In this article, I will talk about Best Credit Card for Qantas Points so that you can select the one that is most suited for your spending habits and travel plans.

- Key Points & Best Credit Card for Qantas Points in 2025 List

- 10 Best Credit Card for Qantas Points In 2025

- 1.Qantas Premier Titanium

- 2.ANZ Frequent Flyer Black

- 3.Citi Prestige Qantas

- 4.Westpac Altitude Qantas Black

- 5.NAB Qantas Rewards Signature

- 6.Bankwest Qantas World

- 7.Citi Premier Qantas

- 8.Qantas American Express Ultimate

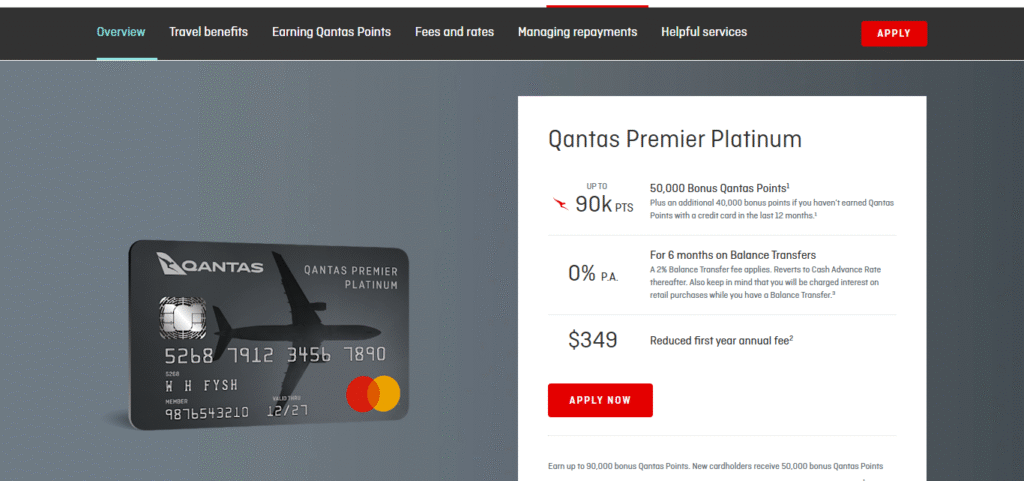

- 9.Qantas Premier Platinum

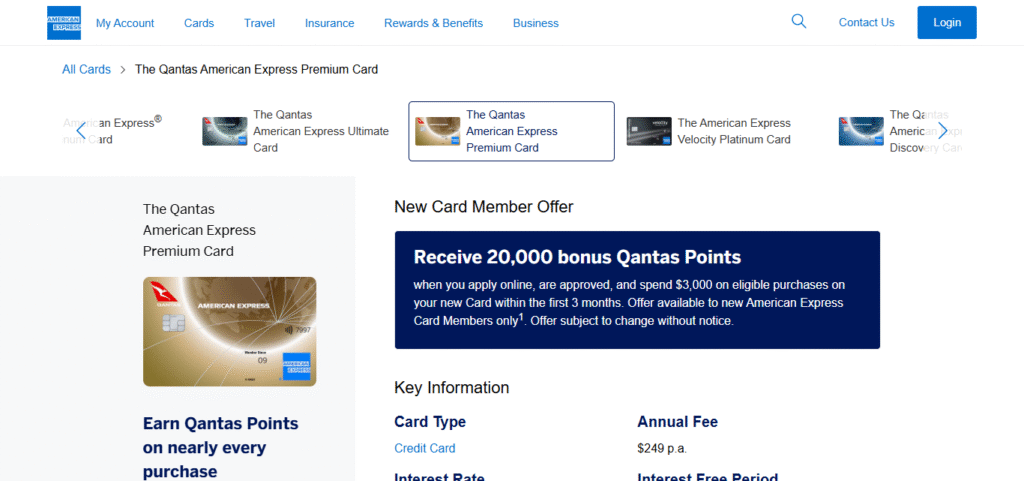

- 10.Qantas American Express Premium

- Conclusion

Regardless if you are an avid traveler or just beginning to earn points, selecting the right card with good sign-up bonuses and high spend earn rates will ensure many travel perks and make the trips worthwhile.

