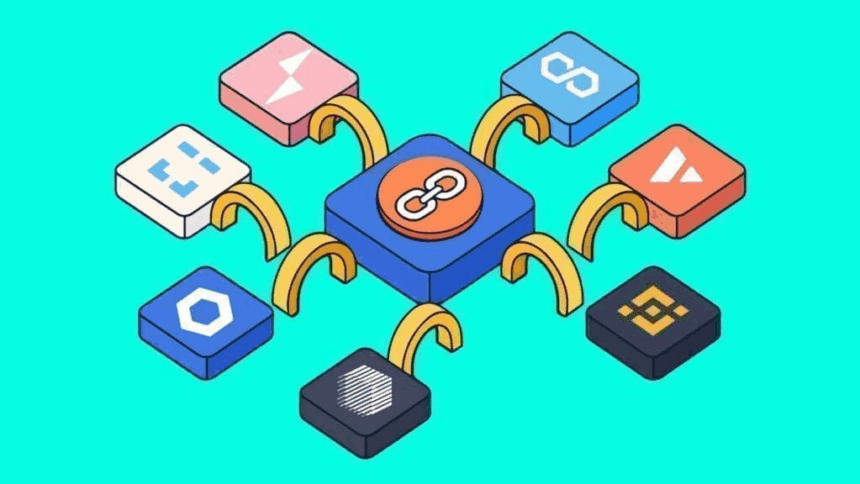

This article focuses on investing in DeFi through top cross-chain platforms. These platforms enable users to transfer assets between several blockchains.

- What is DeFi Investments?

- How to Invest in DeFi with the Best Cross-Chain Platforms

- Example: How to Invest in DeFi Using Cross-Chain Platforms (Step-by-Step)

- Step 1: Set Up Your Wallet

- Step 2: Bridge Assets Using Rango Exchange

- Step 3: Invest on Stargate Finance

- Step 4: Keep an Eye on and Adjust

- Top Cross-Chain Platforms for DeFi Investment

- Benefits of Using Cross-Chain Platforms for DeFi

- Security Tips for DeFi Investors

- Verify Platform Audits

- Use Hardware Wallets

- Double-Check URLs

- Enable Two-Factor Authentication (2FA)

- Avoid Sharing Private Keys

- Test with Small Transactions

- Monitor Smart Contract Permissions

- Stay Updated on Platform News

- Common Mistakes to Avoid

- Future of Cross-Chain DeFi Investments

- Pros & Cons

- Conclusion

- FAQs

Here, you will understand the advantages, primary platforms, and crucial actions to safely and efficiently invest in the interconnected DeFi world.

What is DeFi Investments?

DeFi investments are investments in decentralized finance. These are investments in platforms that do not rely on banks or brokers as intermediaries.

Users can lend, borrow, stake, trade, or accrue interest on digital assets using blockchain technology and smart contracts.

These contracts are automated and guarantee transparency, security, and control over the funds. Passive income can be earned in liquidity pools, yield farming, or by staking tokens.

Contrary to centralized finance, DeFi is borderless; anyone with a crypto wallet can access and innovate finance. It does, however, pose risks such as smart contract bugs and market fluctuations.

How to Invest in DeFi with the Best Cross-Chain Platforms

Example: How to Invest in DeFi Using Cross-Chain Platforms (Step-by-Step)

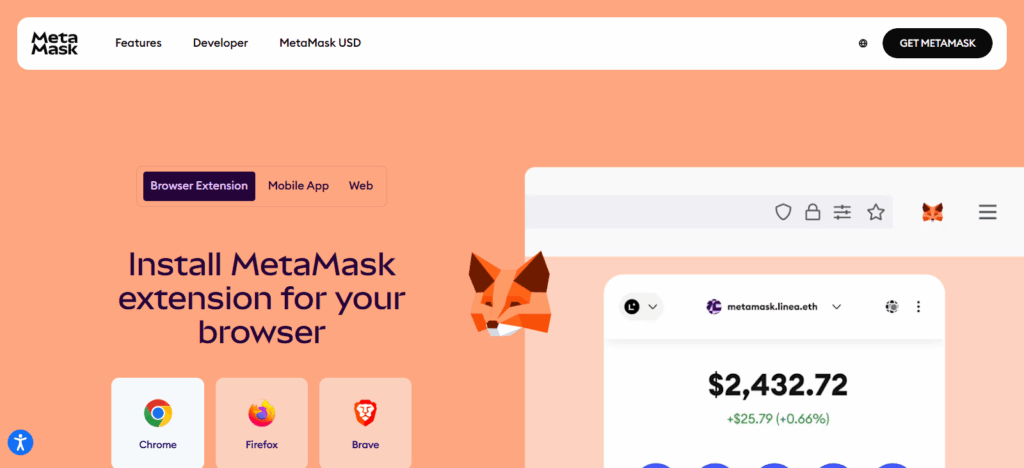

Step 1: Set Up Your Wallet

- Install MetaMask and connect it to multiple chains (Ethereum, BNB Chain, Avalanche, etc.).

