This blog post explores the Best S&P 500 ETFs for investors wanting market exposure as well as long-term growth. Each S&P 500 ETF is characterized by ease of transactions, liquidity, and moderate S&P 500 index investment risk.

- What Are S&P 500 ETFs?

- How to Choose an S&P 500 ETF

- Key Point & Best S&P 500 ETFs List

- 1.SPDR S&P 500 ETF Trust

- SPDR S\&P 500 ETF Trust (SPY)

- 2.iShares Core S&P 500 ETF

- iShares Core S\&P 500 ETF (IVV)

- 3.Vanguard S&P 500 ETF

- Vanguard S\&P 500 ETF (VOO)

- 4.SPDR Portfolio S&P 500 ETF

- SPDR Portfolio S\&P 500 ETF (SPLG)

- 5.Vanguard S&P 500 Growth ETF

- Vanguard S\&P 500 Growth ETF (VOOG)

- 6.iShares S&P 500 Growth ETF

- iShares S\&P 500 Growth ETF (IVW)

- 7.SPDR S&P 500 ESG ETF

- SPDR S and P 500 ESG ETF (EFIV)

- 8.Invesco S&P 500 Equal Weight ETF

- Invesco S\&P 500 Equal Weight ETF (RSP)

- 9. JPMorgan Equity Premium Income ETF

- JPMorgan Equity Premium Income ETF

- 10. ProShares S&P 500 Dividend Aristocrats ETF

- ProShares S&P 500 Dividend Aristocrats ETF

- Pros & Cons Best S&P 500 ETFs

- Conclusion

- FAQ

I will highlight the important factors like expense ratios and total assets alongside unique advantages for each ETF so that investors can make an informed decision as to what ETF would best suit their investment portfolio.

What Are S&P 500 ETFs?

An S&P 500 ETF is a fund that aims to match the performance of the S&P 500 Index, or part of this significant stock market index. Index Exchange Traded Funds (ETFs) started in 1993 when the SPDR S&P 500 ETF Trust was launched, and it is still the largest and most actively traded ETF by assets and volume.

Most ETFs are structured as index funds, which means they hold a portfolio of securities to stock a market index. Like normal stocks, investors can purchase and sell the ETF shares during the entire trading day.

The S&P 500, itself, is a market capitalization weighted index. Many S&P 500 ETFs follow this approach. Other funds, such as Invesco’s RSP, use an equal-weight strategy to evenly distribute exposure to all.

How to Choose an S&P 500 ETF

Here’s a straightforward breakdown on how to pick an S&P 500 ETF with essential aspects summarized.

Expense Ratio – Look into how much (in percent) is charged to the ETF on a yearly basis. Typically a ratio below 0.1% is preferred. Lower expense ratios decrease how much you spend on the investment.

Liquidity – Look for an ETF that has a lot of trading activity. More liquidity means lower costs to buy or sell the position.

Tracking Accuracy – Review the distance the ETF is from the S&P 500 index. The smaller the distance, the better, as you want the investment to do almost the same.

Fund Size – It is much better to invest in larger ETFs as they are more stable and easier to trade. Smaller ETFs tend to be more volatile and carry greater risk.

Dividend Yield & Reinvestment – Look for the ETF that has a decent yielding dividend and permits automatic reinvesting of dividends.

Issuer Reputation – Well established and reputable companies like Vanguard, Blackrock and State street are preferred due to the trustable management and honesty they are known for.

Tax Efficiency – For people who want to invest for a longer time, it is prudent to pick ETFs that are designed to reduce capital gain taxes.

Key Point & Best S&P 500 ETFs List

| ETF Name | Key Points |

|---|---|

| SPDR S&P 500 ETF Trust (SPY) | Most liquid S&P 500 ETF, widely traded, good for short- and long-term investors. |

| iShares Core S&P 500 ETF (IVV) | Very low expense ratio, highly popular for long-term, buy-and-hold investing. |

| Vanguard S&P 500 ETF (VOO) | Low-cost, tax-efficient, ideal for long-term growth and broad market exposure. |

| SPDR Portfolio S&P 500 ETF (SPLG) | Budget-friendly alternative to SPY, low expense ratio, tracks S&P 500 closely. |

