I will examine the best short (inverse) ETFs in this article. Such funds are designed to move in the opposite direction of a certain market index or sector. These ETFs enable the investor to gain profit in a market that is declining or serve as a hedge to an existing portfolio.

- What is Short (Inverse) ETFs?

- How To Choose Best Short (Inverse) ETFs

- Key Point & Best Short (Inverse) ETFs List

- 1.ProShares Short S&P 500

- 2.Direxion Daily S&P 500 Bear 3x Shares

- 3.ProShares Short QQQ

- 4.Direxion Financial Bear 3x Shares

- 5.ProShares UltraPro Short S&P 500

- 6.ProShares UltraShort QQQ

- 7.Direxion Small Cap Bear 3x Shares

- Pros & Cons Best Short (Inverse) ETFs

- Conclusion

- FAQ

These will be discussed along with their notable features, benefits, risks, and the methods of selecting the best short ETF for swift investment techniques of a for optimum effectiveness.

What is Short (Inverse) ETFs?

Inverse ETFs are a type of exchange-traded fund that is structured to do the opposite of what a given asset or index does; that is, when a particular index loses value, these mirrored ETFs aim to gain value. This allows a buyer to gain from a declining market without the need of short selling particular stocks.

They do this with the use of derivatives like options, swaps, or futures. They are used primarily for hedging purposes and are put in speculative trades during bearish market periods. These exchange-traded funds are not made for long term trades, as the focus is on daily performance and consistent rebalancing.

How To Choose Best Short (Inverse) ETFs

Know the Index – Understand which index the ETF tracks inversely. Does it track the S&P 500, NASDAQ, or any sector indexes? Does it match your outlook?

Consider the Risk and Leverage – Some inverse ETFs are leveraged (2x or 3x). How much risk are you willing to take?

Evaluate the Expense Ratios – Expense ratios lower cost and high expense ratios cut the returns. This becomes much more significant in short term trading.

Study Volume and Liquidity – More liquid ETFs at lower prices are easier to buy and sell, and lower slippage.

Examine the Accuracy of the Track – How well does the ETF track the inverse performance of the index? Some will differ because of rebalancing.

Analyze the Time Frame – These ETFs are best held for short term. Long term holding leads to performance decay due to negative compounding.

Examine ETF Providers – ETFs from well known issuers are easier to select with reputation for dependable supervision and clear management.

Key Point & Best Short (Inverse) ETFs List

| ETF Name | Key Point / Focus |

|---|---|

| ProShares Short S&P 500 (SH) | Moves inversely to the S&P 500; suitable for hedging or short-term bearish bets. |

| Direxion Daily S&P 500 Bear 3x Shares (SPXS) | 3x leveraged inverse exposure to S&P 500; high-risk, short-term trading tool. |

| ProShares Short QQQ (PSQ) | Inverse of Nasdaq-100; allows profiting when tech-heavy index declines. |

| Direxion Financial Bear 3x Shares (FAZ) | 3x inverse exposure to financial sector; for aggressive bearish positions. |

| ProShares UltraPro Short S&P 500 (SPXU) | 3x leveraged inverse S&P 500; designed for short-term tactical trading. |

| ProShares UltraShort QQQ (QID) | 2x leveraged inverse of Nasdaq-100; ideal for short-term tech sector downturns. |

| Direxion Small Cap Bear 3x Shares (TZA) | 3x inverse exposure to small-cap Russell 2000; for aggressive small-cap bearish strategies. |

