I will discuss the How to Use DeFi Dashboards for Portfolio Tracking. Platforms such as Zerion, Debank, and Zapper consolidate crypto assets—ranging from tokens and staked positions to liquidity provisions—into a single, user-friendly interface.

- What Are DeFi Dashboards?

- How to Use DeFi Dashboards for Portfolio Tracking

- Access or Establish a Digital Wallet

- Navigate to the Dashboard

- Link Your Wallet

- Examine the Portfolio Summary

- Analyze Asset Composition

- Evaluate Historical Performance

- Configure Alerts and Notifications

- Execute Data-Driven Transactions

- Popular DeFi Dashboards

- Benefits of Using DeFi Dashboards

- Tips for Effective Portfolio Tracking

- Select a Trusted Aggregator

- Aggregate All Wallets

- Conduct Frequent Performance Checks

- Include Varied Asset Classes

- Configure Condition-Based Alerts

- Perform Routine Rebalancing

- Common Mistakes to Avoid

- Pros & Cons

- Conclusion

- FAQ

By delivering real-time valuations, detailed performance metrics, and cross-chain synchronization, these tools facilitate the ongoing assessment of investments, the proactive calibration of yield strategies, and the formulation of data-driven tactical decisions.

What Are DeFi Dashboards?

DeFi dashboards function as integrated command centers for decentralized finance investors, consolidating asset oversight and transaction management across heterogeneous environments. By aggregating holdings across diverse blockchains, protocols, and wallets, they deliver a panoramic real-time view of the entire crypto portfolio rather than isolated segments.

Principal functionalities encompass dynamic performance charts, yield progression tracking, and comparative analytics, all of which enable users to evaluate opportunities and symmetries at a glance.

Distinct from conventional crypto wallets, these platforms furnish an interactive visual experience that simplifies the orchestration of liquidity provisioning, staking, and yield farming strategies, thus minimizing the friction of jumping between multiple user interfaces and obviating the need for manual balance verification.

How to Use DeFi Dashboards for Portfolio Tracking

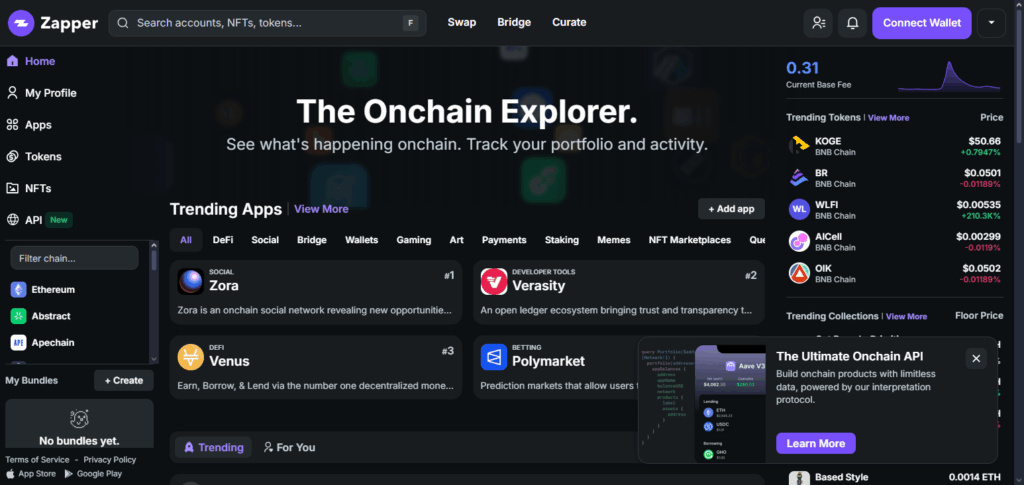

Example: Tracking a DeFi Portfolio through Zapper

Access or Establish a Digital Wallet

Confirm that a wallet application (for instance, MetaMask, Trust Wallet, or Coinbase Wallet) containing your decentralized finance assets is ready for use.

Navigate to the Dashboard

Open the Zapper web interface or corresponding mobile application.