- Fund your wallet with USDC or ETH on any supported chain (e.g., Ethereum).

- Keep some native tokens (ETH, BNB, AVAX) for gas fees on each chain.

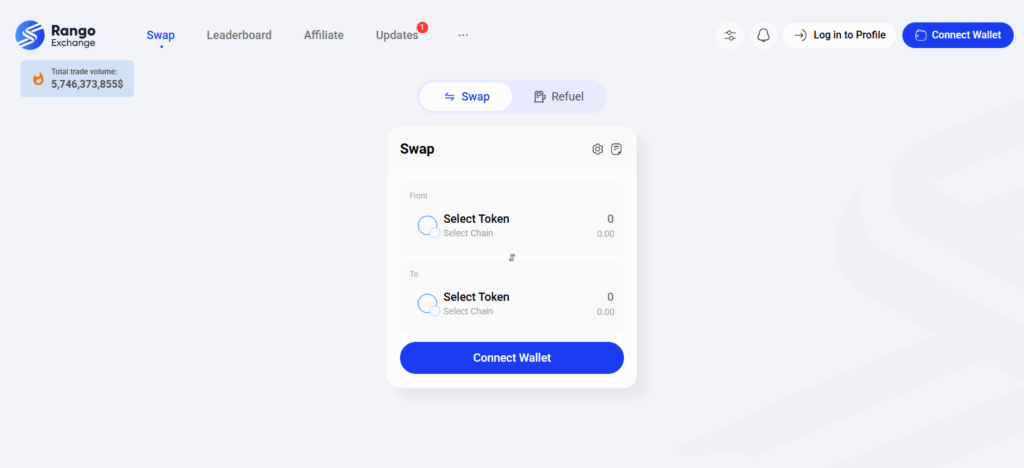

Step 2: Bridge Assets Using Rango Exchange

- Go to Rango Exchange.

- Select your source chain (e.g., Ethereum) and target chain (e.g., Arbitrum).

- Choose the token to bridge (e.g., USDC).

- Connect your wallet and approve the transaction.

- Confirm the bridge and wait for the transfer to complete.

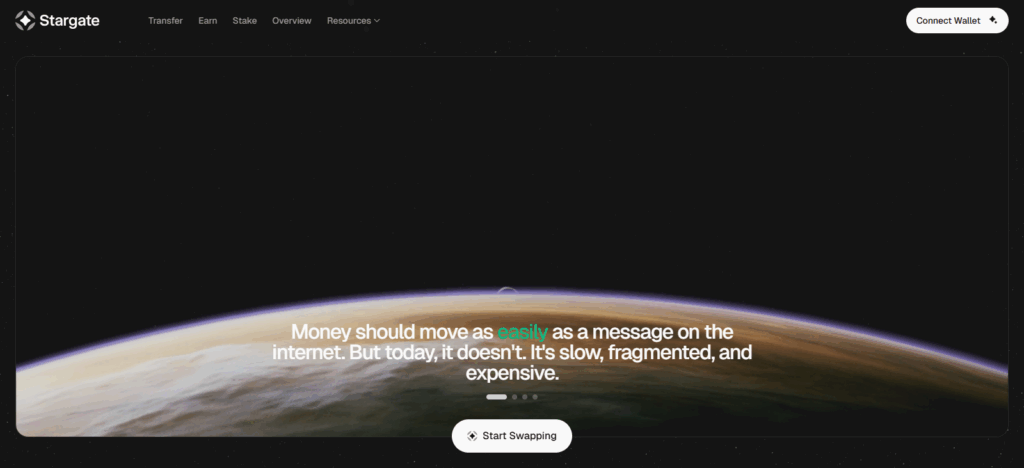

Step 3: Invest on Stargate Finance

- Access Stargate Finance.

- Click on either “Stake” or “Provide Liquidity”.

- Select your chain (Arbitrum, for example) and your token (e.g. USDC).