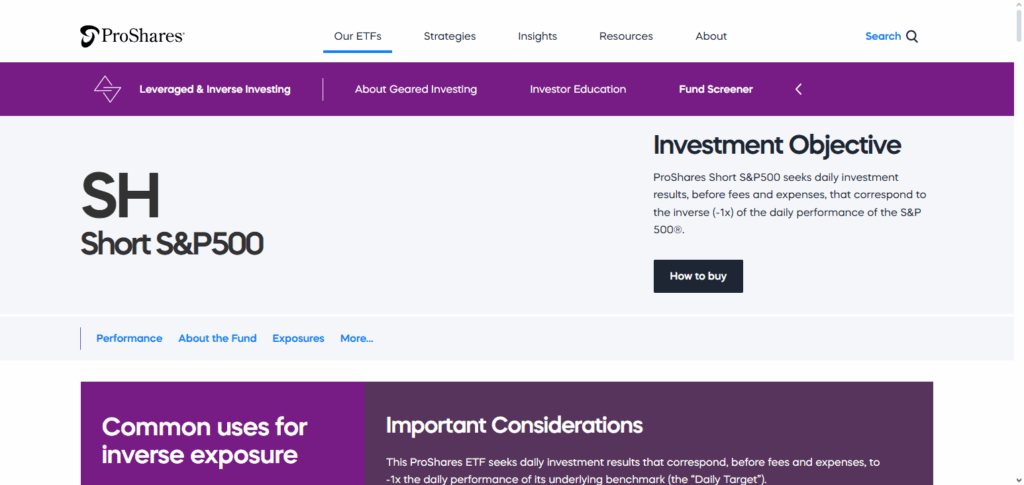

1.ProShares Short S&P 500

One of the best short (inverse) ETFs is the ProShares Short S&P 500 (SH) simply because it provides a straightforward 1:1 inverse exposure to the S&P 500, making it perfect for hedging or profiting from declines in the market.

It’s also an ETF that, unlike its leveraged counterparts, avoids dramatic volatility yet still provides reliable performance. SH is considered a low expense ETF of only 0.89% yet also provides extreme high liquidity, making the trading cheap and the market easily accessible.

It’s predictable and transparent which makes it a strong performer. In this regard, it allows both new and seasoned investors to capture short-term bearish opportunities.

| Feature | Details |

|---|---|

| ETF Name | ProShares Short S&P 500 (SH) |

| Type | Short (Inverse) ETF |

| Exposure | 1:1 inverse of S&P 500 Index |

| Leverage | None (non-leveraged) |

| Expense Ratio | 0.89% |

| Liquidity | High, widely traded on NYSE Arca |

| Use Case | Hedging or profiting from market declines |

| KYC Requirement | Minimal – available through most standard brokerage accounts |

| Investment Horizon | Short-term strategies recommended |

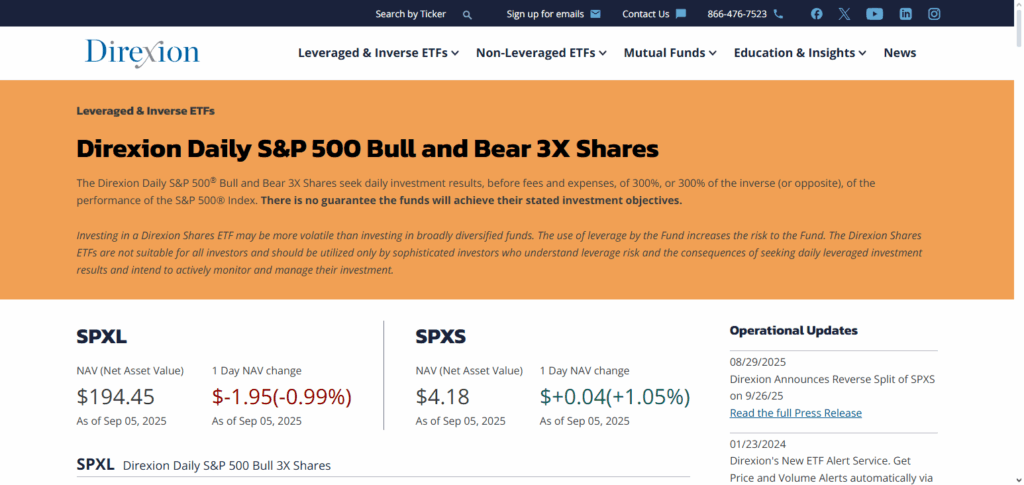

2.Direxion Daily S&P 500 Bear 3x Shares

Direxion Daily S&P 500 Bear 3x Shares (SPXS) is one of the first choices for aggressive traders wishing to have enhanced inverse exposure for short (inverse) ETFs.

Investors stand to gain 3x inverse remission on the S&P 500 and thus, can benefit 3x enhanced losses on the tiered market. SPXS comes with an expense ratio of 0.95% and is meant for very short term trades because of the precision of the daily reallocation after rebalancing to one’s market exposure.

