I will discuss the How to Set Up a Watchlist for Under-the-Radar Altcoins exclusively on obscure altcoins. Monitoring lesser-known digital assets positions investors to detect emerging opportunities ahead of significant price increases.

- Understanding Under-the-Radar Altcoins

- How to Set Up a Watchlist for Under-the-Radar Altcoins

- Step 1: Select a Tracking Tool

- Step 2: Initialize the Watchlist

- Step 3: Investigate Altcoin Candidates

- Step 4: Populate the Watchlist

- Step 5: Activate Alerts and Review

- Choosing the Right Tools and Platforms

- Monitoring and Updating Your Watchlist

- Establish Price Alerts

- Correlate News and Updates

- Quantify Social Sentiment

- Conduct Periodic Performance Reviews

- Refine Based on Independent Research

- Best Practices for Safe Watchlist Management

- Resist Market Euphoria

- Practice Strategic Diversification

- Articulate Measurable Objectives

- Prioritize Security

- Conduct Periodic Reassessments

- Pros & Cons

- Conclusion

- FAQ

A thoughtfully curated watchlist facilitates ongoing evaluation of individual coin trajectories, the assimilation of prevailing market conditions, and the formulation of justified, timely trading actions. Adopting appropriate technological tools alongside evidence-based practices promotes streamlined oversight and enhances the security of altcoin holdings.

Understanding Under-the-Radar Altcoins

Under-the-Radar Altcoins designates cryptocurrencies that remain outside the purview of mainstream discussion and have yet to command considerable media or institutional focus. Typically characterized by relatively modest market capitalizations, these tokens may nonetheless present pronounced upside if their underlying technical or business models flourish.

Market participants therefore monitor their performance in search of maturation pathways before subsequent price acceleration. The corresponding risk profile is proportionately elevated, owing to shallow order books, sporadic developer engagement, and oscillating community sentiment or adoption curves.

Robust due diligence, ongoing engagement with developer and user forums, and proportionate sizing of capital commitments are requisite preconditions to alleviating the centrifugal volatility exposure to which these lesser-known assets are liable.

How to Set Up a Watchlist for Under-the-Radar Altcoins

Step 1: Select a Tracking Tool

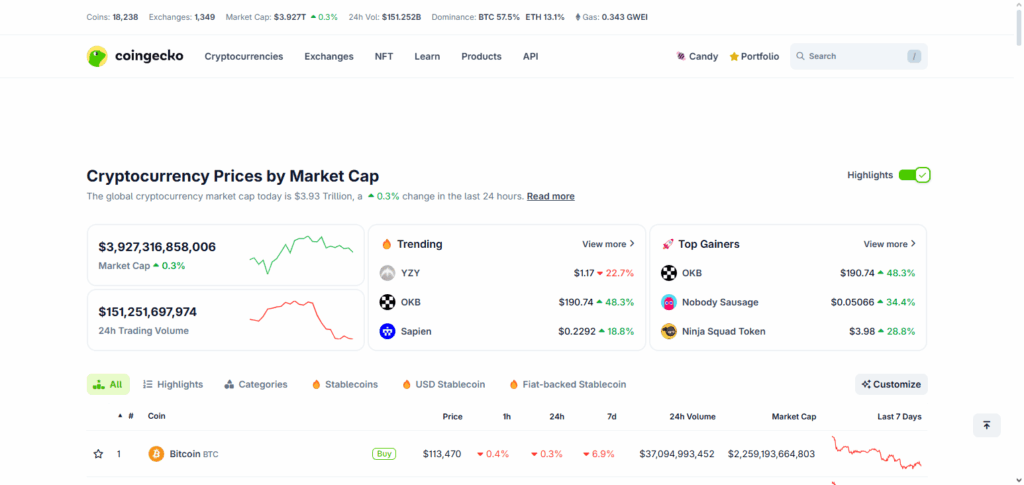

Utilize a cryptocurrency monitoring service—such as CoinGecko, CoinMarketCap, or Binance—to facilitate watchlist creation and ongoing administration.

Step 2: Initialize the Watchlist

Access the relevant function, title the list (for instance, “Hidden Gems” or “Emerging Altcoin Prospects”) and save it.

