In this article, I will discuss the Best Altcoins With Governance Rewards—cryptocurrencies that provide substantial utility and allow users to dictate some changes to protocols.

- Key Point & Best Altcoins With Governance Rewards List

- 1.Uniswap (UNI)

- Pros & Cons Uniswap (UNI)

- 2.Aave (AAVE)

- Pros & Cons Aave (AAVE)

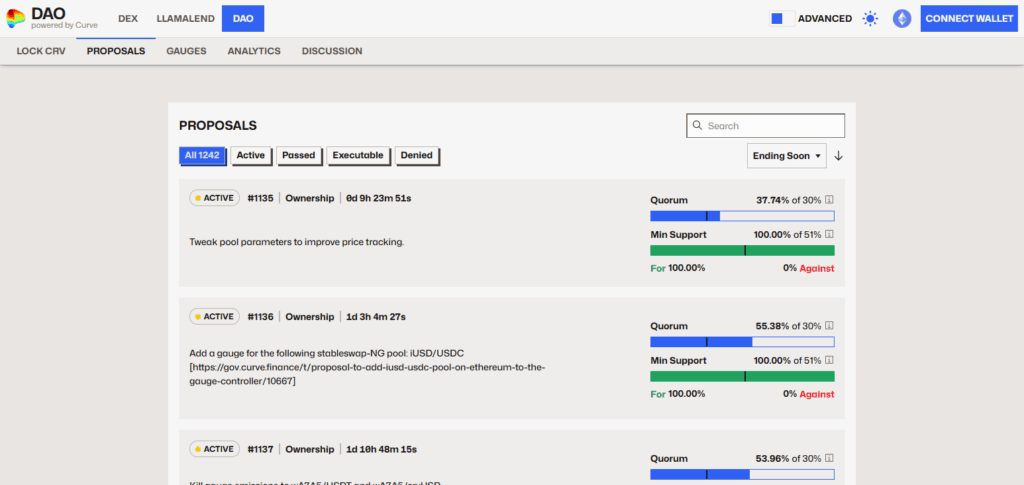

- 3.Curve DAO (CRV)

- Pros & Cons Curve DAO (CRV)

- 4.Maker (MKR)

- Pros & Cons Maker (MKR)

- 5.PancakeSwap (CAKE)

- Pros & Cons PancakeSwap (CAKE)

- 6.Compound (COMP)

- Pros & Cons Compound (COMP)

- 7.Synthetix (SNX)

- Pros & Cons Synthetix (SNX)

- 8.yearn.finance (YFI)

- Pros & Cons yearn.finance (YFI)

- 9.Balancer (BAL)

- Pros & Cons Balancer (BAL)

- 10.SushiSwap (SUSHI)

- Pros & Cons SushiSwap (SUSHI)

- Conclusion

- FAQ

These altcoins have passive governance features. Hence, they are excellent for users who wish to derive returns and control in DeFi. Let us look at leading the projects that are driving this innovation.

Key Point & Best Altcoins With Governance Rewards List

| Platform (Token) | Key Point |

|---|---|

| Uniswap (UNI) | Leading decentralized exchange (DEX) using an automated market maker (AMM). |

| Aave (AAVE) | Popular lending/borrowing protocol with flash loan support. |

| Curve DAO (CRV) | DEX optimized for stablecoin and low-slippage trading. |

| Maker (MKR) | Governance token of MakerDAO, which powers the DAI stablecoin. |

| PancakeSwap (CAKE) | BNB Chain-based DEX offering yield farming and lotteries. |

| Compound (COMP) | Lending platform where users earn interest or borrow assets. |

| Synthetix (SNX) | Enables creation of synthetic assets representing real-world value. |

| yearn.finance (YFI) | Aggregator that automates DeFi yield farming strategies. |

| Balancer (BAL) | DeFi protocol allowing customizable liquidity pools and automated trading. |

| SushiSwap (SUSHI) | Community-run AMM and DeFi suite forked from Uniswap. |

1.Uniswap (UNI)

Uniswap (UNI) has emerged as one of the best altcoins by governance rewards due to its dominance as a decentralized exchange in the DeFi ecosystem. Participants in governance receive diversified assets as a result of their active participation.

As governance participants, they have the right to vote on important matters such as protocol upgrades, fees, and how the treasury is utilized. UNI is remarkable for both its sizable and engaged user base and the ability of its token holders to steer the decentralized exchange’s infrastructure.

Pros & Cons Uniswap (UNI)

| Pros | Cons |

|---|---|

| Holders influence protocol upgrades and fee structures. | Governance voting power is weighted, favoring large holders. |

| Strong community and market dominance. | Governance rewards are indirect (no staking yield). |

| Decentralized and widely adopted DEX model. | Limited utility outside of governance. |

2.Aave (AAVE)

AAVE is one of the leading altcoins which offers governance rewards. Holders can propose and vote on critical matters like interest rate models, asset listings, and treasury utilization. AAVE’s distinct advantage is the participation from governance users in his multichain ecosystem which is heavily integrated and supports a myriad of chains.

AAVE holders are also able to stake their tokens in the Safety Module where they earn rewards while protecting the protocol. This enables them to combine governance with active participation and incentivized protocol defense.