The daily exposure slip within the market and the book charge is ideal for aggressive trades. Withdrawn from the underlying market, the SPXS is better for highly tactical and highly aggressive trades, short term.

| Feature | Details |

|---|---|

| ETF Name | Direxion Daily S&P 500 Bear 3x Shares (SPXS) |

| Type | Short (Inverse) ETF |

| Exposure | 3x inverse of S&P 500 Index |

| Leverage | 3x daily leveraged |

| Expense Ratio | 0.95% |

| Liquidity | High, actively traded on NYSE Arca |

| Use Case | Aggressive short-term trading or hedging during market declines |

| KYC Requirement | Minimal – available via standard brokerage accounts |

| Investment Horizon | Very short-term due to daily rebalancing and compounding effects |

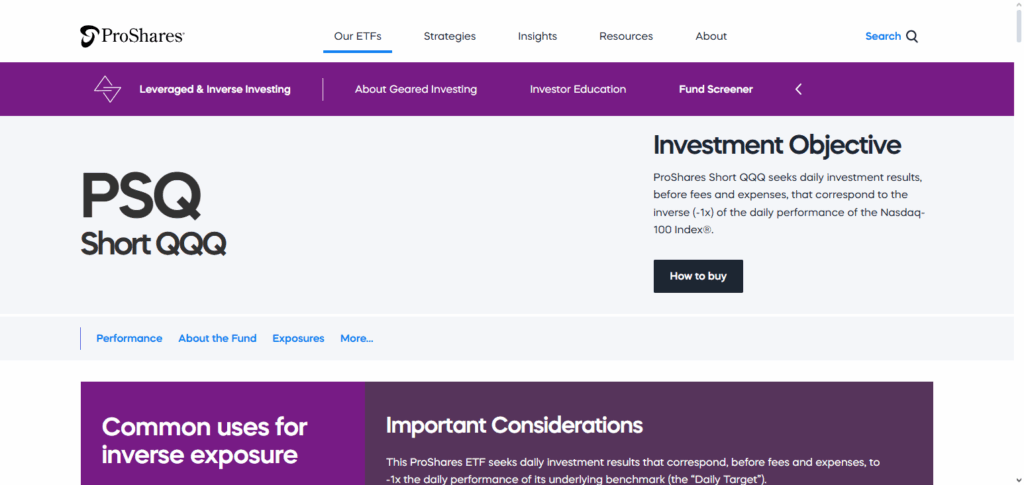

3.ProShares Short QQQ

ProShares Short QQQ (PSQ) is one of the best inverse ETFs available for investors focusing on the Nasdaq-100 index. It offers a 1:1 inverse correlation which enables traders to make a profit when large technology and growth stocks plunge. PSQ has an expense ratio of 0.95%, while having robust liquidity which makes it affordable and easy access to the market.

Its biggest advantage is the predictability of PSQ. This makes it perfect for investors who need to hedge technology-focused portfolios or implement short-term bearish trades. It is a far less risky than leveraged ETFs and far more easy.