| Vanguard S&P 500 Growth ETF (VOOG) | Focused on growth stocks, tech-heavy, suitable for investors seeking growth potential. |

| iShares S&P 500 Growth ETF (IVW) | Targets growth segment of S&P 500, technology and innovation-focused companies. |

| SPDR S&P 500 ESG ETF (EFIV) | ESG-focused S&P 500 exposure, includes companies with strong environmental/social governance. |

| Invesco S&P 500 Equal Weight ETF (RSP) | Equal exposure to all S&P 500 companies, reduces market-cap concentration risk. |

| JPMorgan Equity Premium Income ETF (JEPI) | The low cost is attractive for investors seeking premium income without paying excessive fees, especially given its options overlay strategy for additional yield |

| ProShares S&P 500 Dividend Aristocrats ETF (NOBL) | Its moderate fee ensures most of your returns are retained rather than spent on management costs. |

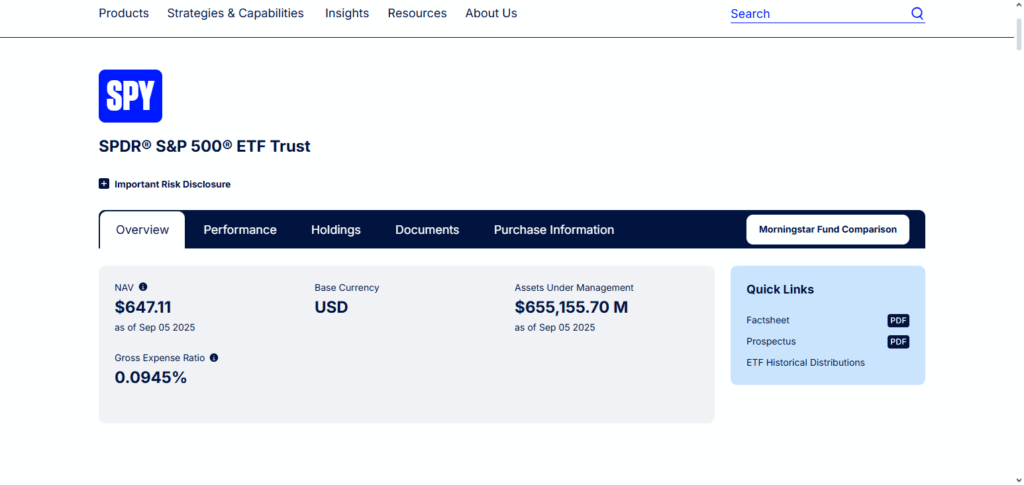

1.SPDR S&P 500 ETF Trust

SPDR S&P 500 ETF Trust (SPY) is highly regarded as one of the S&P 500 ETFs that comes with unmatched trading. On top of that, it possesses a long-standing reputation as well as reliability when it comes to tracking the S&P 500 index. The first SPY ETF was set out in 1993.

It was developed with the purpose of allowing investors to gain access to the top 500 U.S. companies in a single, easy, and seamless trade. The SPY expense ratio sits at 0.09% which makes it a great long-term investment choice.

This is coupled with the fact that SPY is the best in terms of enormous trading volume, SPY makes the best daily trading transactions. Investors in SPY are subject to a diverse investment portfolio with risk mitigated across sectors such as Technology, Healthcare, Finance, and Consumer Goods.

SPY also pays SPY investors SPY investors dividends quarterly which makes the investment a great option if the investor is seeking for a combination of income and growth. SPY is preferred when it comes to investors looking for balance, clarity, and effective tracking of the U.S. stock market.

SPDR S\&P 500 ETF Trust (SPY)

- Expense Ratio: 0.09%

- Total Assets: More than $400 Billion

- Key Highlights: Broad SPY is the first and one of the most liquid S\&P 500 ETFs. It offers great investment opportunities for high liquidity investors and continues to be the most liquid ETF tracker of the S\&P 500 index. For valuable investors, it is often utilized for long-term holding as well as short-term trading.

