In this article, I will discuss the Best Crypto Credit Cards in the USA. With the growing popularity of cryptocurrency, these cards allow users to earn crypto rewards and spend digital assets seamlessly.

- key Points & Best Crypto Credit Cards In The USA 2025 List

- 10 Best Crypto Credit Cards In The USA 2025

- 1.Nexo Credit Card

- 2.Gemini Credit Card

- 3.Venmo Credit Card

- 4.BlockFi Rewards Visa Credit Card

- 5.Coinbase Credit Card

- 6.SoFi Credit Card

- 7.Brex Credit Card

- 8.Wirex Credit Card

- 9.KuCoin Credit Card

- 10.SORA Credit Card

- Conclusion

From cashback offers to no annual fees, I’ll explore the top options to help you find the best crypto credit card that suits your needs.

key Points & Best Crypto Credit Cards In The USA 2025 List

| Card Name | Key Features |

|---|---|

| Nexo Credit Card | Earn up to 2% cashback in BTC or NEXO, spend crypto without selling, no annual fee |

| Gemini Credit Card | Earn up to 3% crypto rewards on purchases, supports multiple cryptocurrencies |

| Venmo Credit Card | Earn cashback on everyday purchases, linked to Venmo balance, customizable rewards |

| BlockFi Rewards Visa Credit Card | Earn 1.5% Bitcoin cashback, no annual fee, low foreign transaction fees |

| Coinbase Credit Card | Earn up to 4% crypto rewards, no annual fee, instant conversion to crypto |

| SoFi Credit Card | Earn up to 3% cashback, no fees, linked to SoFi Invest for easier crypto integration |

| Brex Credit Card | Earn points for purchases, no personal guarantee required, corporate card focus |

| Wirex Credit Card | Earn up to 1.5% crypto cashback, multi-currency support, Visa acceptance worldwide |

| KuCoin Credit Card | Supports multiple cryptocurrencies, earn rewards in native tokens, no annual fee |

| SORA Credit Card | Earn rewards in SORA tokens, linked to SORA ecosystem, global Visa acceptance |

10 Best Crypto Credit Cards In The USA 2025

1.Nexo Credit Card

The Nexo credit card is one of the leading crypto credit cards in the United States because it allows users to spend their cryptocurrency without the need for liquidating it. The card offers superbly helpful cashback rewards of up to 2% in Bitcoin or NEXO tokens.

It does not have an annual fee and has international acceptability as a Mastercard which positions it as a great option for cryptocurrency users.

Nexo users will also benefit from the smooth integration with Nexo’s other offerings, which makes accessing one’s crypto assets easy. If you’re looking for a platform that allows you to earn crypto rewards through spending, Nexo is one of the best options.

| Feature | Description |

|---|---|

| Cashback | Up to 2% cashback in BTC or NEXO tokens |

| Annual Fee | No annual fee |

| Spend Crypto | Spend without selling crypto assets |

| Global Acceptance | Mastercard acceptance worldwide |

| Cryptocurrency Support | Supports Bitcoin, Ethereum, and other cryptocurrencies |

2.Gemini Credit Card

The Gemini Credit Card stands out on the U.S. crypto card market due to offering rewards of up to 3% on purchases.

It also supports multiple currencies such as Bitcoin, Ethereum, and Litecoin which are automatically converted to crypto rewards.

Additionally, they do not charge an annual fee and rewards are given on every purchase. This card makes it easy to build your cryptocurrency portfolio.

The Gemini Credit Card also has strong security features and account management through the Gemini app is available, making it easy for crypto fans to use.

| Feature | Description |

|---|---|

| Cashback | Up to 3% cashback in crypto rewards |

| Annual Fee | No annual fee |

| Spend Crypto | Convert crypto to rewards for purchases |

| Cryptocurrency Support | Supports multiple cryptos including Bitcoin, Ethereum, Litecoin |

| Reward Flexibility | Earn crypto rewards directly into your Gemini account |

3.Venmo Credit Card

The Venmo Credit Card is arguably one of the best cards for earning rewards while spending in the US. While not a crypto credit card per se, users do earn cashback on their purchases which can conveniently be turned into crypto through the Venmo app.

It offers up to 3% cashback on certain categories like dining and groceries, while 1% is offered for general purchases.