Link Your Wallet

Tap the “Connect Wallet” icon, select the desired wallet extension or mobile application, and approve the requested permissions.

Examine the Portfolio Summary

Once linked, Zapper will automatically aggregate and display all DeFi holdings, encompassing native tokens, staked assets, and liquidity pool tokens.

Analyze Asset Composition

View the quantifiable makeup of your portfolio by distinguishing between token classes (e.g., native tokens, liquidity pool tokens, staked tokens).

Evaluate Historical Performance

Access time-weighted return metrics, providing a record of portfolio evolution, alongside disclosed gains, losses, and annualized percentage yields attributable to staking and liquidity provisioning.

Configure Alerts and Notifications

If desired, enable customizable notifications for price deviations or fluctuations in yield.

Execute Data-Driven Transactions

Employ the aggregated insights to rebalance holdings, initiate additional staking, or migrate assets in a judicious manner.

Popular DeFi Dashboards

Zerion

Zerion is an advanced DeFi dashboard engineered to consolidate, monitor, and enhance decentralized finance portfolios within a unified interface. Its distinguishing feature is the aggregation of assets across heterogeneous blockchain ecosystems, encompassing Ethereum, Layer 2 solutions, and additional supported networks, thereby presenting real-time balances, positions, and comprehensive transaction histories.

Portfolio constituents—such as tokens, liquidity positions, and engagements with DeFi protocols—are updated in a single view, eliminating the need to traverse multiple applications. The interface employs a carefully crafted design and in-depth analytical tools to render intricate DeFi behaviors intelligible, thereby streamlining the oversight of digital assets and the formulation of informed strategies for both novice and veteran participants.

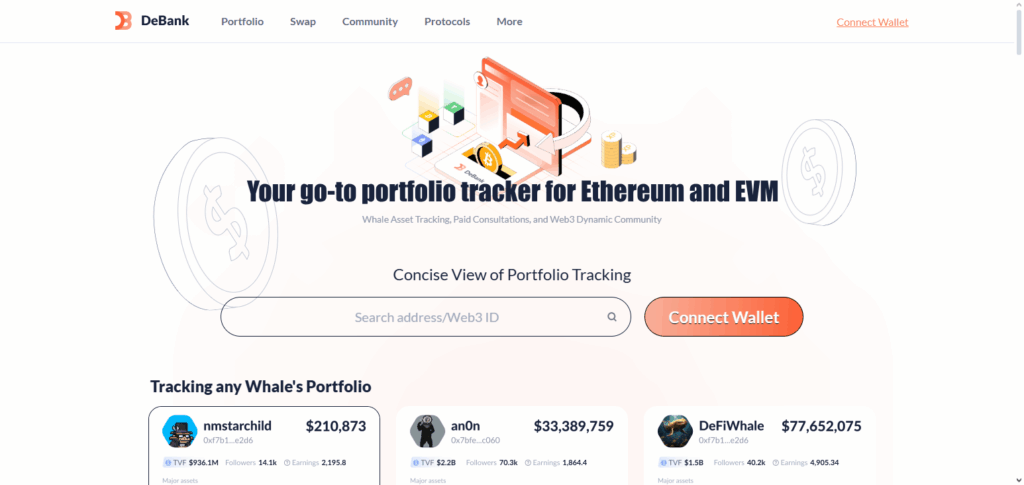

Debank

Debank serves as an integrated DeFi dashboard that consolidates the management of decentralized finance portfolios within a single interface.

Its cross-chain design covers a wide spectrum of blockchain environments, delivering granular visibility into token holdings, lending and borrowing engagements, and liquidity provisioning. What differentiates Debank is its protocol-tier analysis, which renders real-time farm and pool data—applied annual yields, historical return vectors, and interactions across heterogeneous DeFi ecosystems—into a single view.

Such transparency empowers users to streamline asset reallocations and yield optimization while minimizing friction commonly encountered with inter-platform movement. The interface thus equips investors with the requisite intelligence to act decisively and prudently in a fluid DeFi landscape.

