This article will discuss the best alternatives to Polygon. The main focus will be on platforms with unique scalability and efficiency solutions. These choices are known for their novel methods of increasing transaction speed, lowering fees and supporting smart contracts.

- Key Points & Best Polygon Alternatives

- 20 Best Polygon Alternatives

- 1.1inch

- Pros And Cons 1inch

- 2.QuickSwap

- Pros And Cons QuickSwap

- 3.Uniswap

- Pros And Cons Uniswap

- 4.MetaMask

- Pros And Cons MetaMask

- 5.Moonbeam

- Pros And Cons Moonbeam

- 6.Optimism

- Pros And Cons Optimism

- 7.Polygon

- Pros And Cons Polygon

- 8.Solana

- Pros And Cons Solana

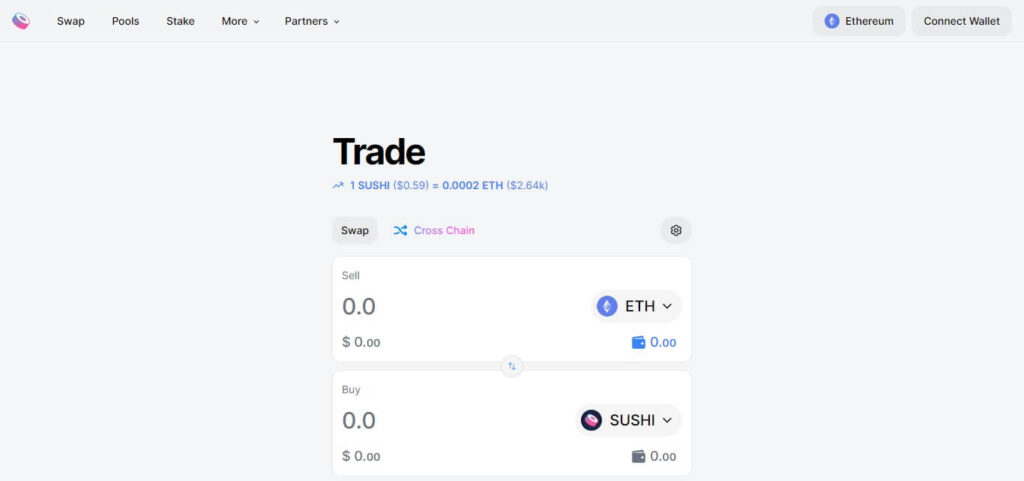

- 9.SushiSwap

- Pros And Cons SushiSwap

- 10.Arbitrum

- Pros And Cons Arbitrum

- 11.Fantom

- Pros And Cons Fantom

- 12.Ankr

- Pros And Cons Ankr

- 13.Solv Protocol

- Pros And Cons Solv Protocol

- 14.Monad

- Pros And Cons Monad

- 15.Cardano

- Pros And Cons Cardano

- 16.Taiko

- Pros And Cons Taiko

- 17.Albus Protocol

- Pros And Cons Albus Protocol

- 18.StarkWare

- Pros And Cons StarkWare

- 19.zkSync

- Pros And Cons zkSync

- 20.Forte Labs

- Pros And Cons Forte Labs

- How To Choose Best Polygon Alternatives?

- Conclusion

Every substitute has something different to offer in terms of features which suits them best for various types of users within the changing world of blockchain technology. Find out what these systems can do to make your experience better!