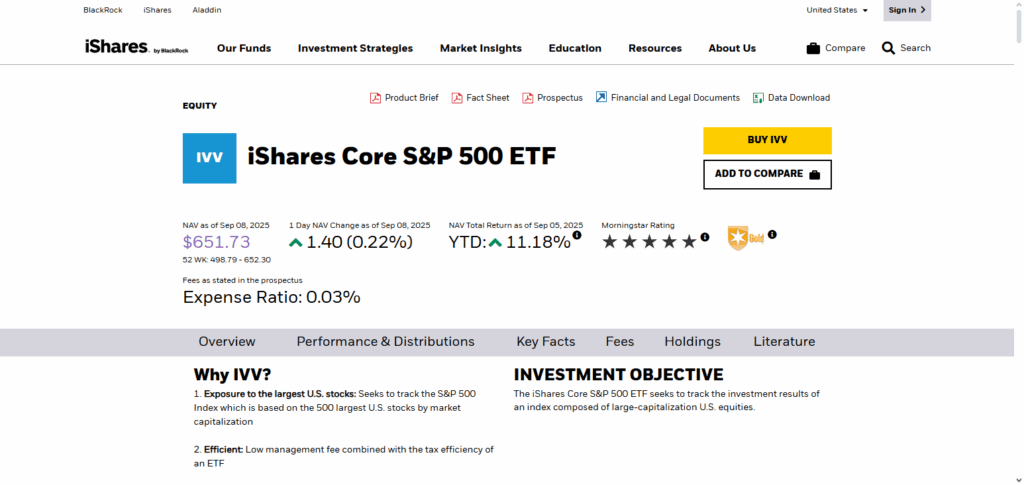

2.iShares Core S&P 500 ETF

Investors have enjoyed the benefits of the iShares Core S&P 500 ETF, IVV, since its inception in 2000, IVV gives investors easy access to the 500 biggest companies in America, while also allowing investors to have a diversified portfolio across numerous sectors.

IVV also charges their investors a very low expense ratio of only 0.03% which is a fraction of what is charged by competing funds. This makes IVV a great ETF for long-term investors who wish to pay little to no management fees over their investment horizon. In addition to being low expense, IVV is very liquid so it can easily be bought and sold with low tracking error.

In addition, IVV’s management is well regarded which helps improve the fund’s overall transparency. Investors seeking a low maintenance fund to invest in the S&P 500 for a long period of time can gain IVV’s benefits that come from quarterly funds and passive management.

iShares Core S\&P 500 ETF (IVV)

- Expense Ratio: 0.03%

- Total Assets: More than $350 Billion

- Key Highlights: iShares Pay IVV offers almost no-cost access to the S\&P 500 index while accurately and strongly tracking it. Because of the low tracking and expense ratio, it is often recommended for long-term investment. It has high liquidity and also offers quarterly reinvestment of dividends.

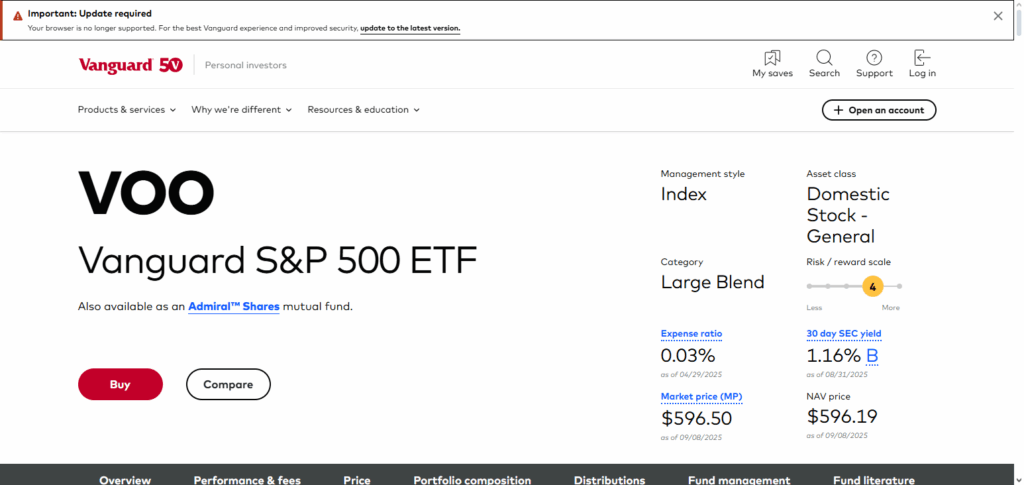

3.Vanguard S&P 500 ETF

One of the best s and p 500 ETFs is the Vanguard S&P 500 ETF (VOO) which is largely attributed to the low cost, wide market reach, and great management from Vanguard.