Step 3: Investigate Altcoin Candidates

Identify low-cap, low-profile altcoins that exhibit strong project fundamentals. Employ platform filters like “Trending” and “Recently Added” for discovery.

Step 4: Populate the Watchlist

Incorporate 5–10 assets onto your list, recording price, market capitalization, and daily trading volume for each.

Step 5: Activate Alerts and Review

Program price and volume notifications, inspect the list each day, and periodically prune or refresh it to reflect continuing merit-based analysis.

Choosing the Right Tools and Platforms

Crypto Tracking Websites: Services such as CoinMarketCap and CoinGecko deliver minute-by-minute price updates, market capitalizations, and lists of coins trending in trading volumes, assisting in initial screenings.

Portfolio Management Applications: Applications like Blockfolio and Delta enable the categorization and continuous surveillance of personal holdings, integrating performance metrics and profit-loss analyses.

Charting Systems: TradingView provides sophisticated charting capabilities for comprehensive technical examination, affording the user the flexibility to overlay multiple indicators and customize visual layouts.

Price Alerts and Notifications: Confirm that the chosen service can dispatch push notifications whenever a specified price threshold is breached, thereby facilitating timely interventions.

News Aggregators: Remain abreast of material developments affecting individual coins by leveraging platforms that incorporate dedicated news filters, thereby aggregating releases from multiple reputable sources within the same interface.

Monitoring and Updating Your Watchlist

Establish Price Alerts

Trigger real-time notifications when altcoin quotations reach predetermined thresholds.

Correlate News and Updates

Track project releases, alliance announcements, and emerging market conditions.

Quantify Social Sentiment

Analyze discourse across Twitter, Reddit, and Discord to gauge community orientation.

Conduct Periodic Performance Reviews

Examine which assets are outpacing their benchmarks and which warrant decommissioning.

Refine Based on Independent Research

Introduce newly vetted tokens with demonstrable promise and excise chronically sluggish or dormant assets.

Best Practices for Safe Watchlist Management

Resist Market Euphoria

Anchor your selections to objective analysis rather than the emotional pulse of social feeds.

Practice Strategic Diversification

Populate your watchlist with assets drawn from distinct sectors to dilute concentration risk.

Articulate Measurable Objectives

Formulate outcome expectations grounded in saner scenarios, acknowledging both upward and downward volatility.

Prioritize Security

Leverage well-established platforms exhibiting audited safety protocols and persistent incident response capabilities.

Conduct Periodic Reassessments

Displace assets failing to deliver while integrating newcomers with credible fundamentals to maintain dynamism in your portfolio surveillance.

Pros & Cons

| Pros | Cons |

|---|---|

| Helps track potential high-growth altcoins early | High risk due to low liquidity and volatility |

| Enables timely buying and selling decisions | Requires constant monitoring and research |

| Provides organized portfolio management | Possibility of hype-driven mistakes if not careful |

| Helps identify market trends and opportunities | Under-the-radar coins may fail or disappear |

| Can improve long-term investment strategy | May become overwhelming with too many coins on the list |

Conclusion

Assembling a curated watchlist of lesser-known altcoins is a strategically sound approach for discerning investors seeking nascent opportunities.

When investors judiciously choose dependable analytical platforms, investigate candidate tokens within clearly defined parameters, and subject the results to systematic review, they facilitate data-driven decision-making and constrain exposure to excessive risk.

Complementary tactics—diversifying across sectors, articulating measurable investment objectives, and resisting crowd-driven impulses—not only fortify the analytical base of the watchlist but also constrain behavioral risk.

Consequently, a rigorously updated register amplifies the probability of discerning high-potential altcoins prior to their contraction of speculative froth.

FAQ

What is an under-the-radar altcoin?

It’s a lesser-known cryptocurrency with lower market visibility but potential for significant growth.

Which platforms are best for creating a watchlist?

Popular options include CoinMarketCap, CoinGecko, TradingView, Blockfolio, and Delta.

How often should I update my watchlist?

Regularly—ideally weekly or whenever there’s major news or price movement.