Pros & Cons Aave (AAVE)

| Pros | Cons |

|---|---|

| Governance includes lending parameters and risk models. | Participation may require technical understanding. |

| Staking AAVE in Safety Module earns rewards. | Governance activity is lower compared to protocol size. |

| Multi-chain support strengthens decentralized governance. | Slashing risk when staking in Safety Module. |

3.Curve DAO (CRV)

Curve DAO (CRV) is one of the best altcoins with governance rewards due to its innovative vote-locking mechanism, where users lock CRV to receive veCRV, gaining boosted rewards and voting power. This system uniquely aligns long-term incentives by rewarding committed users with higher yields and greater protocol influence.

CRV holders directly shape liquidity incentives across pools. Governance is not merely an idle function; rather, it actively propels the returns and growth of the ecosystem, intertwining financial benefits with the power to influence outcomes.

Pros & Cons Curve DAO (CRV)

| Pros | Cons |

|---|---|

| Vote-locking (veCRV) boosts rewards and voting power. | Requires long-term token lock for maximum benefit. |

| Governance affects liquidity incentives directly. | Complex tokenomics and reward structures. |

| High DeFi integration and stablecoin utility. | Curve wars create competition between protocols. |

4.Maker (MKR)

Maker (MKR) is one of the top altcoins having governance rewards since it governs the Maker Protocol which issues DAI stablecoin. The role of MKR holders in the DAI ecosystem is critical. They vote on various risk parameters, collection types, system updates, and other crucial governance parameters which impact DAI’s stability.

A stand out feature of MKR is the “skin in the game” model—MKR is burned from protocol fees, which means governance actions affects the value of the token. This creates a powerful incentive for responsible, long-term-focused governance participation among holders.

Pros & Cons Maker (MKR)

| Pros | Cons |

|---|---|

| Governance decisions impact DAI’s stability and security. | High responsibility due to protocol’s systemic role. |

| MKR is burned through protocol fees—boosting value. | No direct staking rewards. |

| Long-standing DeFi project with institutional backing. | Complex governance proposals and risk assessments. |

5.PancakeSwap (CAKE)

PancakeSwap (CAKE) is regarded as one of the most unique altcoins on the BNB Chain due to the active community engagement and governance rewards offred. CAKE holders get to participate in critical decisions such as token burns, addition of farming pairs, and other progressive features.

What sets Pancake Swap apart is that it synergizes governance with fiercely competitive DeFi offering—users accrue extra dividends if they stake CAKE in Syrup Pools during voting periods. The balance of utility and governance alongside passive income optimization is a cornerstone of the platform.

Pros & Cons PancakeSwap (CAKE)

| Pros | Cons |

|---|---|

| Active community with real-time voting on key features. | Heavily tied to BNB Chain ecosystem. |

| Staking CAKE yields rewards and access to governance. | Inflationary token model affects value over time. |

| Diverse features: lottery, NFTs, prediction markets. | Governance impact diluted by large token supply. |

6.Compound (COMP)

As one of the leading altcoins, Compound (COMP) stands out for governance rewards because it enables participants to dictate changes to the protocol’s evolution, which includes interest rate models, new asset markets, and upgrades.

The distinct feature of COMP is its complete decentralized governance—developers relinquished control after launch, enabling complete community governance. This system captures long-term self-sustaining decentralization, while active participants reap the benefits of control over a key decentralized lending platform that dominates trust within the ecosystem.

Pros & Cons Compound (COMP)

| Pros | Cons |

|---|---|

| Fully decentralized with governance-only control. | Low voter turnout in many proposals. |

| Decisions shape interest models and supported assets. | No yield from simply holding COMP. |

| Transparent and community-led upgrades. | Slow-moving governance due to cautious decision-making. |

7.Synthetix (SNX)

Synthetix (SNX) has positioned itself as one of the best altcoins to invest in as a reward for governance participation because of the unique and exceptional integration of staking and governance. SNX holders who stake their tokens are rewarded with not only fees from synthetic asset trading but also receive the ability to vote on upgrades and incentives of the protocol.

The alignment of protocol growth with active participation is unique in that it highlights governance decisions that directly influence participation which in turn influences the yields from staking—thus guaranteeing that users will meaningfully engage while stabilizing the system and directing its growth and the ecosystem of synthetic assets.

Pros & Cons Synthetix (SNX)

| Pros | Cons |

|---|---|

| Staking earns fees and voting rights. | Requires regular staking and claiming to maximize returns. |

| Governance shapes synthetic asset markets. | High complexity in synthetic asset mechanisms. |

| Aligned incentives between stakers and platform success. | Risk of impermanent loss or debt pool fluctuation. |

8.yearn.finance (YFI)

yearn.finance (YFI) is a prominent altcoin that offers governance rewards, bestowing substantial yield optimization governance on one of DeFi’s most efficient platforms. Unlike many tokens, YFI’s distribution was fully community-driven as it was launched with no pre-mine or developer allocation.