Introduced in 2010, VOO has made it easy and productive for investors to put their money in the largest 500 businesses of the United States across multiple industries such as technology, health, and finance. It has the lowest expense ratio of 0.03% and low annual management fees.

Investors thus pay low management fees and retain most of the returns. VOO has high liquidity which allows investors to trade easily and quickly during the day. Unlike many ETFs, VOO closely follows the performance of the S&P 500 index.

Offering dividends on a quarterly basis makes VOO appealing for investors focusing on both growth and income. VOO is one of the best s and p 500 ETFs due to the streamlined approach and low fees which allows investors to earn money easily.

Vanguard S\&P 500 ETF (VOO)

- Expense Ratio: 0.03%

- Total Assets: More than $300 Billion

- Key Highlights: Vanguard S\&P 500 ETF is an S\&P 500 ETF VOO an investor can buy and hold for the long term. It offers S\&P 500 broad investment exposure at very low cost. Investors in VOO admire the index tracking and regular dividend dividends offered.

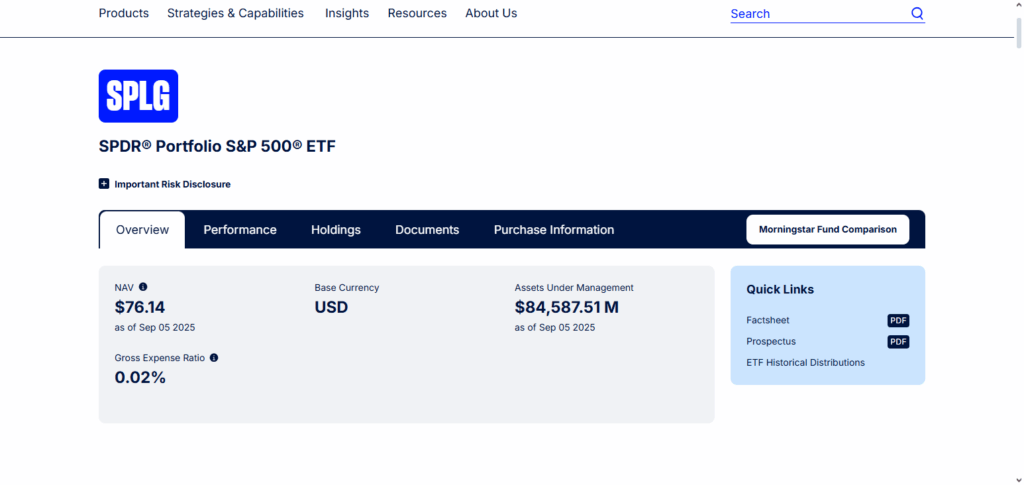

4.SPDR Portfolio S&P 500 ETF

SPDR capa S&P 500 ETF SPLG pisa Investment’s best S&P 500 ETF’s for its affordability, ease of use, and successful market tracking. Since its 2005 launch, SPLG has offered investors the opportunity to invest in and keep diversified portfolios of the 500 largest U.S. companies and other essential sector.

Expense ratio of 0.03% and low management fees over other portfolio years work as another profitable class for investors focused SPLG’s benefits. SPLG’s craving SPLG’s, liquidity leading to seamless trading, SPLG have lowest bid-ask competitive the S&P 500 index SPLG’s tracking error has minimal.

SPLG’s value, clarity, low cost range, high income index and transparent dividends boosted its market value. SPLG pays dividends quarterly. The rest is invested in other assets to provide capital gains.

SPDR Portfolio S\&P 500 ETF (SPLG)

- Expense Ratio 0.03%

- Total Assets Apx. USD 20 Billion

- Key Highlights SPLG provides an investor-friendly option to SPY with lower fees to track S\&P 500. Long-term investors are well served, and SPLG provides enough liquidity to cover moderate trading volumes.