- USDC that you bridged is deposited into the liquidity pool.

- Make your transaction and enjoy your yield rewards.

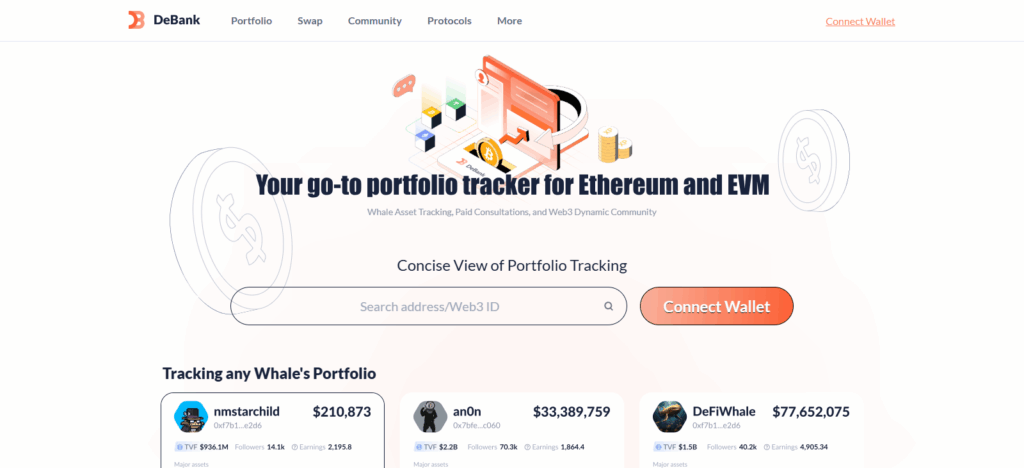

Step 4: Keep an Eye on and Adjust

- Rewards earned and the APY earned is visible on Stargate.

- To manage your cross-chain strategy, utilize DeFi dashboards like DeBank or Zapper.

- Using Rango or other DEX systems like 1inch or LI.FI, you can invest and reorganize your chains in the system.

Top Cross-Chain Platforms for DeFi Investment

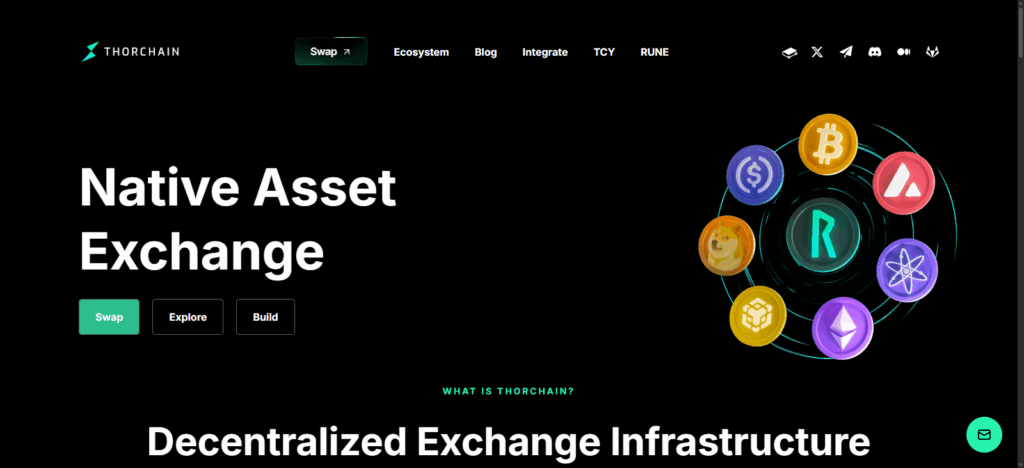

ThorChain (RUNE)

ThorChain (RUNE) has established itself as one of the most important cross-chain tools for investing in DeFi because it makes completely frictionless and decentralized swaps possible on different blockchains without the need for wrapped assets or third-party centralizers.

Built on the Cosmos SDK, it has its own native RUNE token and uses the automated market maker (AMM) liquidity model which provides network security and stability.

AMMs also allow investors to earn liquidity rewards in native assets such as Bitcoin, Ethereum, and BNB (Binance coin). Investing on ThorChain also provides you the ability to completely control your assets in your own network. So much cross-chain functionality is uncommon for most platforms on ThorChain’s scale.

Cosmos (ATOM)

Cosmos (ATOM) has become a cross-chain option for DeFi Investing because it aims to build a “Connected Blockchains” ecosystem. DeFi diversification at one place reduces system complexity, and thus, has a direct impact on profitability.