Key Points & Best Polygon Alternatives

| Platform | Key Points |

|---|---|

| 1inch | Decentralized exchange aggregator; finds best rates across multiple DEXes. |

| QuickSwap | Decentralized exchange on Polygon; low fees and fast transactions. |

| Uniswap | Leading decentralized exchange; known for liquidity pools and swaps. |

| MetaMask | Popular Ethereum wallet; supports decentralized applications. |

| Moonbeam | Ethereum-compatible smart contract platform on Polkadot. |

| Optimism | Layer 2 scaling solution for Ethereum; reduces fees and increases speed. |

| Polygon | Layer 2 scaling solution; enhances Ethereum with faster and cheaper transactions. |

| Solana | High-performance blockchain; fast transaction speeds and low fees. |

| SushiSwap | Decentralized exchange and automated market maker; community-driven. |

| Arbitrum | Layer 2 scaling solution for Ethereum; improves speed and reduces costs. |

| Fantom | High-speed blockchain with low fees; uses DAG-based consensus. |

| Ankr | Provides decentralized infrastructure services and staking. |

| Solv Protocol | Decentralized financial protocols for liquidity and asset management. |

| Monad | High-performance blockchain focusing on scalability and security. |

| Cardano | Layer 1 blockchain with a focus on security and sustainability. |

| Taiko | Ethereum-equivalent rollup; aims for high scalability and low cost. |

| Albus Protocol | Enhances decentralized finance with innovative protocol features. |

| StarkWare | Provides zk-rollups technology for scalability and privacy. |

| zkSync | Layer 2 scaling solution using zero-knowledge rollups; low fees and high speed. |

| Forte Labs | Focuses on integrating blockchain technology with gaming and digital assets. |

20 Best Polygon Alternatives

1.1inch

1inch is an exceptional Polygon substitute which can find the cheapest swaps between decentralized exchanges. The platform selects the best paths for swaps to be executed and thus optimizes trading efficiency on multi-chain level.

It is unmatched in its comprehensiveness of liquidity sources that guarantees competitive prices coupled with smooth transaction experiences through a simple interface which even newbies find easy to navigate.

This unique method of pooling together different protocols’ liquidity not only saves costs but also improves speed during trade execution thus making 1inch appealing for cost conscious traders who still want their transactions done fast.

Pros And Cons 1inch

Pros:

- Best Price: It collects liquidity from numerous decentralized exchanges (DEXs) to provide the best possible rates for trades.

- Less Slippage: More precise and favorable trade executions are achieved through advanced algorithms that reduce slippage.

- Extensive Reach: This platform works with a wide range of tokens and multiple blockchain networks, thereby increasing flexibility and accessibility.

Cons:

- Complication: Sometimes transparency can be compromised by complex transaction routes resulting from aggregating multiple DEXs.

- Fees: Even though it targets at saving trading costs, users may still be charged fees by underlying DEXs which can accumulate overtime.

- Slippage: In spite of efforts to minimize slippage, there may still occur sudden changes in prices due to extremely volatile markets.

2.QuickSwap

QuickSwap is one of the best alternatives to Polygon in terms of transaction fees and speed. It was created on the Polygon network that offers almost immediate swapping as well as liquidity pool features.

The reason why it appeals to traders who want faster trades at cheaper rates is because they have a user friendly interface with low transactions costs.

This ensures scalability and reliability through its integration within the ecosystem of Polygon thus becoming more preferable for people who want quick and affordable trading solutions.

Pros And Cons QuickSwap

Pros:

- Cheap Transactions: Quick transaction fees are much lower than those of ethereum-based DEXs because it is built atop the Polygon network.

- Speedy Trades: It takes advantage of Polygon’s technology to ensure that trades are executed quickly and with minimal latency.

- Lots of Liquidity: It provides large liquidity pools which help improve trading efficiency by preventing slippage.

Cons:

- Limited to Polygon: This implies that assets from other blockchain networks may not be supported directly on quickswap since it is based on polygon only.

- Smaller User Base; Compared to popular decentralized exchanges like uniswap, quickswap might have a smaller user base as well as less liquidity provision.

- Security Risks: As an example for any other DeFi platforms there could always exist vulnerabilities or opportunities for smart contract related attacks within this particular ecosystem too!

3.Uniswap

Uniswap is a top alternative on Polygon and it is famous for being the first decentralized exchange. Being an AMM (Automated Market Maker) frontrunner, it allows smooth token swapping powered by strong liquidity pools. The reason why many traders go for it is because of its user-friendly interface and compatibility with different tokens.

