In this article, I will cover the How to Deposit Crypto Earnings to Your Bank. By converting your crypto assets to fiat currency, you will have access to money you can use to spend, pay bills, or save.

- How to Deposit Crypto Earnings to Your Bank

- Step 1: Create and Verify Your Binance Account

- Step 2: Deposit Earnings into Binance

- Step 3: Exchange Cryptocurrency to Regular Currency(Fiat)

- Step 4: Add Your Bank Account

- Step 5: Transfer To Bank Account

- Step 6: Settle and Monitor

- The Best Place Where to Deposit Crypto Earnings to Your Bank

- Why Deposit Crypto Earnings to Your Bank

- Tips for Safe and Cost-Efficient Transfers

- Select the best exchange

- Turn on 2 Factor Authentication (2FA)

- Understand applicable fees and limits

- Transfer Very Large Amounts of Money in Portions

- Verify Bank Information

- Monitor Transactions Closely

- Common Issues and Troubleshooting

- Risk & Considerations

- Conclusion

- FAQ

I will explain the process step by step, explain how to mitigate transaction fees, and discuss the best and most efficient methods to make sure your crypto to bank transactions are as safe and easy as possible.

How to Deposit Crypto Earnings to Your Bank

Here is a detailed guide on ‘how to deposit crypto earnings to your bank’ and ‘using Binance’ to demonstrate the process:

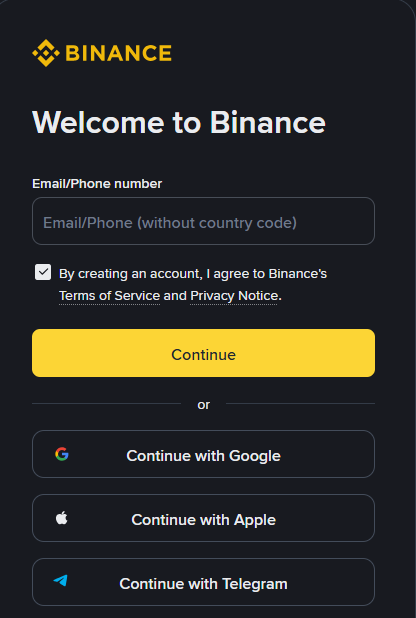

Step 1: Create and Verify Your Binance Account

- To sign up on Binance, you will need your email and a password.

- After signing up, please provide an ID, and proof that you live where you say you live, through a process called verification (KYC).

Step 2: Deposit Earnings into Binance

- Log into your account and head to Wallet” → “Fiat and Spot.

- Click on “Deposit” and select the type of cryptocurrency that you made.

- In your Crypto Wallet, send the money to your Binance wallet address, which you will need to copy.

- Receive approval on the transactions from the blockchain.

Step 3: Exchange Cryptocurrency to Regular Currency(Fiat)

- Click on “Trade” → “Convert.”

- Select the crypto you want, and switch it to your local currency, which can be USD, EUR, or more.

Step 4: Add Your Bank Account

- Select “Wallet” → “Fiat and Spot” → “Withdraw.”

- Click on “Bank Transfer” and fill in the relevant fields with the requested bank account information.

- If requested, do a verification of your bank account.

Step 5: Transfer To Bank Account

- Type in the amount you would like to withdraw.

- Confirm the transaction.

- Generally, a bank account receives their money within 1 to 5 working days.

Step 6: Settle and Monitor

- Verify your account balance and find whether the amount has been credited.

- Save the m-commerce invoice for your record or saving for your taxation.