The card is linked to your Venmo balance which enables spending with ease and integration through the Venmo account. It has no annual fee making it a perfect card for crypto investors with a Venmo account.

| Feature | Description |

|---|---|

| Cashback | Up to 3% cashback on select categories (e.g., dining, groceries) |

| Annual Fee | No annual fee |

| Linked to Venmo | Spend directly from your Venmo balance |

| Cryptocurrency Option | Convert cashback to cryptocurrency through Venmo |

| Reward Flexibility | Customizable reward categories |

4.BlockFi Rewards Visa Credit Card

The BlockFi Rewards Visa® Signature Credit Card is unique amongst crypto credit cards in the USA because it allows users to earn cryptocurrency rewards on everyday purchases. Cardholders earn 1.5% back in Bitcoin on every purchase and this reward rate increases to 2% after an annual spend of $50,000.

New cardholders can take advantage of 3.5% crypto rewards on all purchases within the first 90 days, with rewards capped at $100 in crypto. With no annual fee and no foreign transaction fees, it is inexpensive to hold the card and accumulate cryptocurrency rewards.

It is crucial to keep in mind that BlockFi filed for bankruptcy and paused some operations, including new credit card issuance, as of November 2022. All cardholders need to monitor BlockFi updates for the latest news regarding account and service access.

| Feature | Description |

|---|---|

| Cashback | 1.5% Bitcoin cashback on every purchase |

| Annual Fee | No annual fee |

| Introductory Offer | 3.5% cashback for the first 90 days up to $100 in crypto |

| Cryptocurrency Support | Earn rewards in Bitcoin (BTC) |

| Foreign Transaction Fee | No foreign transaction fees |

5.Coinbase Credit Card

In the USA, the Coinbase Credit Card is predicted to remain one of the best crypto credit cards in 2025. Card users can conveniently spend cryptocurrency through their Coinbase accounts using this Visa debit card.

Holders of the card earn up to 4% in crypto rewards for some purchases and the rewards are given in the ditto currency. Apart from Bitcoin and Etherum, other cryptocurrencies are also supported which adds more flair to the card.

It is perfect for those who want to spend cryptocurrency on daily expenses as there are no annual fees and the Coinbase platform easily accepts both currency deposits and spending.

| Feature | Description |

|---|---|

| Cashback | Up to 4% crypto rewards on purchases |

| Annual Fee | No annual fee |

| Spend Crypto | Directly spend crypto from Coinbase account |

| Cryptocurrency Support | Supports multiple cryptocurrencies (Bitcoin, Ethereum, etc.) |

| Reward Flexibility | Choose the cryptocurrency for rewards |

6.SoFi Credit Card

The SoFi Credit Card is well known among crypto credit cards in the USA due to its simple rewards structure. Customers of the card gets unlimited 2% cash back on all purchases, which can be redeemed for cryptocurrency via SoFi Invest.

This makes it easier to convert their rewards into cryptocurrency such as Bitcoin or Ethereum. Also, the card offers 3% cash back on travel purchases made through SoFi Travel, in addition to having no annual fees or fees for foreign transactions. For individuals who value ease of use and reward in cryptocurrency, it is an alluring option.

| Feature | Description |

|---|---|

| Cashback | 2% unlimited cash back on all purchases |

| Annual Fee | No annual fee |

| Cryptocurrency Integration | Redeem cashback for cryptocurrency via SoFi Invest |

| Cashback on Travel | 3% cashback on travel bookings made via SoFi Travel |

| Foreign Transaction Fee | No foreign transaction fees |

7.Brex Credit Card

The Brex Credit Card is an excellent option for U.S. firms wishing to reap the benefits of earning cryptocurrency as rewards. With Brex, companies can earn up to 8x points on specific categories, including rideshare where they earn 7x and Brex Travel where they earn 4x.

These points can be redeemed for different types of rewards, including Bitcoin (BTC) and Ethereum (ETH), which allows flexibility in how rewards are used. Also, as it is accessible to startups and growing businesses, Brex does not require a personal guarantee .

With its generous rewards and redemptions offered in crypto, the Brex Credit Card offers these businesses a seamless transition into the world of cryptocurrency.

| Feature | Description |

|---|---|

| Cashback | Earn up to 8x points in select categories |

| Annual Fee | No annual fee |

| Points Redemption | Redeem points for crypto (BTC, ETH), travel, or other rewards |

| No Personal Guarantee | No personal guarantee required |

| Crypto Support | Supports crypto redemption for rewards |

8.Wirex Credit Card

Starting at the very top of the hierarchy of cryptocurrency cards in the United States, the Wirex Credit Card stands out in offering seamless payments in USD (dollars) as well as in Bitcoin and Ethereum. Users can get up to 8% cashback with Cryptoback™ rewards, which is earned in the form of WXT tokens.