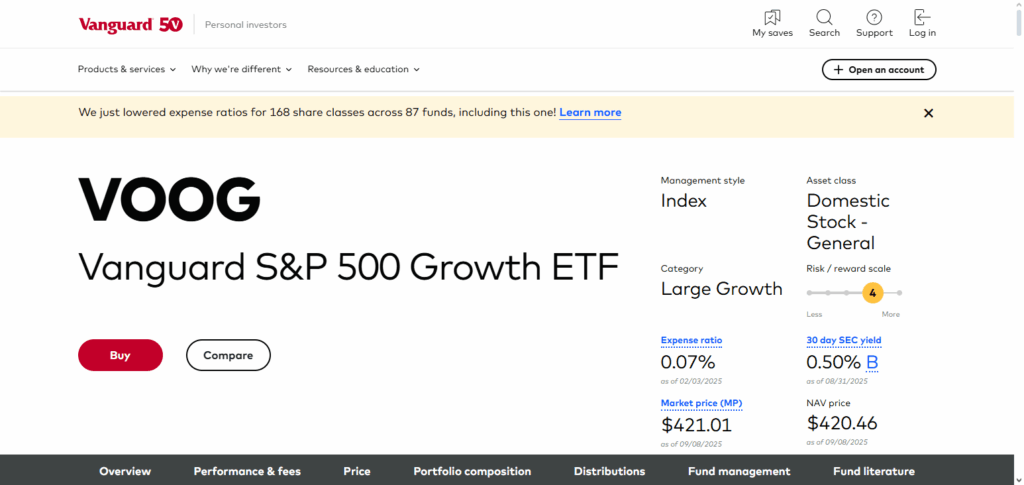

5.Vanguard S&P 500 Growth ETF

Vanguard S&P 500 Growth ETF (VOOG) is one of the best S&P 500 ETFs for investors wanting a specific Focus on growth U.S. companies. VOOG was launched in the year 2000 and focuses on the growth portion of the S&P 500 by overweighting companies that have strong earnings growth potential, innovative products, and strong leadership market positions—especially in the technology and consumer discretionary.

VOOG is very cost-effective and provides growth-driven returns over a long period of time. The total cost of VOOG is 0.04% with very low cost annual management fees. VOOG is also very liquid which permits easy buying and selling on the stock market. As a result the VOOG stock is very closely aligned with the S&P 500 Growth Index.

VOOG also makes quarterly dividend payments which makes it a great equity investment. Many of the assets in the ETF are growth stocks which provide VOOG the ability to have appreciated capital. This makes VOOG a great option for investors looking to have a balance between stability and growth.

Vanguard S\&P 500 Growth ETF (VOOG)

- Expense Ratio 0.08%

- Total Assets Apx. USD 50 Billion

- Key Highlights VOOG invests in growth constituents of S\&P 500 and is best suited for investors looking for capital appreciation, and not dividends.

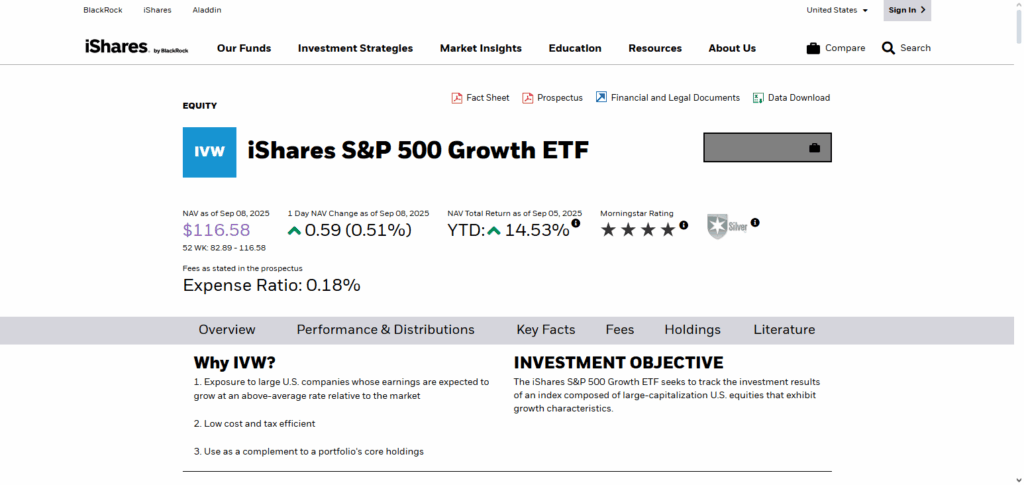

6.iShares S&P 500 Growth ETF

The iShares S&P 500 Growth ETF (IVW) is one of the top S&P 500 ETFs with the focus area set on growth stocks. It’s been around since 2000. Companies with strong earnings growth along with technologically, and healthcare related innovative business models with great potential market are target.