Even though it was created on Ethereum initially, Uniswap has shown how to provide liquidity and trade in innovative ways that can give more ideas about various DeFi options with higher liquidity requirements.

Pros And Cons Uniswap

Pros:

- Great Liquidity: This DEX has a lot of liquidity because it is one of the biggest DEXes and works with many different tokens; this reduces slippage and improves trade execution.

- An innovative model for AMM: Uniswap has an automated market maker (AMM) model that makes trading easy and ensures constant liquidity.

- Support for wide range of Tokens: It supports almost all ERC-20 tokens so people can trade various things.

Cons:

- High Fees on Ethereum: Transactions within the Ethereum network have been congested recently thereby leading to high transaction costs which affect the efficiency of small trades.

- No Limit Orders: The absence of traditional limit order functionality can restrict trading strategies as well as price manipulation

- Smart Contract Risks: Bugs or exploits in smart contracts may put user funds at risk when dealing with such platforms like uniswap

4.MetaMask

One of the most famous substitutes for handling and working with DApps on Polygon is MetaMask. It supports Polygon as well as other chains since it is an Ethereum wallet that is used by many people. Basically, this means that MetaMask acts as a direct link to multiple DeFi platforms.

People can securely store their assets, transact, and interact with smart contracts using a friendly interface provided by MetaMask. The ability of this software to be versatile while integrating with lots of dApps has made it become a very important asset for individuals who want everything they need when dealing with blockchains in one place.

Pros And Cons MetaMask

Pros:

- Provision of multi-network support: It ensures that it allows interaction with several blockchains such as Ethereum and Polygon. Through this, different dApps and DeFi services can be accessed.

- A secure wallet: MetaMask offers strong security measures like private key encryption which safeguard the assets belonging to users.

- User-friendly interface: The platform has an intuitive design for managing digital currencies as well as interacting with decentralized applications (dApps).

Cons:

- Browser Extension Vulnerabilities: Since this is a browser extension, there might be chances of attack through phishing or such other risks associated with any browser-based software.

- Transaction Fee Visibility: For users dealing with different networks, estimating or managing transaction fees can prove difficult.

- Limited Advanced Features: Certain specialized wallets or trading platforms may provide more advanced options in terms of trade execution and management which are absent in MetaMask.

5.Moonbeam

Moonbeam emerges as a good substitute for Polygon because it aims at making an Ethereum-compatible intelligent contract system on the Polkadot network. It helps developers move from Ethereum easily through its support for solidity and Ethereum tools as well as taking advantage of scalability and cross chain capabilities offered by Polkadot.

In terms of interconnectivity and strong foundation, Moonbeam allows for efficient decentralized application development which creates room for integration hence becoming more attractive to people who want a lot of options within the blockchain space.

Pros And Cons Moonbeam

Pros:

- Matching Ethereum: It supports Ethereum tools and smart contracts, so developers can easily move or create dApps from Ethereum.

- Interoperability: It is incorporated with the Polkadot ecosystem which means that it can communicate smoothly and interact with other chains in the same network.

- Scalability: Through this feature, high transaction speeds are achieved as well as efficiency courtesy of Polkadot scalability properties.

Cons:

- Being a Newcomer: Being a relatively new platform implies that there could be few dApps and less developed infrastructure compared to established networks.

- Dependent on Polkadot: Its performance and functionalities depend on the underlying technology provided by polkadots which might bring about complexity or limitation in terms of what can be done using this system.

6.Optimism

Optimism is a leading option for Polygon, which provides a second layer scaling solution to Ethereum using optimistic rollups. It increases the transaction speed and reduces cost while keeping security and decentralization of Ethereum.

Optimism optimizes throughput and minimizes gas fees, creating a smoother decentralized application experience. Scalability and affordability are its main aims hence attracting customers and developers who want high-performance solutions within the Ethereum ecosystem.