The absence of foreign transaction costs, complimentary ATM withdrawals up to $200, and worldwide acceptability makes Wirex an advantageous and economical NFT-spending and reward-earning device for crypto enthusiasts.

| Feature | Description |

|---|---|

| Cashback | Up to 8% cashback via Cryptoback™ rewards program |

| Annual Fee | No annual fee |

| Cryptocurrency Support | Supports over 150 fiat and 10 cryptocurrencies |

| Global Acceptance | Accepted at over 54 million locations worldwide |

| ATM Withdrawals | Free ATM withdrawals up to $200 per month |

9.KuCoin Credit Card

The KuCoin Credit Card, termed as KuCard, provides the most advanced crypto debit card in the USAbecause of the smooth transition between digital coins and cash payments.

Users are able to change their digital currencies such as USDT, XRP, and KCS into fiat money which can be readily spent at more than a million shops that accept Visa.

It comes in both virtual and physical forms, and it can be linked with Apple Pay and Google Pay, adding to its functionality. Besides, KuCard has a cashback program which allows users to earn as much as 3% back on spending, depending on their VIP tier level.

| Feature | Description |

|---|---|

| Cashback | Up to 3% cashback based on VIP level |

| Annual Fee | No annual fee |

| Cryptocurrency Support | Spend crypto like USDT, XRP, KCS, and more |

| Payment Options | Virtual and physical cards |

| Integration | Works with Apple Pay and Google Pay |

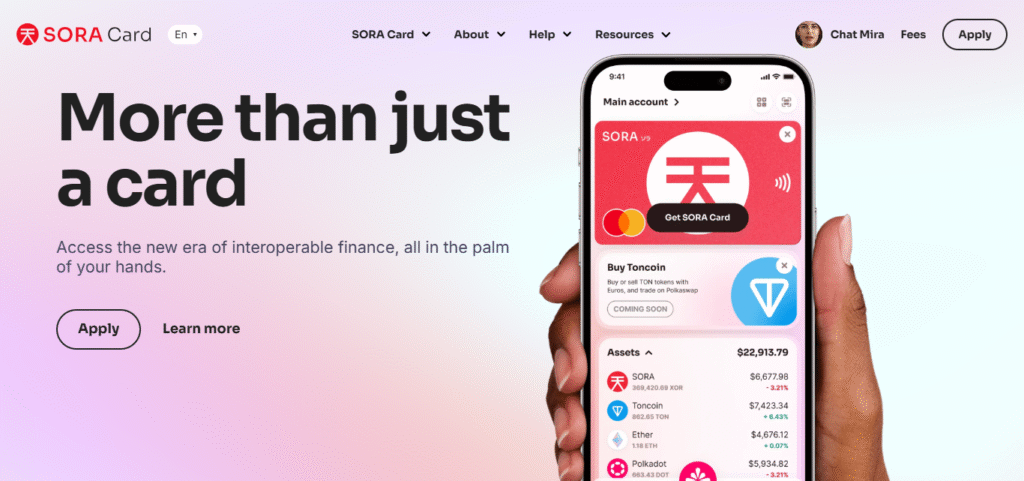

10.SORA Credit Card

In the US, the SORA Credit Card stands out among its competitors because of its hybrid self-custody and banking features. Along with SORA Wallet, users are able to spend crypto through a physical and virtual Mastercard or crypto asset owned by them.

SORA enables transactions through over 90 million merchants globally and works on multiple chains like Polkadot, Ethereum and various others which makes it cross-chain friendly. The SORA Credit Card is focused towards people who want complete control over financial transactions.

| Feature | Description |

|---|---|

| Cryptocurrency Support | Supports Polkadot, Ethereum, and other blockchain ecosystems |

| Annual Fee | No annual fee |

| Spend Crypto | Spend directly through a Mastercard at millions of merchants |

| Global Acceptance | Accepted globally with Mastercard network |

| Privacy-Focused | Designed with decentralized control and privacy in mind |

Conclusion

To sum up, the top rated crypto credit cards in the USA rank on the basis of having rewards in cryptocurrency, low costs, and worldwide spending capacity.

Their ease of use and rewards programs also make the Nexo Credit Card, Gemini Credit Card, and Coinbase Credit Card appear to be ideal choices. Considering your habits related to spending and cryptocurrencies would also help in selecting the best card to maximize benefits.