Key Points & Best Credit Card for Qantas Points in 2025 List

| Credit Card | Key Points |

|---|---|

| Qantas Premier Titanium | 150,000 bonus Qantas points, $1,200 annual fee, premium travel perks, high earn rate, luxury benefits |

| ANZ Frequent Flyer Black | 130,000 bonus Qantas points, $425 annual fee, uncapped points, 2 Qantas Club lounge passes |

| Citi Prestige Qantas | 125,000 bonus Qantas points, $749 annual fee, high earn rate, luxury travel benefits |

| Westpac Altitude Qantas Black | Up to 120,000 bonus Qantas points, $370 annual fee, high earn rate, lounge access, international spend bonus |

| NAB Qantas Rewards Signature | 120,000 bonus Qantas points, $420 annual fee, generous bonus, complimentary insurance |

| Bankwest Qantas World | 100,000 bonus Qantas points, $320 annual fee, high spend requirement, substantial bonus points |

| Citi Premier Qantas | 100,000 bonus Qantas points, $350 annual fee, high earn rate, international spend bonus |

| Qantas American Express Ultimate | 100,000 bonus Qantas points, $450 annual fee, $450 travel credit, lounge access, comprehensive travel perks |

| Qantas Premier Platinum | Up to 90,000 bonus Qantas points, $399 annual fee, bonus for new cardholders, travel perks |

| Qantas American Express Premium | 30,000 bonus Qantas points, $249 annual fee, lower annual fee, decent earn rate, useful for everyday use |

10 Best Credit Card for Qantas Points In 2025

1.Qantas Premier Titanium

The Qantas Premier Titanium Credit Card stands out with its astounding 150,000 bonus Qantas Points, positioning it perfectly for anyone trying to maximize their rewards.

Moreover, it has an annual fee of $1,200 but provides high earning rates with both international and domestic spending. Other than that, cardholders enjoy exclusive benefits such as airport lounge access, travel insurance, and complimentary Qantas Wine membership.

This premium card is definitely for those who frequently travel and appreciate luxury perks. Also, it has the added benefit of providing bonus points for international spending, increasing the pace at which points are accumulated along with several other travel benefits to make your journey better.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 150,000 points for new cardholders |

| Annual Fee | $1,200 |

| Earning Rate | 2 Qantas Points per $1 on eligible purchases |

| International Spend | Earn bonus points on international purchases |

| Travel Perks | Access to Qantas Club, luxury benefits, complimentary travel insurance |

| Additional Benefits | Qantas Wine membership, travel benefits |

2.ANZ Frequent Flyer Black

The ANZ Frequent Flyer Black card best suits those who wish to have a high spend point earning potential, currently offering 130,000 bonus Qantas Points. With an annual fee of $425, the card provides uncapped points earning thereby making it a great option for everyday and a frequent travelers.

Moreover, cardholders receive two complimentary Qantas Club lounge passes which are ideal for those who travel often and need comfort. Other perks include travel insurance and access to flight offers. This card serves solit for any individuals in search of great rewards blended with premium travel benefits.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 130,000 points for new cardholders |

| Annual Fee | $425 |

| Earning Rate | 1.5 Qantas Points per $1 on eligible purchases |

| Complimentary Benefits | 2 Qantas Club lounge passes, travel insurance |

| Bonus Points | Additional points on international spending |

| Special Offers | Exclusive flight offers and discounts for cardholders |

3.Citi Prestige Qantas

The Citi Prestige Qantas card is best for the Citi customers who relish receiving high rewards alongside luxurious benefits. It has one of the highest earning rates over premium credit cards and is offering 125,000 bonus Qantas Points with a yearly fee of $749.