The Best Place Where to Deposit Crypto Earnings to Your Bank

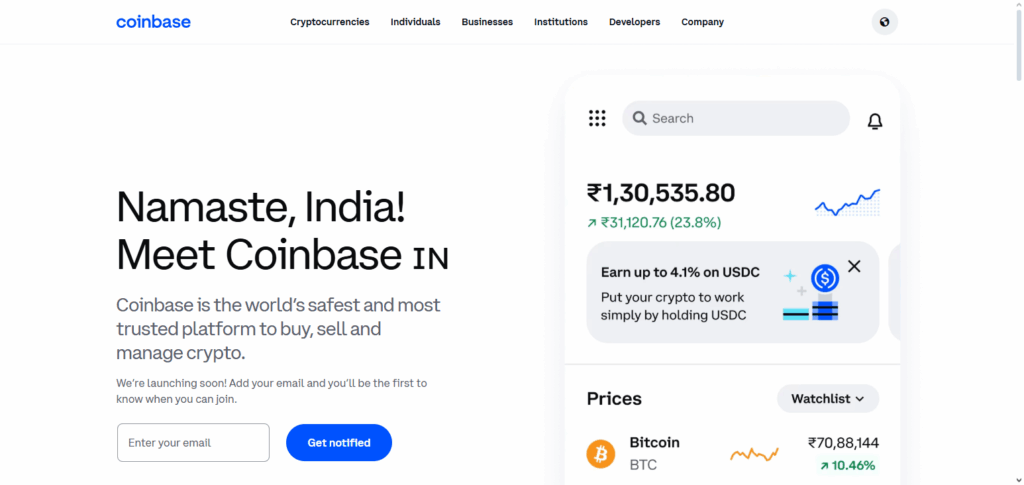

Coinbase

Coinbase is a customize platform for depositing earnings. Coinbase functions as a secure bridge between digital assets and traditional banking by allowing users to deposit and withdraw assets seamlessly.

Using Coinbase, users can convert cryptocurrencies like Bitcoin, Ethereum, and USDC into cash and deposit them into a bank account.

Coinbase is particularly notable for its simple and compliant design and interface, allowing even novice users to withdraw funds in many crypto assets without worry. Users can transfer funds to a bank without worry, since Coinbase utilizes 2FA outer protection and insurance.

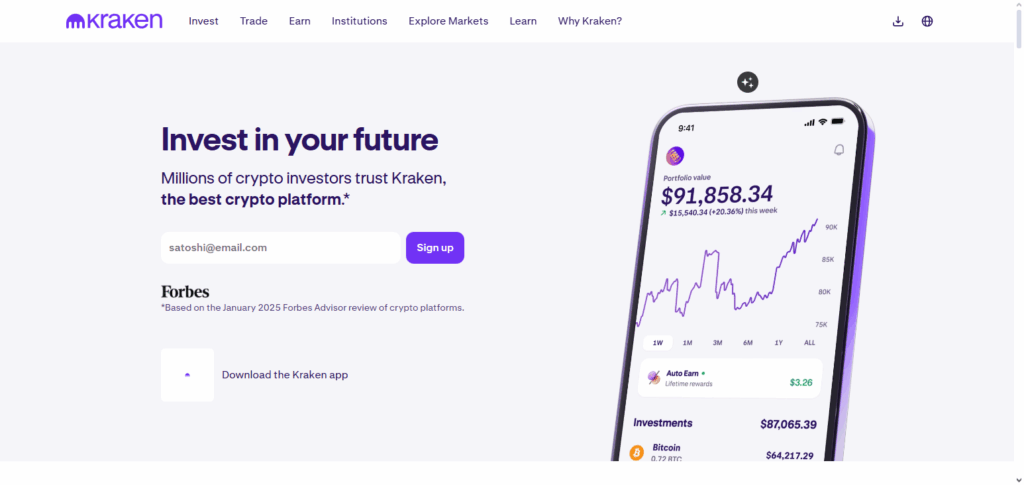

Kraken

Kraken streamlines crypto deposits and withdrawals with the utmost security. Users can seamlessly transfer Bitcoin, Ethereum, and stablecoins to cash and sent directly to any bank around the globe.

What separates Kraken from other exchanges is the low withdrawal fees cold-storage security, and two factor authentication, and rapid withdrawal processing times.

Kraken is great for advanced and novice users, due to their flexible payment and withdrawals, transparent fee structure, and fast banking processing times.

Users also credited with peace of mind, due to Kraken security features, from cold wallets to 2FA, Kraken users can sleep worry free.

Why Deposit Crypto Earnings to Your Bank

Access to Fiat Currency – With crypto banking, you are able to have access to crypto’s traditional counter-part for your day to day activities.

Security and Safety – Keeping funds in the bank minimize the risks associated with hacks and wallet losses.