Pros And Cons Optimism

Pros:

- More Scalable: It uses optimistic rollups for more scalability that can process a large number of transactions and decrease congestion on the Ethereum network.

- Cheap Transactions: For frequent transactions and dApp interactions, it charges significantly lower fees compared to Ethereum’s mainnet.

- Works with Ethereum: It can work with existing smart contracts and tools of Ethereum so migration as well as development are made easier.

Cons:

- Delays in Fraud Proof: There may be delays caused by fraud proofs in case they are needed since optimistic rollups depend on challenge period to validate transactions.

- Ecosystem Limitations: It is possible that there will be fewer dApps and integrations compared to other established layer 2 solutions or even Ethereum’s mainnet.

- Developer Complexity: Although being compatible with ethereum still adds more complexity in terms of development and deployment due to the underlying rollup technology used by it.

7.Polygon

Polygon is a well-known layer 2 scaling solution for Ethereum. It is recognized for its potential to accelerate transaction speeds and lower fees. It allows users to invent their own blockchains that are compatible with Ethereum and connect them to the main network in order to achieve scalability while executing smart contracts efficiently.

The popularity of Polygon can be attributed to this feature because it offers fast transactions at cheap rates. There are other options besides Polygon too; these alternatives have the same level of scalability but differ in terms of performance and cost effectiveness as they serve various demands within blockchain technology.

Pros And Cons Polygon

Pros:

- Scalability Solutions: It can scale well by using side chains based on layer 2 and Plasma technology that shorten the time for transactions while enhancing their volumes.

- Low Fees: In terms of transaction fees, it is much cheaper than Ethereum’s mainnet making it economical for both users and developers.

- Wide Adoption: Supporting variety dApps as well as DeFi projects adds to the strength of an ecosystem which keeps growing.

Cons:

- Security Trade-offs: Compared to Ethereum’s mainnet, trust and safety might be jeopardized due to different security trade-offs faced by Polygon as a sidechain solution.

- Network Fragmentation: The Ethereum ecosystem could become fragmented because there are many layer 2 solutions alongside various sidechains.

8.Solana

Solana is a peer of Polygon that completes transactions at very fast speeds and also charges low fees. A unique agreement method is utilized by Solana to deliver amazing scalability as well as performance which can be used in applications that need quick and affordable operations.

This strong system behind solana ensures lower delays in decentralized apps and smart contracts allowing developers or users who want faster or bigger blockchains than what they are getting from polygon network should consider it as an alternative option.

Pros And Cons Solana

Pros:

- High Performance: Can handle a great number of transactions every second; therefore, it allows for smooth and fast communication between dApps.

- Minimal Fees: This system is characterized by low costs, which make it affordable for users and developers, especially those who perform microtransactions or engage in high-frequency trading.

- Original Method of Agreement: It uses Proof of History (PoH) combined with Proof of Stake (PoS), which ensures its high performance and scalability.

Cons:

- Network Downtime: Sometimes the network goes down from time to time leading to poor reliability thus reducing confidence among users

- Centralization Issues: There have been concerns around centralization given its speed and efficiency where high hardware demands might limit validators diversity

- Limited Smart Contract Language Support: Its main languages used in developing smart contracts are Rust and C but they may require more effort to learn than Ethereum’s Solidity

9.SushiSwap

SushiSwap is a unique alternative to Polygon. It is a decentralized exchange with liquidity pools and community-driven governance. Competitive trade with low slippage can be done through it, and the platform itself is also very easy to use. SushiSwap has integrated different blockchains so that people from around the world can access them easily while swapping efficiently.

It has got various attractive qualities such as yield farming or staking which would attract many users since they are looking for places where they can trade different things other than what polygon offers them while making money at the same time.

Pros And Cons SushiSwap

Pros:

- Community Governance: This governance system is designed to let members of the public have a say in how things are run.

- Yield Farming and Staking: User engagement and rewards can be boosted through additional revenue streams such as staking or yield farming.