It gives exclusive benefits to frequent flyers like more than 1,000 airport lounge access globally, travel insurance, and hotel offers.

The card earns international spending bonus points, which facilitates accumulating Qantas Points quickly. With its luxury perks and high earning ratio, the Citi Prestige Qantas card is top tier.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 125,000 points for new cardholders |

| Annual Fee | $749 |

| Earning Rate | 2 Qantas Points per $1 on eligible purchases |

| Travel Perks | Access to over 1,000 airport lounges worldwide |

| Additional Benefits | Comprehensive travel insurance, luxury hotel offers |

| International Spend | Earn extra points on international purchases |

4.Westpac Altitude Qantas Black

Depending on the spending threshold, the Westpac Altitude Qantas Black card offers up to 120,000 bonus Qantas Points. Along with this, the card charges an annual fee of $370. This Mastercard Unlock with Air Canada offers earning of points through local and overseas purchases.

It also comes with airport lounge access and international flight bonuses, making it favorable for overseas travelers. The card is perfect for those who spend significantly on their credit cards as there is no limit on the earning offer.

Other than this, travelers receive comprehensive travel insurance along with a suite of additional benefits which guarantee value for the users.

| Feature | Details |

|---|---|

| Bonus Qantas Points | Up to 120,000 points (depending on spend) |

| Annual Fee | $370 |

| Earning Rate | 1.25 Qantas Points per $1 on local spend, 2 Qantas Points per $1 on overseas spend |

| Airport Lounge Access | Access to airport lounges |

| Travel Insurance | Comprehensive travel insurance for cardholders |

| Additional Benefits | International flight bonus offers |

5.NAB Qantas Rewards Signature

The most suitable for travelers looking for reward Nokia Qantas Rewards Signature Discount. With a $420 annual fee, it offers 120,000 bonus Qantas Points alongside earning potential with eligible purchases.

The card also comes with complimentary insurance benefits like travel and purchase protection. The flexibility offered by NAB’s rewards program enables cardholders to redeem points for flights and upgrades. The program is beneficial to those looking to earn rewards with an uncomplicated structure.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 120,000 points for new cardholders |

| Annual Fee | $420 |

| Earning Rate | 1.5 Qantas Points per $1 on eligible purchases |

| Complimentary Benefits | Travel insurance, extended warranty insurance |

| Additional Benefits | Access to exclusive flight deals and rewards redemption |

| Bonus Points | Bonus points for overseas purchases |

6.Bankwest Qantas World

The credit card offers one of the most lucrative reward options. Bankwest Qantas World Credit Card boosts your earning potential with an additional 100,000 bonus Qantas Points.

With an annual fee of $320, this card easily outperforms competing premium credit cards with its high reward potential. Best suited for high spenders, these bonus points come at a cost.

Alongside competitive earn rates on eligible purchases, this card provides additional travel benefits such as Qantas Frequent Flyer membership, travel insurance, and access to limited-time flight specials. A great option for travelers on a budget.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 100,000 points for new cardholders |

| Annual Fee | $320 |

| Earning Rate | 1 Qantas Point per $1 on eligible purchases |

| Complimentary Benefits | Complimentary Qantas Frequent Flyer membership |

| Travel Perks | Travel insurance and exclusive flight offers |

| Additional Benefits | Points for international spending and bonus offers |

7.Citi Premier Qantas

The Citi Premier Qantas card is tailored for use by frequent travelers who wish to earn Qantas Points and are also interested in earning points for everyday use. Earning this much is easy because the cards at mid-tier level offer 100,000 bonus points, the fee is $350 annually, travel insurance is included, and there are many other high value items Citi deals.