| Feature | Details |

|---|---|

| ETF Name | ProShares Short QQQ (PSQ) |

| Type | Short (Inverse) ETF |

| Exposure | 1:1 inverse of Nasdaq-100 Index |

| Leverage | None (non-leveraged) |

| Expense Ratio | 0.95% |

| Liquidity | High, actively traded on NASDAQ |

| Use Case | Hedging or profiting from declines in tech-heavy Nasdaq-100 |

| KYC Requirement | Minimal – available via standard brokerage accounts |

| Investment Horizon | Short-term strategies recommended |

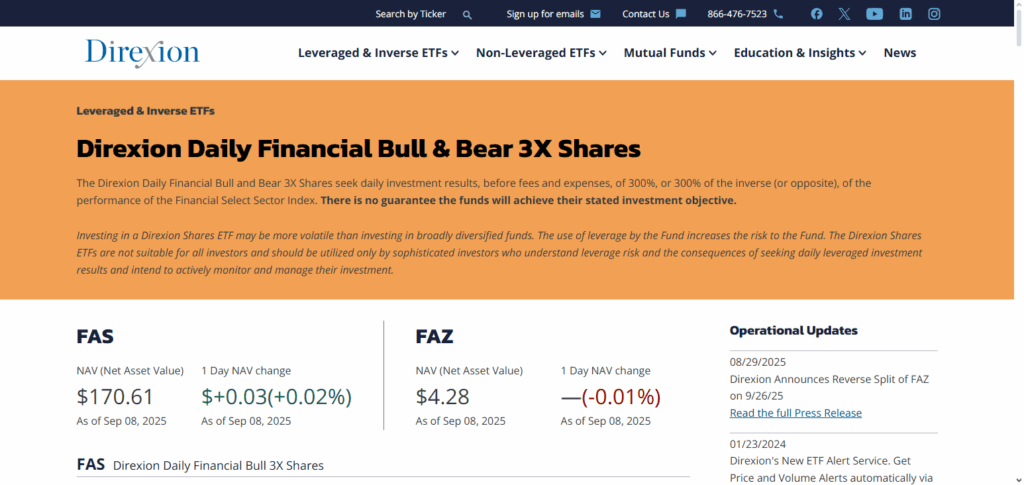

4.Direxion Financial Bear 3x Shares

The Direxion Financial Bear 3x Shares (FAZ) is an ETF for investors who want aggressive short (inverse) exposure to the declines in the financial sector. It gives 3x leveraged inverse exposure to the underlying Russell 1000 Financial Services Index. This allows traders to magnify gains even in a downtrend.

Having an expense ratio of 0.95%, the FAZ remains liquid and fit for short-term tactical plays. It’s also a unique FAZ feature that allows finance sector stock shorts to be coupled together. This makes the fund excellent for hedges and profits on bearish financial sector plays.

| Feature | Details |

|---|---|

| ETF Name | Direxion Financial Bear 3x Shares (FAZ) |

| Type | Short (Inverse) ETF |

| Exposure | 3x inverse of Russell 1000 Financial Services Index |

| Leverage | 3x daily leveraged |

| Expense Ratio | 0.95% |

| Liquidity | High, actively traded on NYSE Arca |

| Use Case | Aggressive short-term trading or hedging financial sector declines |

| KYC Requirement | Minimal – available via standard brokerage accounts |

| Investment Horizon | Very short-term due to daily rebalancing and compounding effects |

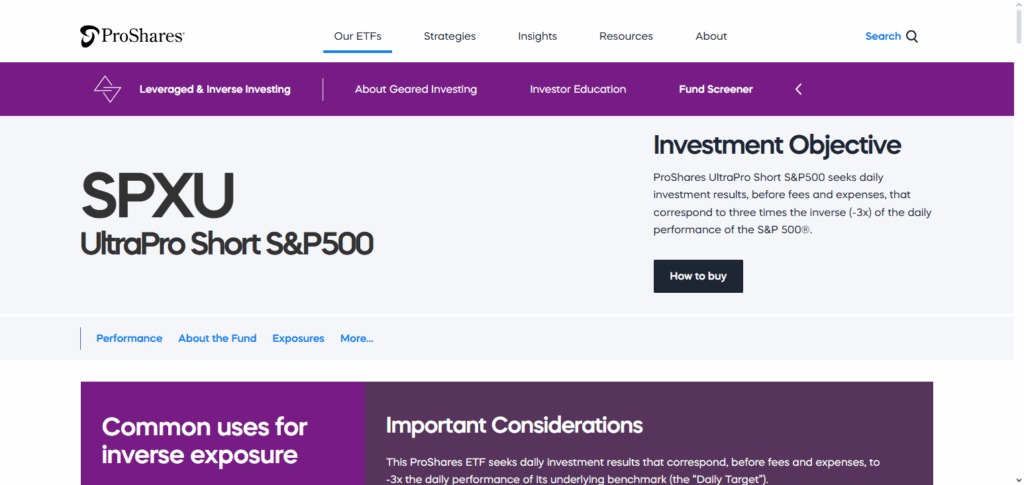

5.ProShares UltraPro Short S&P 500

ProShares UltraPro Short S&P 500 (SPXU) focuses on short (inverse) ETFs for amplified exposure to declines in declines in the underlying assets. The proshares offer 3x leveraged inverse performance on the S&P 500, allowing traders to triple the gains if the underlying assets decline.