Low system complexity means reduced friction, and this is enhanced further with features like the innovative Inter-Blockchain Communication (IBC) protocol that safely and quickly synchronize data and move value across different chains.

Podium accessibility to a range of DeFi systems improves user DeFi diversification. Modular design overall improves system flexibility, thus reducing system complexity across the layers of a DeFi app built using the Cosmos SDK. The future of cross-chain DeFi will be built on the interoperable systems and Cosmos infrastructure.

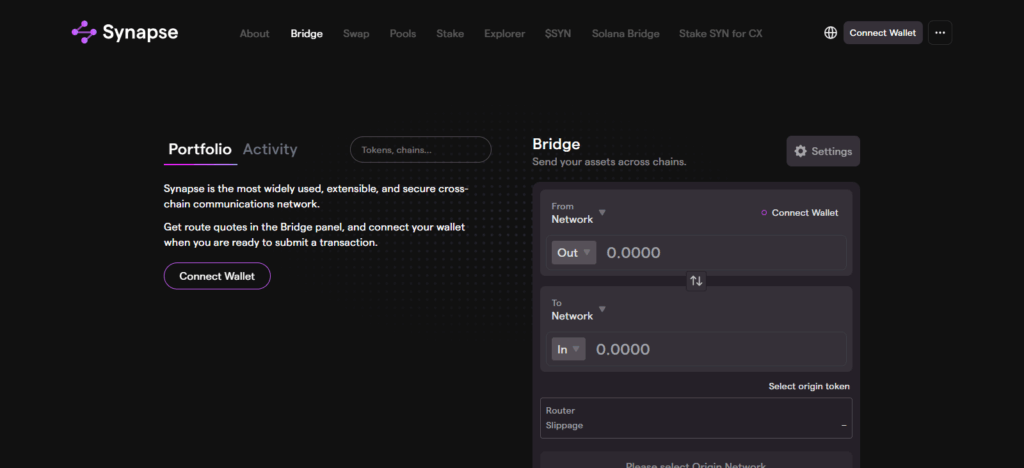

Synapse Protocol

Synapse Protocol stands out as one of the most reputable cross-chain platforms for DeFi investment because of its seamless cross-chain asset transfer capabilities.

Something that differentiates Synapse is its unified liquidity network which facilitates immediate swaps and bridging without the need for liquidity fragmentation cross chains.

Synapse facilitates the transportation of tokens and stablecoins across several chains which include Ethereum, Avalanche, BNB Chain, and Arbitrum. Cross-chain transactions are executed with the lowest slippage and the most optimal rates due to the protocol’s Synaps Automatted Market Maker (AMM).

With Synapse, investors can utilize DeFi without the complexities that come with switching between ecosystems thanks to the protocol’s interoperability, scalability, and yield opportunities.

Benefits of Using Cross-Chain Platforms for DeFi

Seamless Interoperability – Through cross-chain solutions, users can perform cross-Blockchain transactions in DeFi without any limitations.

Greater Investment Opportunities – Investors can explore DeFi projects and tokens, thus expanding their yield possibilities across various blockchains.

Improved Liquidity – The linkage of blockchains boosts the movement of liquidity thus decreasing the chances of slippage and enhancing the effectiveness of the trade.

Lower Transaction Costs – Users of cross-chain solutions can select the most cost-effective blockchains, which decrease costs of gas and transactions.

Enhanced Portfolio Diversification – Users can decrease a singular chains overreliance by holding assets on numerous chains.

Increased Yield Potential – Investors can tap into various protocols which provide yield opportunities through DeFi activities like lending and liquidity farming.

Better User Flexibility – Cross-chain systems ease the movement of assets, allowing users to change their means of payment and exchange as easily as possible.

Future-Proof Technology – These systems provide cross-chain integration, thus enhancing DeFi systems for future innovations and scalable improvements in blockchains.

Security Tips for DeFi Investors

Verify Platform Audits

If a DeFi platform hasn’t had their smart contracts audited by a credible security company, don’t get involved with that platform.

Use Hardware Wallets

Use hardware wallets such as Ledger and Trezor to store crypto since they are unhackable.

Double-Check URLs

Only use the real website and watch out for phishing websites masquerading as the real DeFi websites.

Enable Two-Factor Authentication (2FA)

Unlock an additional layer of security for your wallets and exchange accounts.