- Cross-Chain Capabilities: Multi-chain functionality means that users gain access to different cryptocurrencies across various networks.

Cons:

- Security Risks: Since it is part of the DeFi space, SushiSwap could suffer from security vulnerabilities or risks associated with smart contracts that may lead to loss of funds by users.

- Competitive Market: There are many other decentralized exchanges similar to this one hence attracting liquidity providers might prove difficult due to high levels of competition among them.

- Complexity for New Users: For beginners trying out all these features might seem daunting especially when they involve different chains at once.

10.Arbitrum

Arbitrum is the top alternative to Polygon, which is why it offers Ethereum layer 2 scaling solutions using optimistic rollups. It improves transaction speed and lowers gas fees while keeping up with the security of Ethereum platform.

Faster and cheaper transactions are possible with Arbitrum’s technology thus providing a smooth user experience; this makes it an appealing option for DApps and DeFi projects as well.

This focus on scalability enhancements of Ethereum performance has earned its place among blockchain lovers who seek more from their favorite platforms.

Pros And Cons Arbitrum

Pros:

- Enhanced Transaction Speed: Utilizes optimistic rollups to significantly increase transaction processing speed, reducing delays and improving user experience.

- Cost Efficiency: Offers much lower transaction fees compared to Ethereum’s mainnet, making it more affordable for various dApp interactions.

- Ethereum Compatibility: Maintains full compatibility with Ethereum’s existing smart contracts and development tools, easing integration and migration.

Cons:

- Challenge Period Delays: The optimistic rollup model relies on a challenge period to verify transactions, which can introduce delays in dispute resolution.

- Limited Adoption: May have a smaller ecosystem compared to Ethereum’s mainnet or other more established layer 2 solutions.

- Complex Development: The underlying technology and rollup mechanisms can add complexity to the development and deployment of dApps.

11.Fantom

Fantom is a good option for Polygon as it offers high transaction speeds and low fees. The platform uses DAG-based consensus, which means it is highly scalable and can process transactions quickly.

In addition to this, Fantom has a strong infrastructure that supports smart contracts with decentralized apps that have very little latency.

Developers love how efficient and cheap to run it is too; therefore, if you need something more scalable or faster than what Polygon provides then try out Fantom!

Pros And Cons Fantom

Pros:

- Fast transactions: It finishes its transactions very fast and allows many transactions per second because it uses a system of consensus based on DAG.

- Cheapness: It has low transaction fees which makes it affordable for users or developers.

- EVM Compatibility: The platform supports Ethereum Virtual Machine (EVM) that enables easy deployment for Ethereum-based smart contracts and dApps.

Cons:

- Network Security Lapses: Compared with other well-known blockchains, the security and resilience of this network are not safe due to the nature of its consensus mechanism which speeds up things too much.

- How people view it in the market: People may look at it with doubt and take longer before accepting it widely as many could do with established networks such as those powered by Binance Smart Chain or Ethereum.

- Narrow ecosystem: Even though the platform has grown over time; still there exists limited dApp availability caused by smaller ecosystems affecting liquidity compared to larger platforms

12.Ankr

Ankr is a well-known alternative to Polygon that provides decentralized infrastructure services and staking solutions. It allows for the deployment and management of blockchain nodes on a more scalable and cost-effective platform.

Ankr’s main goal is to simplify entry points into blockchains as well as allowing them to be easily staked, making it an attractive option for any developer or user who needs trustless computing power in the cloud.

Besides being versatile enough to support different types of chains such Ethereum among others; this makes it a great choice for people looking past just using one chain like Polygon.

Pros And Cons Ankr

Pros:

- Decentralized Infrastructure: This refers to the fact that Ankr provides a network of blockchain nodes that are decentralized which makes the whole network more reliable and less dependent on single points of failure.

- Node Management Simplification: Ankr provides tools for deploying and managing blockchain nodes in an easy-to-use manner, thereby allowing developers to join different networks conveniently.