Benefits of Using DeFi Dashboards

Unified Portfolio Visibility—Aggregate tokens, LP positions, and staked collateral across diverse protocols into a single, coherent view.

Instantaneous, Live Data—Automatically refreshes balances, transaction logs, and overall value, preserving the currency of asset status.

Multi-Chain Tracking—Seamlessly consolidate and assess holdings operating on distinct base layers and associated Layer 2 solutions.

Sophisticated Performance Metrics—Break down realized and unrealized returns, including yield derived from both staking and liquidity provision functions.

Analytical Decision Support—Provide actionable metrics—such as annualized yield, fee impact, and exposure to smart contract risk—thereby enhancing investment rationality.

User-Centric Interface—Streamline complicated DeFi workflows, ensuring accessibility for novices without sacrificing feature depth for the seasoned trader.

Tips for Effective Portfolio Tracking

Select a Trusted Aggregator

Leverage established dashboards such as Zerion, Debank, or Zapper to ensure accurate, real-time portfolio visibility.

Aggregate All Wallets

Sync every wallet across all relevant chains to capture a comprehensive snapshot of your holdings.

Conduct Frequent Performance Checks

Regularly assess not only balances but also annual percentage yields and unrealized gains or losses.

Include Varied Asset Classes

Monitor a mix of holdings—including standard tokens, staked assets, and liquidity-pool positions—to spread exposure across sources of risk.

Configure Condition-Based Alerts

Activate notifications for key variables such as price deviations, yield shifts, or noteworthy transaction events.

Perform Routine Rebalancing

Re-evaluate and adjust asset weights at predetermined intervals to align with changing performance metrics and prevailing market trends.

Common Mistakes to Avoid

Overlooking Cross-Chain Holdings – Excluding tokens or LP position spread across various blockchains produces misleading totals.

Neglecting Wallet Syncs – Leaving obsolete or unlinked wallets in a tracker skews the reported balance.

Ignoring Transaction Costs – Failing to account for gas fees or platform commissions distorts the effective profit or loss.

Focusing Solely on Yield Numbers – Pursuing the highest reported APY without evaluating underlying risk frameworks invites adverse outcomes.

Compromising Security Practices – Granting wallet permission to dubious interfaces or exposing mnemonic phrases endangers the entire portfolio.

Omitting Routine Audit – Allowing prolonged periods between balance checks risks unrealized gains from new avenues or unnoticed drawdowns from impermanent loss or liquidation.

Pros & Cons

| Pros | Cons |

|---|---|

| Centralized view of all DeFi assets | Some dashboards may have limited blockchain support |

| Real-time portfolio performance tracking | Dependent on wallet connections for accurate data |

| Cross-chain asset aggregation | Can be overwhelming for beginners due to complex analytics |

| Easy monitoring of staking, liquidity, and yields | Risk of exposing wallet addresses to third-party platforms |

| Informed investment decisions with analytics | Limited offline access; requires internet connection |

| Alerts and notifications for price and APY changes | Some advanced features may require paid subscriptions |

Conclusion

In summary, the adoption of DeFi dashboards for portfolio oversight streamlines the administration of decentralized assets by delivering a consolidated, live representation of holdings from a single interface. Services such as Zerion, Debank, and Zapper empower users to oversee token inventories, liquidity positions, and staking performance across diverse blockchains.

By harnessing integrated analytics, configurable alerts, and cross-chain reconciliation, investors gain the ability to make evidence-based decisions, enhance yield, and mitigate exposure. Systematic review, complemented by disciplined interaction with these dashboards, promotes resilient portfolio oversight within the dynamically shifting DeFi landscape.

FAQ

What is a DeFi dashboard?

A DeFi dashboard is a platform that aggregates your decentralized finance assets, including tokens, staking, and liquidity positions, providing a single interface to monitor and manage your portfolio.

Which DeFi dashboards are most popular?

Zerion, Debank, and Zapper are widely used for real-time portfolio tracking and cross-chain support.

Do I need to connect my wallet?

Yes, connecting your crypto wallet (e.g., MetaMask, Trust Wallet) is required to fetch and display your holdings.