Easy Bill Payments – By making deposits in a bank, you are able to pay your bills, loans and other expenditures effortlessly.

Simplified Tax Reporting – A bank record makes it easier to track income for purposes of taxation.

Liquidity and Flexibility – With crypto deposits, it is easy to access funds for investments, unexpected needs and expenditures.

Peace of Mind – It eliminates worry that is associated with volatility since your earnings are converted to fiat currency.

Tips for Safe and Cost-Efficient Transfers

Select the best exchange

Stick to reputable and regulated sites for buying and selling such as Coinbase, Kraken, and Binance to facilitate and ensure safety.

Turn on 2 Factor Authentication (2FA)

Defend against unsolicited access to the site to maintain the authorization process.

Understand applicable fees and limits

Check for network and withdrawal fees to not pay over the set limits.

If Required, Change to Stablecoins

Decrease volatility by changing to usdc.

Transfer Very Large Amounts of Money in Portions

For larger sums, use multiple smaller transfers to maintain transaction safety.

Verify Bank Information

Correct any errors in bank and account numbers to maintain their safety.

Monitor Transactions Closely

Observe the bank processing and confirmations on the blockchain to ensure the funds go to the right place.

Common Issues and Troubleshooting

Common Issues

Delayed Transfers – Completing transfers may take longer because of the bank’s processing time and congestion on a network.

Rejected Deposits – Transfers may be unsuccessful if bank account information is wrong or if the account is unrelated.

High Fees – Fees charged for network and withdrawal may be higher than expected and the amount received is significantly much less.

Exchange Account Restrictions – Accounts that are not verified and the amount of money that can be withdrawn can be blocked.

Volatility Loss – The value of crypto may change and therefore, the value after converting it may not exactly be what is expected.

Troubleshooting Tips

Check Information – Account number, bank routing number and codes, and crypto wallet address should be verified.

Check Withdrawal Limits – Withdrawals should not exceed the limits for the account.

Review Movement of Assets – Assets on the blockchain and bank should be monitored and tracked.

Reach Out to Support – Your bank and exchange should be contacted for the problems that are unresolved.

Timing is Everything – Transfers should not be made at the time there is the highest congestion of the network.

Risk & Considerations

Market Risk

The value of the crypto for your earnings could race in value due to price fluctuations.

Processing Time

Funds would not instantly become available due to bank processing time or if the blockchain network is congested.

Charges

The crypto customer has to pay withdraw fees, plus corresponding bank fees.

Criminal Activities

Different regions for different countries could have different rules, not following them could cost a lot of money.

Lost Transfers

Transfers could be lost if the correct bank details such as account numbers or routing codes are not correctly typed in.

Account Issues

With accounts and platforms that are not secured could have unauthorized withdrawals, or even worse, hacks.

Conclusion

Depositing your crypto earning into the bank as the final step on the way to transforming a digital asset to fiat currency can be a major step forward. However, it is recommended to use a reputable exchange such as Coinbase or Kraken.

Once you have completed the sufficient identity verification steps, you may convert crypto to domestic currency and bank on on a two way securely linked account.

Payment of the applicable fees, as well as adherence to nbsp;the applicable transfer limits, and the maintained protective measures facilitates optimal downside risk control and unilateral user convenience.

With a little bit of planning and monitoring and following the set regulatory steps, it is feasible and practical to assume that crypto earning deposits will become an integral used bank step of your workflow.

FAQ

How long does it take to deposit crypto earnings to a bank?

Transfer times vary depending on the exchange, cryptocurrency, and bank. Typically, it takes 1–5 business days for funds to appear in your account.

Are there fees for depositing crypto to a bank?

Yes, fees may include exchange withdrawal fees, network fees, and bank processing charges. Checking these beforehand helps minimize costs.

Which cryptocurrencies can I deposit to my bank?

Most major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins (USDC, USDT) can be converted to fiat and withdrawn.

Can I deposit crypto to any bank?

Not all banks support crypto deposits. Verify that your bank allows incoming transfers from crypto exchanges.

Is it safe to deposit crypto earnings to a bank?

Yes, if you use regulated exchanges, enable security measures like two-factor authentication, and carefully verify bank account details.