerabilities

- High Gas Fees

- Transaction Delays

- Slippage and Low Liquidity

- Smart Contract Risks

- Market Volatility

- Regulatory Uncertainty

- Future of Cross-Chain Arbitrage

- Conclusion

- FAQ

By the end of the article, you will understand how Synapse Protocol, ThorChain, Multichain, and LI.FI streamline transfers, provide rapid transaction speeds, and offer secure opportunities for extracting price differentials within the expanding scope of DeFi.

Understanding Cross-Chain DeFi Arbitrage

Cross-Chain DeFi Arbitrage is one of several methods of cryptocurrency arbitrage trading and entails the trading of the same crypto-asset over a number of blockchain networks and deriving a profit.

While the crypto-asset is traded over a particular blockchain network and the profit is realized, the trading is finished over that particular network, hence, over a single network.

Importantly, cross-chain bridge and decentralized exchanges (DEXs) supports the transfer of crypto-assets over multiple networks and hence, cross-chain trades. Here, the trader is said to utilize decentralized liquidity pools and interoperability protocols.

Yet the model has tight constraints with speed, cost of transactions, and slippage risk. This is mainly due to the latency and risk the bridges carries.

How to Do Cross-Chain DeFi Arbitrage with the Top Platforms

Example: Cross Arbitrage on Synapse Protocol and PancakeSwap on Ethereum and BNB Chain

Step 1: Spot a Price Difference

As an example, check the USDT price on two different DEXs.

- Uniswap (Ethereum) – 1 USDT = 0.99(approx0.99(approx0.99)

- PancakeSwap (BNB Chain) – 1 USDT = 1.01(approx1.01(approx1.01)

This $0.02 difference per token gives you an arbitrage opportunity.

Step 2: Prepare Your Funds and Wallet

In this instance, you will need a multi-chain wallet. MetaMask and Rabby Wallet will work.

Just ensure it is linked to both Ethereum and BNB Chain and confirm there is enough to cover gas fees on both networks.

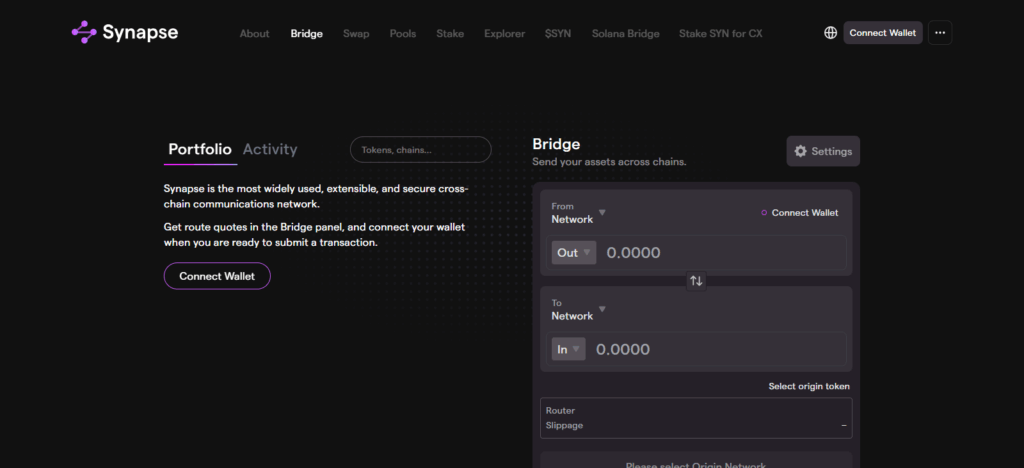

Step 3: Move Your USDT Via The Bridge

Use Synapse Protocol or Multichain (Anyswap) to quickly and safely shift your USDT from Ethereum to BNB Chain.

When you shift the token, it will convert to the wrapped version (e.g. nUSDT on BNB Chain).