Avoid Sharing Private Keys

Your private keys, seed phrases and wallet passwords should never be shared.

Test with Small Transactions

Any large transfers should be preceded by small transfers to make certain the system and wallet are safe to use.

Monitor Smart Contract Permissions

Revoking excess token approvals using something like Revoke.cash is a good practice.

Stay Updated on Platform News

Stay up to date on official communication so you are aware of changes that expose the system to risks.

Common Mistakes to Avoid

Ignoring Platform Research – Investing without understanding the project’s team, audits, or reputation can lead to scams or rug pulls.

Overlooking Gas Fees – Not checking the network congestion and gas prices can end in high transaction costs, eating into your profits.

Using Unverified Bridges or DApps – Interacting with unofficial or fake websites can cause lost funds.

Not Diversifying Investments – Investing a single token or platform subjects you to significant market and protocol risk.

Falling for Unrealistic APYs – Unsustainable high yield, often with fraudulent schemes, are used to attract users.

Ignoring Smart Contract Risks – DeFi platforms are reputable, and the market relies on their audit reports; that does not mean you can ignore the underlying risks.

Mismanaging Private Keys – Your funds can disappear permanently if you lose or give access to your seed phrase.

Skipping Small Test Transactions – Before moving large amounts to new chains or platforms, always do a small test transaction.

Neglecting Portfolio Tracking – Not tracking your open positions can lead to surprise losses or missed opportunities.

Ignoring Security Updates – Not paying attention to new threats or patches can make your wallet vulnerable to attacks.

Future of Cross-Chain DeFi Investments

Cross-chain DeFi investments are indeed built on the right track as interoperability defines the next steps in the decentralized finance landscape.

With more decentralized blockchains emerging, the potential to integrate network connectivity and liquidity sharing will be vital for a robust and unified DeFi system.

Highly sophisticated cross-chain protocols will facilitate the faster, cheaper, and more secure transfer of all types of assets, effectively rendering archetypal cross-chain barriers obsolete.

Recent innovations on zero-knowledge proofs, modular blockchains, and decentralized bridges will undoubtedly improve system transparency and scalability.

Considering that there is rising institutional interest in DeFi, the primary objective of cross-chain tech will be integrating disparate pieces of a fine mesh, streamlining financial flows and access, operational efficiencies, and control over digital assets for the decentralized global network of investors.

Pros & Cons

| Pros | Cons |

|---|---|

| Interoperability: Enables seamless transfers and asset swaps across multiple blockchains. | Security Risks: Cross-chain bridges and smart contracts can be vulnerable to hacks. |

| Diversified Opportunities: Access a wide range of DeFi projects and yield options on different networks. | Complexity: Managing assets across multiple chains can be challenging for beginners. |

| Improved Liquidity: Combines liquidity from different blockchains, reducing slippage and boosting trading efficiency. | Higher Transaction Fees: Some cross-chain transfers may involve multiple gas fees. |

| Lower Dependence on One Blockchain: Reduces the risk associated with a single network’s congestion or downtime. | Limited Platform Support: Not all wallets or DApps support every cross-chain platform. |

| Better Yield Potential: Access to multiple ecosystems can offer higher staking and farming rewards. | Regulatory Uncertainty: Different jurisdictions may have unclear or changing rules for cross-chain DeFi. |

Conclusion

Investing in DeFi using top cross-chain systems greatly enhances the easy to inter-operate, profitable, and efficient crypto ecosystems.

These systems overcome the constraints posed by systems limited to a single blockchain and enable the investor to move assets freely, access multi-faceted DeFi systems, and optimize profits on several blockchains.

Utilizing verified cross-chain systems such as ThorChain, Cosmos, and Synapse Protocol enable users to experience advanced systems cross-chain inter-operability while losing none of the control of their assets.

However, crossing blockchains in DeFi requires working extensive systems security, and deep risk control. These tools make cross-chain DeFi investing the best growth tool for decentralized finance.

FAQs

What are the risks of cross-chain DeFi investments?

Risks include smart contract bugs, bridge vulnerabilities, and price volatility. To minimize them, use verified platforms, avoid high-risk pools, and diversify investments.

Can I use multiple cross-chain platforms simultaneously?

Yes, you can use several platforms to diversify your DeFi portfolio and take advantage of different yield and liquidity opportunities.

Which tokens can be transferred using cross-chain platforms?

Most major cryptocurrencies and stablecoins like ETH, BTC, USDC, and BNB can be bridged across chains depending on platform support.