The 0.05% expense ratio and low annual management fees are promising for long-term investors with high-growth potential. IVW is one of the most liquid ETFs with low management fees and is almost perfectly correlated with the S&P 500 Growth Index, so it trades with low tracking errors. IVW also pays dividends four times a year.

Long-term, IVW provides investors with growth and income. IVW is still one of the best growth ETFs since it invests in top growth businesses and provides low-cost access to the dynamic U.S markets.

iShares S\&P 500 Growth ETF (IVW)

- Expense Ratio: 0.18%

- Total Assets: Apx. USD 20 Billion

- Key Highlights: IVW is used for S\&P 500 growth stocks that VOOG also covers. Growth investors target this ETF and its performance during bullish markets is historically solid.

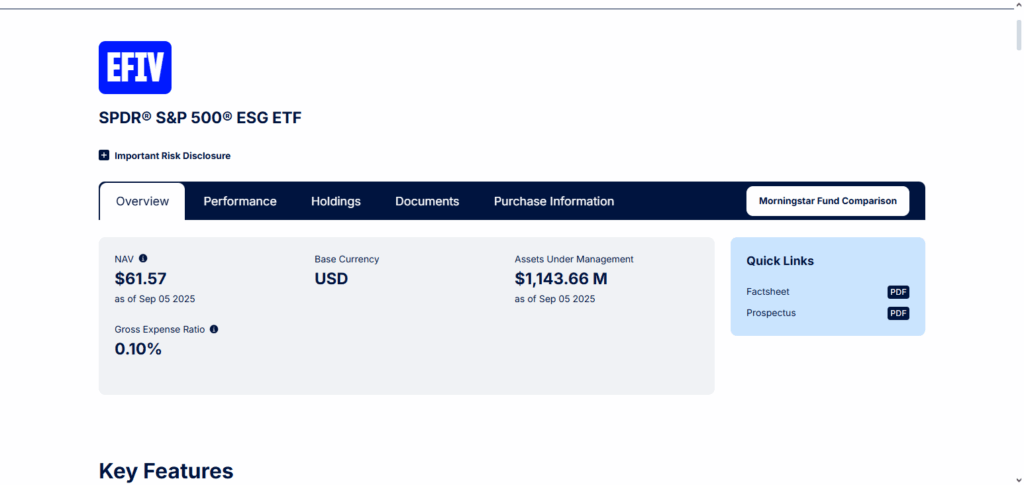

7.SPDR S&P 500 ESG ETF

The SPDR S&P 500 ESG ETF (EFIV) is one of the top contenders for the S&P 500 ESG ETFs aimed at investors looking for more market diversification alongside environmental, social, and governance (ESG) attributes.

SInce its inception in 2019, investors are able to align their portfolios with sustainable and socially responsible practices since EFIV picks out S&P 500 companies that meets the stringent ESG standards.

Having a low expense ratio of only 0.10% and extremely low annual fees, EFIV is one of the cheapest ways to invest in companies that are leaders in ESG matters. High liquidity of the ETF guarantees easy buying and selling on the stock exchange.

At the same time, the ETF remains a close to perfect replica of the S&P 500 ESG Index. EFIV also offers reliable income through quarterly dividends while enabling investors to foster sustainable impact by investing in responsible companies. This makes EFIV one of the best ESG S&P 500 ETF funds.

SPDR S and P 500 ESG ETF (EFIV)

- Expense Ratio: 0.10%

- Total Assets: Around $2 billion

- Key Highlights: For socially responsible enthusiastic investors that want to invest with the S and P 500, EFIV combines ESG (Environmental, Social, and Governance) criteria with S and P 500 investing.