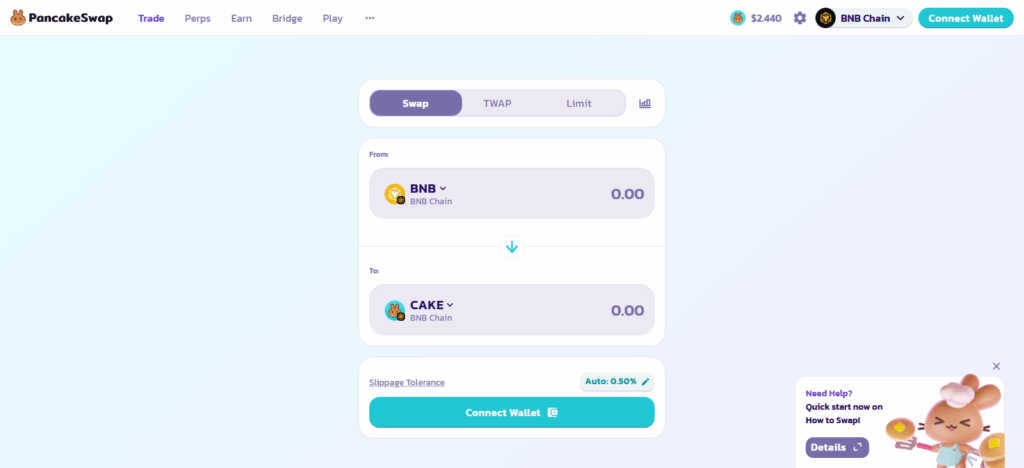

Step 4: Complete The Exchange

When your token is on BNB Chain, you can:

- Use PancakeSwap and Swap USDT for BNB or another stablecoin and simply sell for profit.

- Pay the difference to complete the trade and take the profit.

Step 5: Rebalance Your Funds

To repeat the process, transfer profits back to the lower-priced chain using Synapse or deBridge.

Keeping both chains balanced enables future arbitrage trades.

Step 6: Track and Optimize

Monitor price gaps, fees, and slippage using DeFiLlama, DEXTools, or LI.FI Dashboard.

For speed, automate future trades with arbitrage bots.

How Cross-Chain Arbitrage Works

Identify Price Gaps Across Chains

Traders look at multiple blockchains and decentralized exchanges to identify where a token has different prices, for example, lower on Ethereum and higher on BNB Chain.

Select the Right Tools

Data aggregators such as DeFiLlama, DEXTools, and ArbitrageScanner can be helpful for spotting and comparing prices on various chains.

Bridge Tokens Between Networks

Bridge your tokens using reliable cross-chain bridges such as Synapse Protocol, Multichain, and deBridge moving tokens from the lower value blockchain to the higher value one.

Execute the Trade

Buy on the chain where the token is less expensive and sell on the chain where it is priced higher to optimize profits, using DEXs like Uniswap, PancakeSwap, or SushiSwap.

Manage Fees and Slippage

Profits must be kept by measuring the cost of each transaction, gas fees, and the margin of slippage to confirm that it will still be a gain after all is said and done.

Automate the Process (Optional)

To minimize human error, advanced users automate their trades using DeFi arbitrage bots, other AI tools, and additional software to enhance speed and precision.

Top Platforms for Cross-Chain DeFi Arbitrage

ThorChain

ThorChain has emerged as a premier option for decentralized arbitrage as it is the only protocol that lets you exchange assets directly across different blockchains without needing a wrapped token or a centralized exchange.

It is the only protocol that has a decentralized liquidity network built around the RUNE token which allows you to trade Bitcoin, Ethereum, and BNB Chain. It is much easier to deal with and less risky to use direct cross-chain transactions than to use bridges.

The ThorChain network has automated liquidity pools which would make arbitrage trading easier since the pools have fair liquidating and pricing. They have a secure, non-custodial system that lets you calculate cross-chain arbitrage in real-time and process the calculations.

Multichain (Anyswap)

Multichain (formerly known as Anyswap) stands out as one of the best options for cross-chain DeFi arbitrage owing to its sophisticated interoperability and support for more than 80 blockchains.

It allows token swaps and transfers across Ethereum, BNB Chain, Fantom, and Polygon at minimal costs and high speeds. The platform’s Secure Multi-Party Computation (SMPC) technology supports decentralized and safe cross-chain operations while minimizing the risks that come with bridges.

The Multichain router’s protocol is designed to identify the fastest pathway for swaps so that traders can quickly move liquidity and access real-time arbitrage opportunities. Its security, vast network coverage, and scalability ascertains that there is cross-chain arbitrage.

LI.FI

LI.FI provides one of the best cross-chain DeFi arbitrage services because of its unique combination of a bridge and DEX aggregator, consolidating numerous blockchains and liquidity pools into one access point.

Cross-chain swaps involving Ethereum, Arbitrum, Avalanche, and Polygon are automatically assessed and optimized for the fastest and cheapest swaps. LI.FI’s smart routing technology stands out because of the proprietary blend of slippage and gas fee mitigation bridges and DEXs provide.

LI.FI’s ease of use and transaction map accessibility create a seamless experience for developers. LI.FI’s approach to cross-chain interoperability capture DeFi arbitrage resources and optimize speed and efficiency for the user.

Strategies for Successful Cross-Chain Arbitrage

Real-Time Price Differences

Detect token price differences across blockchains using DeFiLlama, DEXTools and CoinMarketCap and capture price differences profitably at the same time.