- Staking Solutions: Ankr enables users to stake across multiple blockchain networks thus earning rewards as well as participating in securing networks.

Cons:

- Service Complexity: The range of services offered may be too complicated for new users who may not be able to fully comprehend them or use them optimally.

- Limited Ecosystem: It might have a smaller ecosystem when compared with bigger established cloud or infrastructure providers although it is still carrying out expansion works.

- Dependence on Third-Party Validators: Users depend on validators from Ankr, which may affect control and decentralization aspects.

13.Solv Protocol

A well-known Polygon substitute is the Solv Protocol that brings revolution in managing decentralised finance and liquidity. It strives to introduce financial products in modules so as to improve flexibility and efficiency in handling assets.

By stressing on tailored financial systems alongside simplified liquid provision, this platform becomes a good choice for anyone who wants more sophisticated DeFi capabilities including both users as well as developers.

The way this system works with financial protocols is different from any other method used before like scaling solutions such as polygons on blockchains.

Pros And Cons Solv Protocol

Pros:

- Financial Products that can be tailored: It allows for the creation of flexible financial products that are modular and can be customized to suit the needs of different DeFi use cases.

- Efficient Liquidity Management: It provides tools for managing liquidity in a way that is more optimized, which benefits investors as well as providers of liquidity.

- Unique Protocol Design: Among its kind, it has features like tokenized vaults and structured financial instruments thereby expanding the boundaries within DeFi.

Cons:

- Difficulty of Use: For new users, these advanced functionalities plus all their customization possibilities may pose a challenge when trying to navigate through them effectively.

- Adoption Challenges: Being a relatively unknown protocol, it may face difficulties in gaining popularity and achieving enough liquidity across different markets.

- Regulatory Uncertainty: Its creative financial products are likely to draw attention from regulators who might then impede on its growth trajectory by introducing strict regulations around what it does or how operates within such an environment where everything else seems regulated already .

14.Monad

Monad is an important substitute for Polygon because it has a blockchain that performs very well when it comes to size and protection. Monad also provides advanced functionalities for smooths deal processing and smart contract execution.

Monad’s unique consensus algorithm and architectural plan enable decentralized applications with strong support at low latency and high throughput.

In terms of quickness as well as scalability, this focus on these aspects adds value not only to consumers but also developers who may want more powerful blockchains than what they can get from working with Polygon.

Pros And Cons Monad

Pros:

- Speed: Built for high transaction rates, it allows fast execution and scalability for dApps.

- Better Consensus Algorithm: It is designed with creative agreement protocols which improve efficiency of the network and reduce delay.

- Supports Developers: The system works with many commonly used programming languages and tools that can be used in developing blockchain applications.

Cons:

- Growing Infrastructure: Being a new type of chain might mean having an immature ecosystem or less available dApps than established platforms do.

- Complicated Structure: People may find it difficult to understand and implement this because its architecture is so advanced along with consensus mechanism being complex too.

15.Cardano

Cardano is a popular substitute for Polygon because it places an emphasis on safety, growth capacity and sustainability. It provides a solid foundation for smart contracts and decentralized applications through rigorous scholarship and proof-of-stake consensus.

Its efficiency in transactions is boosted by its multilayered design which also strengthens the security of the network; hence, anyone who wants to scale up their blockchain system can depend on it.

Cardano has various unique characteristics that make it a good option when one is looking for other options apart from Polygon.

Pros And Cons Cardano

Pros:

- Approach Driven by Study: It was created with attention to academic research and methodologies reviewed by peers thus establishing strong technology which is vigorous as well.

- Scalability and Sustainability: To promote long-term scalability that will cater for millions of users, it employs a multi-layer architecture coupled with its proof-of-stake consensus model aimed at ensuring sustainability.

- Interoperability: This feature allows communication between different chains thereby increasing their overall functionalities across each other.

Cons:

- Slow Development Pace: The thorough investigations carried out before any implementation may cause delay when trying to catch up with agile models that are faster in releasing features.