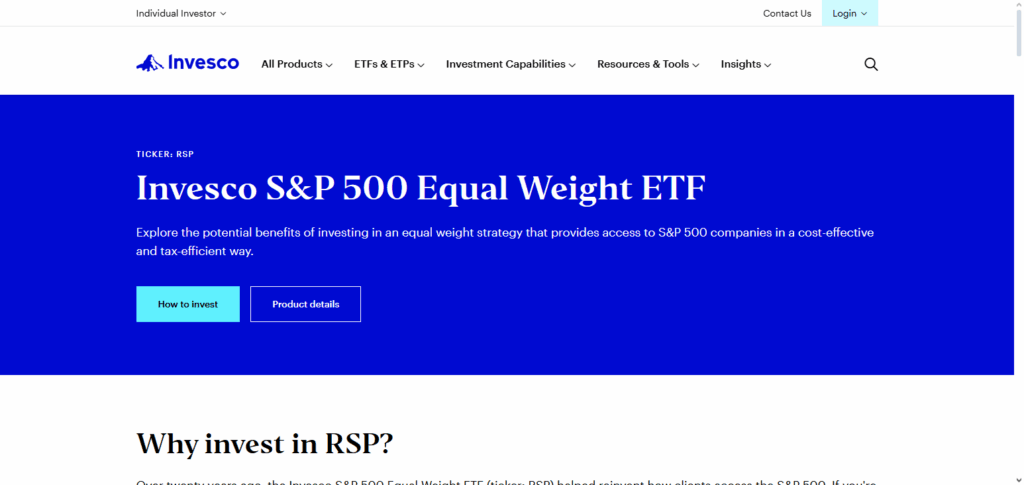

8.Invesco S&P 500 Equal Weight ETF

The Invesco S&P 500 Equal Weight ETF stands out as a best-in-class S&P 500 ETF for long-term investors wanting a more tailored approach to U.S. large-cap exposure. Founded in 2003, RSP is different from other S&P 500 ETFs in that it, rather than market capitalization, allocates equal weight to all 500 firms in the index.

This lowers concentration risk in the largest companies and increases diversification and growth potential in all other companies. RSP has an expense ratio of 0.2% as well as low annual management fees, both of which keep the fund as a very cheap expense alternative to traditional market-cap ETFs.

RSP is one of the more liquid ETFs which makes intraday trading simple, and it issues quarterly dividends which can appeal to income-oriented investors.

RSP’s strategy of equal weight investing, along with its comprehensive sector diversification, index replication, and dependable ratio of balanced risk to reward all come together to make it a great fund for balanced investors wanting to capture the performance of the U.S. stock market.

Invesco S\&P 500 Equal Weight ETF (RSP)

- Expense Ratio: 0.2%

- Total Assets: More than $20 billion

- Key Highlights: RSP gives the same percentage allocation to every stock within the S&P 500, meaning smaller companies have a stronger impact than typical ETFs that are weighted by market capitalization. This increased potential for smaller companies can provide greater growth opportunities as well as increased diversification.

9. JPMorgan Equity Premium Income ETF

JEPI is one of the most innovative S&P 500 ETFs, particularly when it comes to income generation and risk control. Armored with an actively managed strategy, JEPI combines the defensive equity with covered call ELNs and thus, retains the ability to sustain less volatility than the traditional S&P 500 ETFs.

While giving out consistent monthly income, as of September 2025, JEPI boasts a 30-day SEC yield of 8.76%. This makes the fund a suitable one for income-generating investors. Moreover, the ETFs expense ratio is an incredibly low 0.35%.

JP Morgan defensive equity and covered call writing has been actively managing JEPI since it was launched on May 20, 2020. JEPI has shown strong performance during “risk-off” periods in the market. Using covered calls decreases volatility and downside risk. This makes JEPI an even more interesting fund for conservative investors.

Over the last few months, interest rates have risen dramatically. The equity markets and bond yields have become positively correlated. This has, in turn, made alternative income-generating options even more interesting.