Trusted Cross-Chain Bridges

Use Synapse Protocol and Multichain for quick and secure asset transfers which reduce and reliably manage the delays and risks that can come with asset transfers.

Trade Automation

Use AI-powered arbitrage bots and automation tools to execute trades and reduce the chances of losing latency-sensitive trades to slower manual execution.

Gas and Transaction Fee Optimization

Always trade on blockchains with lower network fees like BNB Chain and Polygon to maximize profit and avoid losing profits to high gas fees.

Diversification

Don’t rely on one network and rot platform; spread trades across different chains and decentralized exchanges to capture more opportunities.

Slippage and Liquidity

Always avoid price profit loss due to low liquidity and sudden price changes by checking pool depth and slippage settings before you trade.

Tips to Maximize Profits

Choose High-Liquidity Chains

Ethereum, BNB Chain, and Arbitrum are the networks to trade on. They have deep liquidity, meaning you can avoid slippage and get stable prices for your swaps.

Compare Multiple DEXs Before Trading

Always avoid the assumption that you will get the best deal on a DEX. Token prices on other DEXs can help you to execute a profitable trade.

Track Gas and Bridge Fees

Profits can be negated by arbitrage that is too costly. Small arbitrage gains can easily be wiped out by high gas fees, so aim to use blockchains with lower gas costs.

Automate for Speed and Efficiency

Crossing the manual finish line can cause profitable opportunities to be missed, so set up arbitrage bots and custom scripts to execute trades for you.

Stay Updated on Market Trends

Price differences across chains will arise from DeFi events like token launches and protocol upgrades.

Risks and Challenges

Bridge Vulnerabilities

Cross-chain bridges are unsafeguarded and are frequently targeted for hacks. Losing funds can occur during smart contract buggy transfers or chain cross transfers.

High Gas Fees

During congestion, trading on the Ethereum network will become expensive, thus diminishing or eliminating arbitrage profits.

Transaction Delays

There are delays in cross-chain bridge transfers due to bridge network latency which can cause price changes to occur after a trade prematurely exits and thus an arbitrage opportunity will be missed, and likely, resulting in a loss.

Slippage and Low Liquidity

Large price shifts caused by low liquidity can result in slippage which can cause the arbitrage to become unprofitable.

Smart Contract Risks

DeFi protocols and DEXs having bugs or poor governance can become smart flashes and loss caused by hack or exploited gain.

Market Volatility

Defi arbitrage opportunities become more unpredictable with the price changes and declines in the crypto market.

Regulatory Uncertainty

Global crypto regulations shifts creates siloed DeFi operations, which may push liquidity access down and introduce transactional cross-border DeFi routing.

Future of Cross-Chain Arbitrage

Cross-chain arbitrage opportunities will keep getting better. It is just a matter of time. With bridges and protocols evolving, and AI thr bots automating trading, we are going to be able to conduct cross-chain transactions with only a few, and little risk.

As communication standards and protocols become more common, we will be able leverage shifting arbitrage opportunities across different chains, and escalated silos of disparate liquidity.

The combination of ZK tech and other Layer-2 skips will take performance, of cross-chain merging and arbitrage, to a new realm. The coming years will be characterized by automated processes, and ultra-layered liquidity to abstract arbitrage is cross-chain without a doubt.

Conclusion

To summarize my analysis, DeFi arbitrage on different blockchains can greatly benefit traders searching for profitable trading opportunities. The Synapse Protocol, ThorChain, Multichain, and LI.FI are some of the most used systems whereby traders can efficiently execute trades and move assets.

However, traders need a thorough understanding of liquidity, fees, and the bridge mechanics for the planning and execution of trades. The growing automation and interoperability of blockchains in DeFi will eventually lower the arbitrage opportunities, but they will still remain profitable.

The constantly evolving decentralized finance ecosystem, risk management, and the proper tools and strategies will allow traders to remain profitable with DeFi arbitrage.

FAQ

What is cross-chain DeFi arbitrage?

Cross-chain DeFi arbitrage involves buying a cryptocurrency at a lower price on one blockchain and selling it at a higher price on another, using bridges and decentralized exchanges to transfer assets between networks.

Which platforms are best for cross-chain arbitrage?

Top platforms include Synapse Protocol, ThorChain, Multichain (Anyswap), and LI.FI, as they offer fast bridging, deep liquidity, and secure interoperability between major blockchains.

Is cross-chain arbitrage profitable?

Yes, it can be profitable if executed efficiently. Traders who monitor price differences, manage transaction fees, and act quickly can earn consistent returns from market inefficiencies.