- Smaller Ecosystem: Cardano has fewer dApps and projects as compared to Ethereum or other popular platforms hence it may not be used widely enough.

- Limited Smart Contract Support: Initially this platform had limited capabilities on smart contracts but they have been improving them recently through upgrades made so far .

16.Taiko

Taiko is a well-known substitute for Polygon. It was designed as an Ethereum rollup which can scale better and reduce the cost of transactions at the same time. The main goal of this project is to combine Ethereum security and decentralization with high throughput and low latency.

Taiko concentrates on smooth integration into Ethereum so that developers and users could easily work with it. In addition, innovative rollup technology makes Taiko attractive for those who need more efficient or cheaper blockchains than Polygon does.

Pros And Cons Taiko

Pros:

- Ethereum Compatibility: It was developed as a rollup solution that can work with Ethereum’s current infrastructure making it easy to integrate and develop.

- Scalability: By using rollup technology, it seeks to increase the number of transactions per second while decreasing confirmation time for each transaction in Ethereum.

- Security: All operations done within this system are secure since they rely on Ethereum’s security model which guarantees transaction safety and integrity on such platforms.

Cons:

- Dependency on Ethereum: However, as much as it benefits from relying upon the security provided by ethereum, taiko is still limited by ethereums ecosystem and scalability challenges too

- Complexity Of Rollups Disputes or even reversals of transactions could be difficult to understand or manage due to increased complexities brought about by rolling up everything into one block

- Adoption Challenges: Since this is relatively new tech there might be some difficulties when trying to get widespread adoption or integrating with other dApps/services that are already in existence.

17.Albus Protocol

Albus Protocol is a well-known alternative to Polygon. It works on liquidity management and decentralized finance solutions. It introduces inventive ways of creating and managing products in the financial sector, which helps improve flexibility when dealing with assets. The reason why Albus shines among other platforms is because it simplifies how money moves around through modular financial structures and streamlined liquidity.

This makes it a robust DeFi capability for any user or developer who wants more out of their current system; or needs something new altogether. Its approach towards protocols is what sets them apart from traditional blockchain scaling options such as Polygon as they provide different ways that are very valuable for finance systems too.

Pros And Cons Albus Protocol

Pros:

- Monetary Products of Parts: It makes it easy to make financial products that are flexible and customizable to adapt to different DeFi strategies.

- Efficient Liquidity Management: Finding new ways to optimize liquidity thereby ensuring users’ efficiency as well as for liquidity providers.

- Interoperability: Having been designed for use across various blockchain networks, it should lead to wider integration within the DeFi space thereby increasing its functionality.

Cons:

- Complexity in Implementation: The features are advanced and modularities may be difficult for developers to effectively implement or manage.

- Low Popularity: Being a protocol that serves specific purposes might not gain wide adoption and attract enough liquidity as other established platforms do.

- Regulatory Risks: These types of innovative financial products could draw regulatory attention which may slow down their development or compliance with rules.

- Smart Contract Vulnerabilities: Complex smart contracts have several weaknesses making them prone to attacks leading loss funds by users and instability in protocols themselves.

18.StarkWare

StarkWare is a well-known substitute for Polygon, they are focused on zk-rollups technology which helps in scaling and privacy. StarkWare allows for more transactions per second at lower fees by employing zero-knowledge proofs while ensuring secureness and accuracy of data.

It becomes an excellent choice for decentralized applications (dApps) and DeFi projects because it scales Ethereum with sophisticated cryptographic methods. The company’s inventions offer people looking for improved performance over what can be achieved through Polygon with a viable option

Pros And Cons StarkWare

Pros:

- Zero-Knowledge Proofs: People can use zk-rollups and STARKs (Scalable Transparent Arguments of Knowledge) that are meant to scale and protect the privacy of transactions without compromising security.

- Low Transaction Costs: It makes the transaction fees much cheaper by using an efficient rollup technology.