As long as you are within Citi’s extensive network of global offers and partnerships, things are easy because they allow you to redeem these points for flights, spin these points for exclusive rewards, upgrades, and other deals.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 100,000 points for new cardholders |

| Annual Fee | $350 |

| Earning Rate | 1.5 Qantas Points per $1 on eligible purchases |

| International Spend | Extra points on international purchases |

| Travel Insurance | Comprehensive travel insurance |

| Additional Benefits | Special Qantas offers, including discounted flights and upgrades |

8.Qantas American Express Ultimate

The Qantas American Express Ultimate is one of the most sought after cards in this sector with unparalleled features including 100,000 bonus Qantas Points for new applicants. It does require an annual fee of $450 which is not cheap either.

This card is comparatively more appealing to the ones who are looking for a balance of high rewards while maintaining a value in spending for the travel perks.

Receiving travel credits is also possible. Holders of this card will receive it annually which can be used on travel, they can also enter some special airport lounges all over the world too.

Like the other cards, these also provide travelers with comprehensive travel insurance while allowing you spin these points on flights, upgrades, and more which is ideal for a person with basic requirements.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 100,000 points for new cardholders |

| Annual Fee | $450 |

| Earning Rate | 1.25 Qantas Points per $1 on eligible purchases |

| Travel Benefits | $450 annual travel credit, access to lounges |

| Travel Insurance | Complimentary travel insurance |

| Additional Benefits | Exclusive access to Qantas Wine offers |

9.Qantas Premier Platinum

Qantas Premier Platinum card is less costly than the Titanium version, and yet it provides a good level of benefits. With an annual fee of $399, it provides 90,000 bonus Qantas Points.

You can earn points through several daily activities like purchases, and enjoy special travel privileges such as priority boarding and exclusive flight deals.

Additionally, this card provides complimentary Qantas Wine membership and wines from Qantas’ travel and lifestyle collection, as well as complimentary travel insurance.

Although the card does not have the highest earning rate in the market, that makes it one of the best mid-tier options in Australia for earning premium travel rewards.

| Feature | Details |

|---|---|

| Bonus Qantas Points | Up to 90,000 points for new cardholders |

| Annual Fee | $399 |

| Earning Rate | 1.25 Qantas Points per $1 on eligible purchases |

| Travel Perks | Priority boarding, Qantas Wine membership |

| Additional Benefits | Travel insurance and special flight deals |

| Bonus Points | Bonus points for new cardholders and spending |

10.Qantas American Express Premium

The Qantas American Express Premium stands out for low to mid range spenders looking to garner Qantas Points without paying top dollar on the fees. $249 in annual fee and 30,000 bonus Qantas Points offer a lower spend requirement catered to most people.

The card earns points for benefiting travel insurance and other purchases. This is best suited for infrequent travelers or those who are at the start of their points mile journey with Qantas. While it lacks some premium features of higher tier cards, it is a good alternative for everyday spending.

| Feature | Details |

|---|---|

| Bonus Qantas Points | 30,000 points for new cardholders |

| Annual Fee | $249 |

| Earning Rate | 1 Qantas Point per $1 on eligible purchases |

| Travel Insurance | Comprehensive travel insurance |

| Additional Benefits | Lower annual fee, decent rewards for everyday spend |

| Bonus Points | Points for overseas purchases and everyday transactions |

Conclusion

In conclusion, selecting a credit card that is best suited for earning Qantas Points relies deeply on one’s spending habits and travel frequency.

For premium travelers, Qantas Premier Titanium and Citi Prestige Qantas offer top-tier rewards and luxury benefits. For everyday earners, ANZ Frequent Flyer Black and Qantas American Express Ultimate are incredibly valuable cards that also offer discretionary rewards.

If user has a lower budget may prefer the Qantas American Express Premium. Budget conscious users may prefer the Qantas American Express Premium. Every credit card has distinct advantages—choose the one that fits best with your spending patterns to optimize both your Qantas Points and travel opportunities.