Given the expense ratio of 0.95% and high liquidity, SPXU is intended for short-tactical trading. SPXU’s strongest features are its exceptional leverage combined with outstanding market coverage, making it ideal for seasoned investors wanting to take advantage of bearish trends.

| Feature | Details |

|---|---|

| ETF Name | ProShares UltraPro Short S&P 500 (SPXU) |

| Type | Short (Inverse) ETF |

| Exposure | 3x inverse of S&P 500 Index |

| Leverage | 3x daily leveraged |

| Expense Ratio | 0.95% |

| Liquidity | High, actively traded on NYSE Arca |

| Use Case | Aggressive short-term trading or hedging during market declines |

| KYC Requirement | Minimal – available via standard brokerage accounts |

| Investment Horizon | Very short-term due to daily rebalancing and compounding effects |

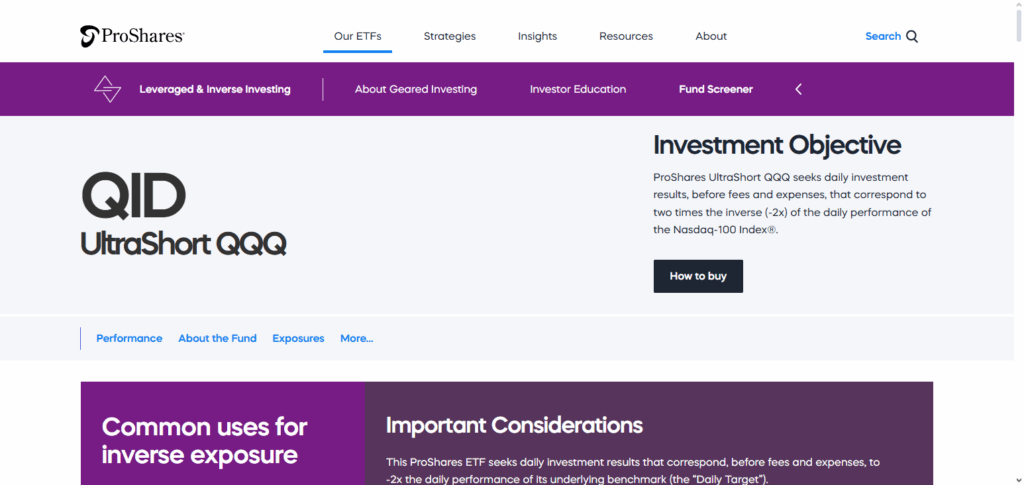

6.ProShares UltraShort QQQ

ProShares UltraShort QQQ (QID) is one of the leading short (or inverse) ETFs for traders focused on the Nasdaq-100 Index. The fund provides 2x leveraged inverse exposure, enabling investors to profit from drops in large technology and growth stocks.

QID’s expense ratio of 0.95% and robust liquidity also makes it well suited for short-term strategies. Its main advantage is the combination of focused exposure to the technology sector and moderate leverage. This provides a powerful yet manageable instrument for hedging portfolios or implementing tactical bearish trades with precision.

| Feature | Details |

|---|---|

| ETF Name | ProShares UltraShort QQQ (QID) |

| Type | Short (Inverse) ETF |

| Exposure | 2x inverse of Nasdaq-100 Index |

| Leverage | 2x daily leveraged |

| Expense Ratio | 0.95% |

| Liquidity | High, actively traded on NASDAQ |

| Use Case | Aggressive short-term trading or hedging tech-heavy portfolios |

| KYC Requirement | Minimal – available via standard brokerage accounts |

| Investment Horizon | Very short-term due to daily rebalancing and compounding effects |