This fosters strong governance culture as every vote impacts vault strategy, fee structure, integrations, and more. With performance fees and incentive mechanisms based on user community alignment, YFI holders actively shape the protocol’s evolution while reaping benefits.

Pros & Cons yearn.finance (YFI)

| Pros | Cons |

|---|---|

| YFI holders vote on vault strategies and protocol changes. | Low YFI supply leads to governance concentration. |

| No pre-mine or developer allocation—fully community-driven. | Token is expensive and inaccessible to small holders. |

| Integrates multiple DeFi protocols into yield-optimizing strategies. | Less frequent governance proposals. |

9.Balancer (BAL)

Balancer (BAL) is regarded as one of the best altcoins especially with governance rewards thanks to its innovative method of automated portfolio management via adjustable liquidity pools. BAL holders participate in governance votes regarding protocol fee adjustments, asset listings, and liquidity mining parameters.

Its unique edge lies in enabling users to create self-balancing index funds, with governance participants shaping these incentives. BAL holders are able to actively steer the protocol’s development and accrue governance rewards by actively shaping the reward structures through active participation in the creation of value-aligned incentives.

Pros & Cons Balancer (BAL)

| Pros | Cons |

|---|---|

| Governance controls dynamic pool structures and fees. | Complex interface for casual users. |

| BAL holders vote on reward allocation and protocol updates. | Lower liquidity compared to top-tier DEXs. |

| Unique feature: self-balancing portfolios. | Requires understanding of pool mechanics for active participation. |

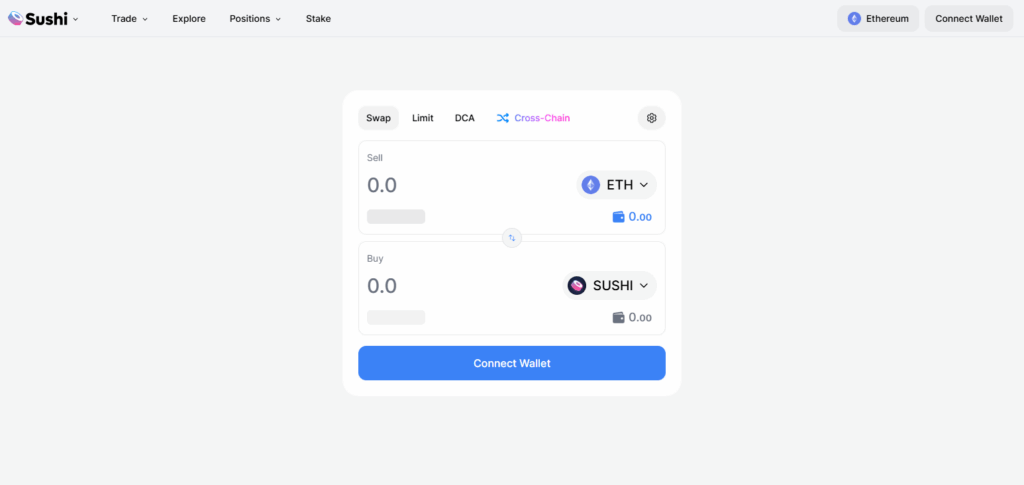

10.SushiSwap (SUSHI)

SushiSwap (SUSHI) is one of the most important altcoins because it offers governance rewards, enabling participants to take an active role in one of the most comprehensive DeFi ecosystems. SushiSwap also functions as a DEX and incorporates lending, launchpads, and yield farming.

What sets SUSHI apart is its focus on community engagement—anyone holding tokens can participate in governance, which shapes numerous cross-chain products. SUSHI stakers receive xSUSHI which not only grants them partial ownership of protocol revenue but also aligns governance action with earnings, thus fostering community devotion and proactive involvement for the long term.

Pros & Cons SushiSwap (SUSHI)

| Pros | Cons |

|---|---|

| Governance spans multiple DeFi products (DEX, lending, launchpad). | Faced leadership and direction challenges. |

| xSUSHI offers yield plus governance rights. | Protocol forks and competitors reduce uniqueness. |

| Community-first development ethos. | Fragmentation across products may reduce governance focus. |

Conclusion

In summary, the leading altcoins of the Web 3.0 era with governance rewards do not only achieve passive income but also allow users to earn while actively participating in shaping decentralized finance.

Community governance within the Aave project, Uniswap, Curve, and Maker dwarfs the traditional unilateral approach taken by central financial institutions to eliminate the conflict of interests such institutions operate under.

These projects have made it possible to earn financial rewards for submission of community proposals aimed at system improvements. Their innovative governance systems allow users to earn dividends, make these altcoins preferable for those who want to be part of the DeFi revolution and get profit at the same time.

FAQ

What are governance rewards in crypto?

Governance rewards are incentives given to token holders who participate in protocol decision-making, such as voting on proposals, protocol upgrades, and fund allocations.

Why are altcoins with governance rewards important?

They promote decentralization, encourage active community participation, and align token holder incentives with the protocol’s long-term success.

Which altcoins offer strong governance rewards?

Some top altcoins include Uniswap (UNI), Aave (AAVE), Curve DAO (CRV), Maker (MKR), and SushiSwap (SUSHI), each offering unique governance structures and reward systems.