JPMorgan Equity Premium Income ETF

- Expense Ratio: 0.35%,

- Total Assets: $26 billion

- Key Highlights: JEPI stands out by combining S&P 500 exposure with an options overlay to generate monthly income, making it ideal for investors seeking regular payouts. It focuses on low-volatility stocks to reduce risk while providing consistent returns. Its innovative approach provides enhanced income potential without sacrificing equity market participation, positioning it as a top choice for income-oriented S&P 500 investors.

10. ProShares S&P 500 Dividend Aristocrats ETF

Founded in 2013, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is one of the best S&P 500 ETFs because of its focus on the S&P 500 companies that have increased their dividends for 25 consecutive years or more.

The increase in dividends gives the investor not only an income but also provides stability which is why income investors would be keen on prolong investment. The expense ratio is also low for 0.35%, which is an economical way to gain exposure to the best of the best.

NOBL has more volatility than the S&P 500, but NOBL focuses more on the ability to compound in a recurring income. This makes it NOBL a preferred pick for investors focusing on growth with recurring dividends.

ProShares S&P 500 Dividend Aristocrats ETF

- Expense Ratio: 0.35%,

- Total Assets: $8.5 billion

- Key Highlights: NOBL focuses exclusively on S&P 500 companies that have increased dividends for at least 25 consecutive years, providing stability and income potential. This makes it a favorite for long-term investors seeking consistent dividends alongside capital appreciation. Its strategy combines dividend growth with S&P 500 exposure, offering a balance of growth and income.

Pros & Cons Best S&P 500 ETFs

Pros

- Diversification– Reduces the risk involved from individual stocks by exposing one to 500 large US firms across various industries.

- Lower Fees– IVV, SPLG and VOO are some of the ETFs that have very low expense ratios (0.03%–0.09%) and, hence, low fee structures.

- Easily Tradable– High daily trading volumes makes it easy to either buy or sell and ensures that the bid-ask spread is nice and tight.

- Gapless Cash Flow– Quarterly dividends that most ETFs pay confer the benefit of a steady income stream.

- Cost-Effective– ETFs that track a specific index spend very little in active management and are, therefore, very transparent.

- Availability– Similar to regular stocks, it can be bought or sold from any brokerage account.

- Flexibility– One can opt for ESG-focused or equal-weighted exposure or growth-focused ETFs (IVW, VOOG, etc.) and even various tiers of exposure.

Cons

- Bear Market– Broad ETFs that track the S&P 500 can also lose value during a market downturn, exposing one to additional risk.

- Stagnation– The market is not passed by, and hence the index is also not outperformed by, any passive ETFs.

- Overweighting Specific Sectors– Some Market-cap ETFs can suffer from large portions of the total market value being centered on finance and tech.

- ETF Mismanagement– While it is always very minimal, some ETFs have a tendency to not perform according to the index.

- Dividend Taxes – Depending on where you live, dividend payouts might be taxed.

- Less Flexibility – A passive ETF does not go on to purchase high-flying stocks outside its index.

Conclusion

To wrap up, the best S&P 500 ETFs give investors the ability to access the largest American companies from the stock market simply and affordably. Whether it’s the low-fee broad market access from VOO and IVV, the growth-oriented ETFs VOOG and IVW, the sustainable investing vehicle EFIV, or RSP’s equal weight diversification, every investor has an ETF tailor made for them.

These ETFs are easy to buy or sell, easy to understand, and have had persisting performance making them great for traders and long term investors alike. Choosing the right ETF means that you can take advantage of the growth and stability of the U.S. equity market while keeping expenses low and remaining strategically flexible.

FAQ

Which are considered the best S&P 500 ETFs?

Some of the top S&P 500 ETFs include SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 ETF (VOO), SPDR Portfolio S&P 500 ETF (SPLG), Vanguard S&P 500 Growth ETF (VOOG), iShares S&P 500 Growth ETF (IVW), SPDR S&P 500 ESG ETF (EFIV), and Invesco S&P 500 Equal Weight ETF (RSP).

Why are these ETFs considered the best?

They are favored for their low expense ratios, high liquidity, reliable tracking of the S&P 500 index, diversified portfolios, and dividend income potential. Some also offer targeted growth or ESG-focused exposure.

How do I choose the right S&P 500 ETF?

Consider factors like expense ratio, liquidity, dividend distribution, tracking accuracy, investment focus (growth, ESG, or equal-weight), and your long-term financial goals.