- High Throughput: This can process very many transactions within a short time thereby improving the efficiency of dApps and DeFi applications.

Cons:

- Complex Technology: According to developers, this kind of technology which uses advanced cryptographic techniques as well as rollup solutions may be difficult for them to understand or even implement it into their work flow systems.

- Integration Challenges: Due to its specific nature being known as zk-rollup technology integration with existing dApps and services might require adjustments and adaptations.

- Newer Ecosystem: There could be less integrations available because there is not much adoption yet since it is relatively new compared with other solutions in the market today.

19.zkSync

zkSync is a well-known substitute for Polygon that uses zero-knowledge rollups to scale Ethereum and lower transaction fees. Though it takes advantage of zero knowledge proofs to ensure strong security, transactions are still fast and cheap. What makes zkSync interesting for decentralized applications (dApps) and DeFi projects is its scalability-first mentality coupled with user-friendliness.

The technology is advanced and the methods used are cost-effective which provide efficiencies beyond what can be achieved on Polygon alone.

Pros And Cons zkSync

Pros:

- Zero Knowledge Rollups: It uses zk-rollups to enhance scalability and privacy, providing high throughput and cheap transactions.

- Ethereum Compatibility: Compatible with Ethereum smart contracts as well as development tools which makes it easy for developers to integrate and deploy.

- Instantaneous finality: Zero-knowledge proofs efficient verification process leads to almost instant transaction finality.

Cons:

- Complicated Integration: Existing dApps may need significant adjustments when integrating with zkSync rollup technology while smart contracts could be affected too.

- Limited ecosystem: It might have lesser number of dApps and liquidity as compared to well-established platforms being that it is still new in the market.

- Scalability limitations: Although scalable, this roll-up solution for zksync may not handle very high transaction volumes like some other layer 2 solutions can do so effectively.

20.Forte Labs

Forte Labs is a well-known substitute for Polygon that works to blend blockchain technology with digital assets and gaming. What it does is create ways in which game economies can work better as well as make it possible for developers or gamers to interact with the blockchain more easily.

This company’s primary focus is on producing scalable tools that work efficiently within gaming applications, which makes it an attractive option for anyone trying to connect these two industries through the use of blockchain tech. Its approach also offers different ways of thinking about general-purpose blockchain scaling solutions provided by Polygon because they are innovative.

Pros And Cons Forte Labs

Pros:

- Gaming-Focused Platform: Specifically designed to support blockchain gaming, providing tailored solutions for game developers and publishers.

- Comprehensive Toolset: Offers a wide range of tools and services, including token creation, NFTs, and in-game economy management, to streamline game development.

- Interoperability: Supports cross-chain functionality, allowing games to interact with various blockchain networks and ecosystems.

Cons:

- Niche Market: Primarily focused on gaming, which may limit its appeal and adoption outside the gaming industry.

- Development Complexity: The specialized tools and features might require additional expertise and resources for effective implementation.

- Dependency on Game Adoption: The platform’s success is heavily reliant on the adoption and popularity of blockchain games, which is still an emerging market.

How To Choose Best Polygon Alternatives?

Scalability: Determine how well the system works under a high number of transactions and as demand increases. Opt for answers that provide low latency and high throughput.

Transaction fees: Compare the cost of transactions between different platforms. This can have a significant effect on your overall expenditure, especially for frequent transactions.

Compatibility: Check if there are smart contracts or dApps supported by this alternative, or any other specified DeFi functions you require. Ethereum fits with most things so it may be vital too.

Security: Examine what kind of security measures/protocols they use; look out for breaches in their history or any other vulnerabilities known about them while taking into account strong points like audits done on them where applicable.

Performance: Consider performance metrics like transaction speed and network congestion levels when evaluating these systems because good performances are necessary for smooth user experiences.

User experience: Consider how easy it is to use this service and what people say about their experiences using them. A platform with an intuitive interface may save time, but good customer support will ensure efficiency which leads to better results at work places where such things matter most – efficiency!