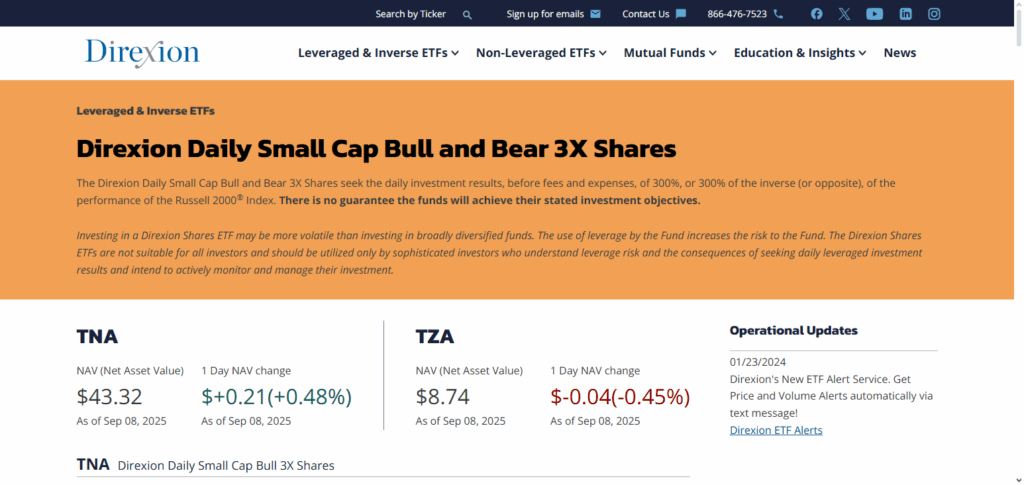

7.Direxion Small Cap Bear 3x Shares

Direxion Small Cap Bear 3x Shares (TZA) is the most popular short (inverse) ETF for those wanting to capitalize on declines in small-cap stocks. It provides 3x leveraged inverse exposure to the Russell 2000 Index, allowing traders to take advantage of inverse exposures and enhance returns during declines.

Designed for short-term tactical strategies, TZA has an expense ratio of 0.95% and considerable liquidity. Its main advantage is the focus on small-cap equities, which allows for effective hedging or gaining in bearish positions, especially in small-cap equities which is a high-growth and volatile segment.

| Feature | Details |

|---|---|

| ETF Name | Direxion Small Cap Bear 3x Shares (TZA) |

| Type | Short (Inverse) ETF |

| Exposure | 3x inverse of Russell 2000 Index |

| Leverage | 3x daily leveraged |

| Expense Ratio | 0.95% |

| Liquidity | High, actively traded on NYSE Arca |

| Use Case | Aggressive short-term trading or hedging small-cap market declines |

| KYC Requirement | Minimal – available via standard brokerage accounts |

| Investment Horizon | Very short-term due to daily rebalancing and compounding effects |

Pros & Cons Best Short (Inverse) ETFs

Pros:

- Profit from Declines – Gain when markets fall. ETFs have a lower total cost.

- Hedging Tool – Reduce risk for existing portfolios.

- Easy Access – Unlike short stocks, ETFs are traded.

- Leverage Options – Captures 2 and 3 times the normal market profit.

Cons:

- High Risk – Potential to lose a larger capital with leveraged ETFs.

- Short-Term Focus – Daily rebalances lower value over time.

- Expense Ratios – Costlier to buy than leveraged ETFs.

- Timing Required – Ability to profit from a decline is necessary.

- Complexity – Affected by power of positive leverage.

Conclusion

In short, Best Short (Inverse) ETFs serve investors’ needs to hedge portfolios against, or take advantage of, declining markets. From 1:1 inverse ETFs to 2x or 3x highly leveraged products inverse ETFs, there is something for both conservative and aggressive investors.

Besides offering liquidity, accessibility, and precise exposure, inverse ETFs are best suited for day trading strategies and should be avoided for intermediate or long-term trading. As a result of higher risk, daily rebalancing, and possible compounding, strategies must be precise and well understood to maximize their benefits.

FAQ

Are short ETFs safe for long-term investing?

No. They are intended for short-term strategies because daily rebalancing and compounding can reduce long-term performance.

What is the difference between leveraged and non-leveraged short ETFs?

Non-leveraged ETFs provide 1:1 inverse exposure, while leveraged ETFs amplify gains or losses, typically 2x or 3x, increasing risk and reward.

Can I use short ETFs to hedge my portfolio?

Yes. They are effective tools for protecting against market downturns or sector-specific declines.

What should I consider before investing in a short ETF?

Consider the underlying index, leverage, expense ratio, liquidity, risk tolerance, and investment horizon to ensure alignment with your strategy.

What are short (inverse) ETFs?

Short or inverse ETFs are funds designed to move opposite to a specific index or asset, allowing investors to profit when markets decline.